Life Science Software Market Overview

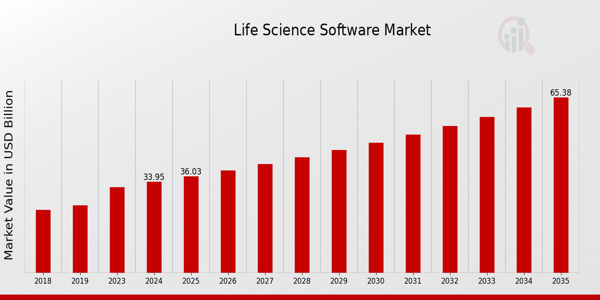

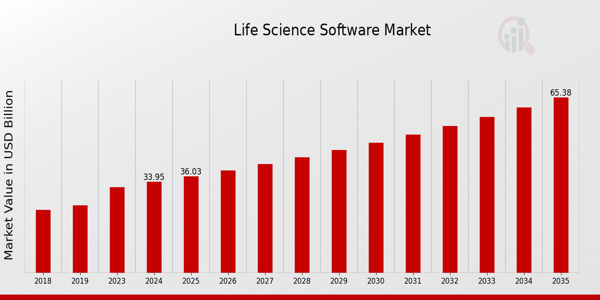

As per MRFR analysis, the Life Science Software Market Size was estimated at 31.98 (USD Billion) in 2023. The Life Science Software Market Industry is expected to grow from 33.95(USD Billion) in 2024 to 65.4 (USD Billion) by 2035. The Life Science Software Market CAGR (growth rate) is expected to be around 6.14% during the forecast period (2025 - 2035).

Key Life Science Software Market Trends Highlighted

The Global Life Science Software Market is undergoing substantial changes as a result of the growing emphasis on personalized medicine and the increasing demand for efficient data management solutions. The life sciences sector's ongoing digital transformation is a significant factor in this market, as it requires sophisticated software tools to optimize research and development processes. Ultimately, companies are investing in innovative technologies such as artificial intelligence and machine learning to enhance drug discovery and clinical trials, resulting in more accurate and expedited results.

In recent years, there has been a significant shift toward cloud-based solutions, which has allowed life science organizations to improve collaboration and data sharing among global teams.

This change enables remote access to critical tools and data, which is essential for research teams that frequently operate across multiple geographies. Moreover, regulatory compliance continues to be a vital factor, which is why it is becoming increasingly important to have software that assures adherence to strict guidelines. The demand for software solutions that are tailored to the unique requirements of biopharma companies and research institutions that specialize in genomics and precision medicine is creating opportunities.

Tailored innovations that can considerably improve the efficacy of research findings are available through the expansion of collaborations between software providers and life sciences firms.

Additionally, the increasing significance of real-world data in clinical decision-making is driving the development of software that can seamlessly incorporate a variety of data sources of information. As the Global Life Science Software Market continues to develop, these trends and opportunities suggest a shift toward more sophisticated and integrated technological solutions, which will assist organizations in more effectively navigating the intricacies of the life sciences landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Life Science Software Market Drivers

Increasing Demand for Electronic Health Records

The demand for Electronic Health Records (EHR) systems in the Global Life Science Software Market Industry is on a notable rise. The World Health Organization's reports indicate that over 60% of healthcare providers in many developed regions have transitioned to EHR systems in recent years. This transition is fundamentally driven by the need for better patient data management and accessibility, particularly in response to the COVID-19 pandemic, which has accelerated the digital transformation in healthcare.Furthermore, governmental policies across multiple countries are increasingly emphasizing the adoption of EHRs to improve healthcare efficiency.

For instance, the U.S. government's Medicaid Incentive Program has incentivized healthcare providers to adopt EHR technology, resulting in significant growth in the market. This trend is complemented by major technology software companies like Epic Systems and Cerner, which continue to innovate and expand their offerings in this segment, thus bolstering the prospects of the Global Life Science Software Market.

Rise in Research and Development Expenditure

The increase in Research and Development (R&D) expenditure, particularly in the biopharmaceutical sector, is a significant driver of the Global Life Science Software Market Industry. According to statistics from the European Federation of Pharmaceutical Industries and Associations, global pharmaceutical R&D spending has reached approximately 182 billion USD in recent years, reflecting a consistent annual growth rate. Major pharmaceutical companies such as Novartis and Pfizer are significantly investing in R&D to foster innovation and develop new therapeutic solutions.This critical investment has led to a heightened demand for specialized software solutions that streamline the R&D processes, data analysis, and regulatory compliance.

