- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

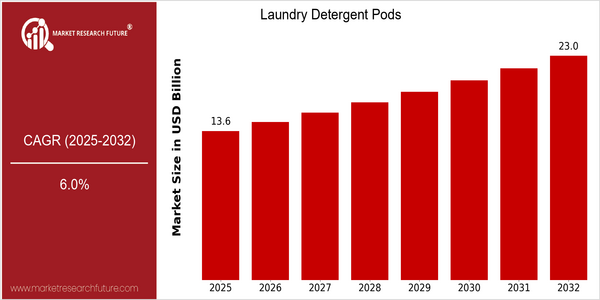

| Year | Value |

|---|---|

| 2025 | USD 13.64 Billion |

| 2032 | USD 23.04 Billion |

| CAGR (2025-2032) | 6.0 % |

Note – Market size depicts the revenue generated over the financial year

The global laundry detergent pods market is poised for significant growth, with a current market size of USD 13.64 billion in 2025, projected to expand to USD 23.04 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 6.0% over the forecast period. The increasing consumer preference for convenience and efficiency in laundry solutions is a primary driver of this market expansion. As households seek products that simplify the laundry process, detergent pods, known for their ease of use and precise dosing, are becoming increasingly popular. Technological advancements in product formulation and packaging are also contributing to the market's growth. Innovations such as eco-friendly ingredients and biodegradable packaging are attracting environmentally conscious consumers, further propelling demand. Key players in the industry, including Procter & Gamble, Unilever, and Henkel, are actively investing in research and development to enhance product efficacy and sustainability. Strategic initiatives, such as partnerships with retailers and targeted marketing campaigns, are also being employed to capture a larger market share and meet the evolving needs of consumers.

Regional Market Size

Regional Deep Dive

The Laundry Detergent Pods Market is experiencing significant growth across various regions, driven by consumer demand for convenience and efficiency in laundry care. In North America, the market is characterized by a high penetration of single-use pods, with consumers increasingly favoring these products for their ease of use and precise dosing. In Europe, sustainability trends are influencing product formulations and packaging, while in Asia-Pacific, rapid urbanization and changing lifestyles are propelling market expansion. The Middle East and Africa are witnessing a gradual adoption of pods, influenced by rising disposable incomes and a growing middle class. Latin America is also seeing a shift towards modern laundry solutions, although traditional detergents still hold a significant market share. Overall, the market dynamics are shaped by regional consumer preferences, economic conditions, and regulatory frameworks that promote sustainable practices.

Europe

- In Europe, there is a growing trend towards refillable laundry pod systems, with companies like Henkel introducing refill stations in retail outlets to reduce plastic waste and promote sustainability.

- The European Union's stringent regulations on chemical safety are pushing manufacturers to reformulate their products, leading to innovations in hypoallergenic and dermatologically tested laundry pods.

Asia Pacific

- The Asia-Pacific region is experiencing rapid growth in the laundry pods market, particularly in countries like China and India, where urbanization is driving demand for convenient laundry solutions.

- Local companies, such as Unicharm in Japan, are innovating with unique scents and formulations tailored to regional preferences, enhancing consumer appeal and market penetration.

Latin America

- In Latin America, the market is still dominated by traditional powder detergents, but brands like Omo are introducing pods to attract younger consumers looking for convenience.

- Cultural factors, such as the preference for hand-washing in some regions, are influencing the pace of adoption, but increasing urbanization is expected to drive future growth in pod usage.

North America

- The North American market is witnessing a surge in eco-friendly laundry pods, with companies like Procter & Gamble launching products that use biodegradable materials and plant-based ingredients to cater to environmentally conscious consumers.

- Regulatory changes in the U.S. regarding packaging safety have prompted manufacturers to innovate with child-resistant packaging, as seen with brands like Tide, which has implemented new safety measures to prevent accidental ingestion.

Middle East And Africa

- In the Middle East and Africa, the market is gradually evolving, with increased marketing efforts by brands like Ariel to educate consumers about the benefits of laundry pods over traditional detergents.

- Economic growth in countries like South Africa is leading to a rise in disposable incomes, which is expected to boost the adoption of premium laundry products, including pods.

Did You Know?

“Did you know that laundry pods were first introduced in 2012, and within just a few years, they accounted for nearly 30% of the laundry detergent market in the U.S.?” — Market research reports and industry analyses

Segmental Market Size

The Laundry Detergent Pods segment plays a crucial role in the overall laundry care market, currently experiencing robust growth due to increasing consumer preference for convenience and efficiency. Key drivers of demand include the rising trend of busy lifestyles, which necessitate quick and easy laundry solutions, and the growing awareness of sustainability, prompting consumers to seek eco-friendly products. Additionally, advancements in formulation technology enhance cleaning efficacy, further boosting adoption rates. Currently, the segment is in a mature adoption stage, with leading companies like Procter & Gamble and Unilever spearheading innovations in product design and sustainability. Notable regions such as North America and Europe are at the forefront of adoption, driven by strong marketing campaigns and consumer education. Primary use cases include residential laundry, where pods simplify the dosing process, and commercial applications in hospitality and healthcare sectors, where efficiency is paramount. Macro trends such as the push for sustainable packaging and the impact of the COVID-19 pandemic, which has heightened hygiene awareness, continue to catalyze growth in this segment, while technologies like biodegradable materials and smart packaging are shaping its future landscape.

Future Outlook

The laundry detergent pods market is poised for significant growth from 2025 to 2032, with the market value projected to increase from $13.64 billion to $23.04 billion, reflecting a robust compound annual growth rate (CAGR) of 6.0%. This growth trajectory is driven by the increasing consumer preference for convenience and efficiency in laundry solutions, as well as the rising awareness of sustainable and eco-friendly products. By 2032, it is anticipated that laundry detergent pods will capture approximately 30% of the overall laundry detergent market, up from an estimated 20% in 2025, indicating a strong shift towards this format among consumers. Key technological advancements, such as the development of biodegradable and water-soluble materials for pod packaging, are expected to enhance product appeal and align with growing environmental concerns. Additionally, regulatory policies promoting sustainable practices in consumer goods will further bolster the adoption of laundry detergent pods. Emerging trends, including the integration of smart technology in laundry appliances and the rise of subscription-based models for household products, will also play a crucial role in shaping the market landscape. As consumers increasingly seek out innovative and sustainable solutions, the laundry detergent pods market is well-positioned for continued expansion and transformation in the coming years.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 10.8 Billion |

| Market Size Value In 2023 | USD 11.44 Billion |

| Growth Rate | 6.00% (2023-2032) |

Laundry Detergent Pods Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.