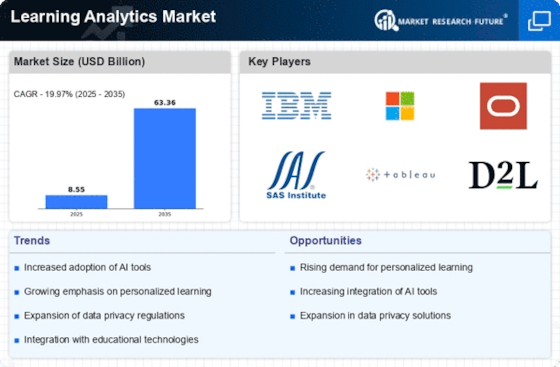

Market Share

Learning Analytics Market Share Analysis

The Learning Analytics Market is a highly dynamic and rapidly growing segment that shapes the future of education. With Education facilities and organizations increasingly recognizing the importance of data-driven insights for better learning outcomes, competition within this market has become tougher than ever before. A prominent approach used by companies within the Learning Analytics Market is a differentiation strategy. Companies in such a landscape tend to adopt various strategies aimed at getting unique or innovative solutions compared to their competitors so as to seize opportunities that arise from this period of change with regard to teaching methodologies, student engagement models alongside open source content, especially where colleges are trying hard towards adopting them for instance through developing more advanced analytical tools that offer greater detail about student performance, engagement, and learning styles beyond basic ones. By offering features that extend beyond simple analytics, businesses can acquire a niche market segment seeking specialized products or services in the field they are interested in dealing with. Cost leadership is another important technique that organizations use to focus on providing affordable learning analytics solutions without compromising on quality. Cost-effective solutions are particularly attractive to educational institutions with limited budgets, allowing these firms to capture a large market share. Furthermore, the primary industry and collaborations have played an instrumental role in shaping market share positioning. To extend their reach and influence, Learning Analytics Market's companies often form alliances with educational institutions, technology providers, or other stakeholders. By integrating their analytics solutions with popular learning management systems or partnering with outlined players in the education technology space, firms can exploit existing networks and gain a competitive advantage over others. Furthermore, customer-oriented approaches are gaining prominence as enterprises recognize the importance of understanding and addressing their consumers' unique needs. Customizing learning analytics solutions to meet specific institutional requirements enhances customer loyalty and boosts market share. In addition, global expansion is one of the methods used by companies seeking to enlarge their portion of this market. With the growing globalization of education and penetration of e-learning platforms, businesses aim to enter international markets. Adapting analytics answers for different social and educational settings enables these firms to leverage new opportunities and lay out a global footprint that further cements their presence within that particular market.

Leave a Comment