The consequent increased need for robust life science software platforms effectively sustains market growth as biopharmaceutical processes become increasingly data-driven.

Regulatory Compliance and Quality Control Improvements

Ensuring regulatory compliance has become increasingly crucial within the Global Life Science Software Market Industry. Regulatory agencies worldwide, including the U.S. Food and Drug Administration and the European Medicines Agency, have established stringent quality control measures to ensure compliance and safety in drug development and production. Research indicates that firms are spending upwards of 10-15% of their total operational budgets on compliance-related software solutions to meet these rigorous standards.Companies such as Veeva Systems have developed specialized software to aid pharmaceutical firms in navigating this complex landscape, allowing for better quality assurance and compliance management.

The growing emphasis on quality control fosters demand for software solutions that can help track compliance with constantly evolving regulations, thus propelling the growth of the Global Life Science Software Market.

Life Science Software Market Segment Insights

Life Science Software Market Application Insights

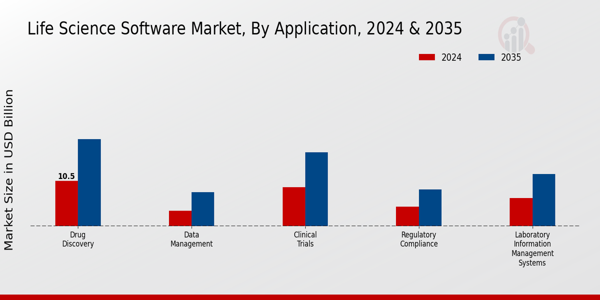

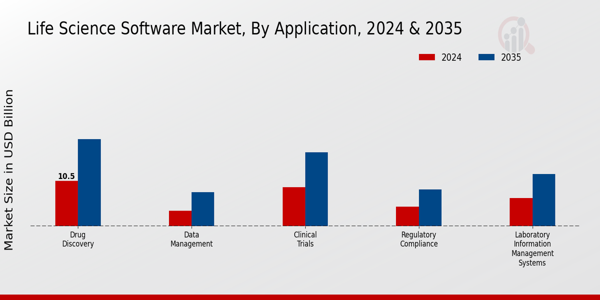

The Global Life Science Software Market, with a projected valuation reaching 33.95 USD Billion in 2024, showcases a vibrant landscape centered around the Application segment, which plays a crucial role in optimizing various life sciences processes. Within this segment, five key areas are distinguished Drug Discovery, Clinical Trials, Laboratory Information Management Systems, Regulatory Compliance, and Data Management. Drug Discovery holds a significant market position with valuations of 10.5 USD Billion in 2024, capturing a major share of the overall Application market due to its vital role in accelerating novel therapeutics' development.

This sub-segment is characterized by innovative software enabling researchers to streamline their efforts, ultimately leading to cost savings and efficiency that are crucial in today’s competitive environment.Following closely, the Clinical Trials segment is valued at 9.0 USD Billion in 2024, reflecting the increasing need for robust software solutions that ensure compliance, enhance patient recruitment, and provide real-time data monitoring during the trials. This area is becoming increasingly important as the global demand for personalized medicine rises, necessitating improved methodologies in trial design and execution.

Laboratory Information Management Systems, with a valuation of 6.5 USD Billion in 2024, facilitates data management and compliance within laboratories, aiding in the effective tracking of samples and regulatory data, which underscores the importance of maintaining data integrity in today’s research.Furthermore, Regulatory Compliance is another pivotal area valued at 4.5 USD Billion in 2024, spotlighting the increasing pressure on life sciences companies to adhere to stringent regulations and ensure product safety.

The software within this domain helps streamline compliance processes, reducing risks that could lead to costly penalties or product recalls.

Lastly, the Data Management segment, valued at 3.5 USD Billion in 2024, emphasizes the critical need for organizations to manage the vast amounts of data generated within the life sciences industry, ensuring that information is not only accessible but also secure and compliant with data privacy regulations.The Global Life Science Software Market insights consequently demonstrate that various segments are witnessing growth driven by the rising demand for software solutions that enhance efficiency, compliance, and data management across all areas of life sciences.

