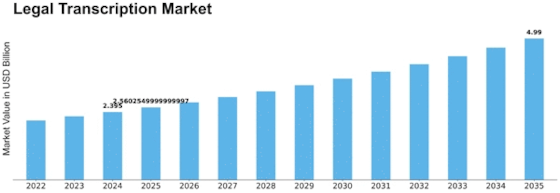

Legal Transcription Size

Legal Transcription Market Growth Projections and Opportunities

The legal transcribing business is changing due to technological advances, changing regulatory requirements, and the need for rapid and precise recordkeeping. Legal transcription helps lawyers create formal documents and practice by transcribing legal sessions. Legal transcription industry trends depend on several aspects.

First, technical advances shape legal transcribing market dynamics. Speech recognition, AI, and machine learning have automated transcribing. These technologies improve transcribing speed and accuracy. Legal practitioners increasingly use these technologies to effectively transcribe court sessions, depositions, and other legal documents.

The legal environment and regulatory regulations affect legal transcription demand. Legal processes, research, and case preparation require accurate transcripts and strict documentation requirements. Laws, rules, and new legal procedures can affect transcribing service demand, forcing legal transcription companies to change and comply.

Legal processes and the growing legal business increase legal transcribing service demand. As law firms, courts, and legal departments handle more cases, transcribing services are needed to capture and manage the large volume of legal material. Meeting the growing need for accurate and timely documentation requires professional legal transcribing services' scalability and efficiency.

Globalisation of legal services makes the legal transcribing industry dynamic. International litigation, cross-border trade, and multilingual transcribing services are increasing. Legal transcription providers must adapt multiple languages, legal systems, and cultural idiosyncrasies to serve the global legal profession and provide efficient communication in a multicultural legal context.

Legal transcribing market trends depend on quality assurance and security. Legal transcribing must be accurate since mistakes might have major implications. Legal transcribing services must use strict quality control methods to ensure content accuracy. Legal information is sensitive, hence strict security standards are needed to protect client confidentiality and legal papers.

Remote employment and virtual cooperation in the legal field have further changed legal transcribing market dynamics. Flexible and secure transcribing services are needed when legal practitioners operate remotely. Legal transcription providers must adapt to the changing workplace by delivering remote collaboration options that meet legal accuracy and security criteria.

Leave a Comment