As the industry evolves, these Application segments will play increasingly significant roles in addressing the diverse challenges faced by life sciences organizations, promoting innovative solutions that drive market growth and ultimately improve patient outcomes. Overall, the Application segment of the Global Life Science Software Market is poised for substantial expansion, contributing effectively to the expected overall market valuation of 65.4 USD Billion by 2035, indicating a robust and dynamic industry landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Life Science Software Market Deployment Model Insights

The Global Life Science Software Market, particularly in the Deployment Model segment, is projected to experience significant growth, with an expected valuation of 33.95 USD Billion in 2024. As the industry evolves, the demand for efficient, flexible solutions has propelled the Cloud-based model into a leading position, allowing organizations to harness scalable resources and remote access to software applications. The On-premises model remains crucial for firms prioritizing data security and regulatory compliance, providing greater control over sensitive information.Additionally, the Hybrid model serves as a bridge, combining the best of both Cloud-based and On-premises solutions, catering to diverse operational needs.

The segmentation within the Global Life Science Software Market drives tailored solutions that enhance Research and Development workflows, improve operational efficiency, and support regulatory compliance. The growth of this market segment is further fueled by advancements in technology, increasing focus on personalized medicine, and the need for collaborative platforms in life sciences.

However, challenges such as cybersecurity concerns and the integration of legacy systems may impact market dynamics.Overall, the Deployment Model segment plays a vital role in shaping the future of the Global Life Science Software Market, leveraging Cloud-based, On-premises, and Hybrid solutions to meet the unique demands of the industry.

Life Science Software Market End User Insights

The Global Life Science Software Market continues to expand, with significant contributions from various end users, including Pharmaceutical Companies, Biotechnology Firms, Contract Research Organizations, and Academic Institutions. In 2024, the market is valued at 33.95 USD Billion, reflecting the demand for advanced software solutions that aid in research and development, regulatory compliance, and data management. Pharmaceutical Companies play a crucial role as they heavily invest in software to streamline drug discovery and development processes, enhancing overall efficiency.Biotechnology Firms increasingly leverage these tools to facilitate innovative research, significantly impacting the global landscape of therapeutic advancements.

Contract Research Organizations thrive on these technologies, offering vital services to both pharmaceutical and biotechnology sectors, thus driving the demand further. Academic Institutions contribute to the market by employing software for educational purposes, research projects, and collaborative initiatives. Overall, the Global Life Science Software Market segmentation showcases the diverse utility of software across different end users, underscoring the vital importance of technology in the continued growth and development of the life sciences industry.

Life Science Software Market Type Insights

The Global Life Science Software Market is poised for significant growth, expected to be valued at 33.95 USD Billion by 2024, with a robust increase to 65.4 USD Billion by 2035. Within this expansive market, various types of software play critical roles, notably Data Analytics Software, Clinical Trial Management Software, Laboratory Information Management Software, and Research and Development Software.

Data Analytics Software is essential for its ability to process vast amounts of data efficiently, driving innovations in patient care and drug discovery.Clinical Trial Management Software dominates the sector by streamlining trial processes, enhancing compliance, and providing valuable insights that support timely drug approvals.

Laboratory Information Management Software is significant as it ensures that laboratory workflows are efficient, accurate, and compliant with industry regulations, thus facilitating effective management of laboratory data. Research and Development Software is crucial for accelerating the development of new therapies and fostering collaboration among research institutions and pharmaceutical companies.As the Global Life Science Software Market continues to evolve, advancements in these software applications are expected to propel market growth, driven by increasing investments in healthcare innovation and rising demand for efficient data management solutions within the industry.

Life Science Software Market Regional Insights

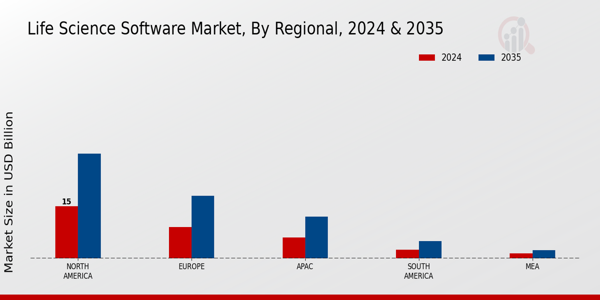

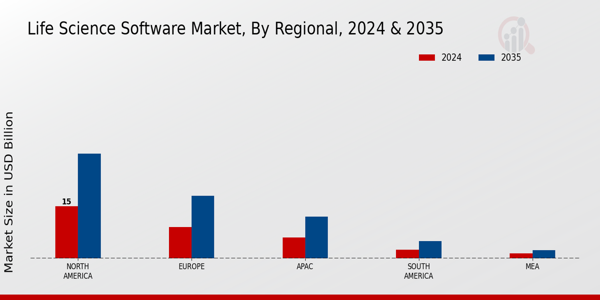

The Global Life Science Software Market is projected to showcase significant growth across various regions, with North America leading in market valuation. In 2024, North America holds a value of 15.0 USD Billion, expected to rise to 30.0 USD Billion by 2035, illustrating its dominant position due to advances in technology and robust investment in Research and Development.

Europe follows with a valuation of 9.0 USD Billion in 2024, anticipated to reach 18.0 USD Billion in 2035, driven by stringent regulatory requirements and the need for compliance in healthcare practices.The Asia-Pacific (APAC) region, valued at 6.0 USD Billion in 2024 and projected to expand to 12.0 USD Billion by 2035, benefits from increasing investments in healthcare infrastructure and biotechnology.

South America, although smaller in valuation at 2.5 USD Billion in 2024, is expected to grow to 5.0 USD Billion by 2035, reflecting a developing market with emerging opportunities. The Middle East and Africa (MEA) stands at a valuation of 1.45 USD Billion in 2024, growing to 2.4 USD Billion in 2035, representing a region with significant potential owing to rapid development in healthcare technology.Collectively, these regional dynamics contribute to the comprehensive understanding of Global Life Science Software Market revenue and its segmentation, highlighting growth opportunities and industry trends.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Life Science Software Market Key Players and Competitive Insights

The Global Life Science Software Market is characterized by its rapid evolution and dynamic competitive landscape, driven by technological advancements and increasing demand for innovative solutions across various segments such as research and development, regulatory compliance, and data management. Companies operating in this market are increasingly focusing on optimizing their product offerings to meet the unique needs of life sciences organizations, healthcare providers, and pharmaceutical companies. Competitive insights reveal a trend toward software integration, allowing organizations to streamline their workflows, enhance collaboration, and improve overall efficiency.

The market is witnessing significant growth, fueled by rising investments in healthcare IT and the growing importance of data analytics in life sciences.

As competition intensifies, key players are investing in research and development to pioneer cutting-edge solutions and technologies that can deliver value and ensure compliance in an increasingly regulated environment.Dassault Systemes has established itself as a formidable player in the Global Life Science Software Market by capitalizing on its strengths in 3D modeling and simulation technologies. The company's innovative software solutions enable life sciences organizations to manage complex processes and improve product development cycles.

Dassault Systemes leverages its expertise in design and engineering to provide comprehensive platforms that help users visualize and simulate their products, thus facilitating better decision-making and improving time-to-market for various life science applications.

With a robust global presence, the company maintains significant partnerships with numerous stakeholders in the industry, enabling it to stay ahead of competitors by offering tailored solutions that address the specific challenges faced by life science organizations. The emphasis on providing interoperability and collaboration features within its software further enhances its position, making Dassault Systemes a key contributor to the evolving landscape of life science technology.Thermo Fisher Scientific is another notable entity within the Global Life Science Software Market, recognized for its comprehensive suite of solutions that encompass essential components of research and laboratory management.

The company's product offerings are focused on laboratory informatics, data management, and workflow optimization, specifically designed for life science applications.

Thermo Fisher Scientific has a strong global reach, supported by a continuous investment in innovation and the development of advanced software tools that cater to the diverse needs of researchers, biopharmaceutical companies, and academic institutions. Their solutions are instrumental in streamlining data collection, analysis, and reporting processes, ultimately enhancing productivity and compliance with regulatory standards. Recent mergers and acquisitions have expanded Thermo Fisher's capabilities within the life sciences space, further solidifying its position and creating synergies that enhance product offerings.

Through a commitment to quality, reliability, and innovative research, Thermo Fisher Scientific continues to play a pivotal role in shaping the landscape of life science software solutions on a global scale.

Key Companies in the Life Science Software Market Include

Life Science Software Market Industry Developments

Recent developments in the Global Life Science Software Market have showcased a surge in growth and activity. Primarily, companies like Illumina, Thermo Fisher Scientific, and Veeva Systems have been focusing on expanding their software capabilities, particularly in genomic and clinical data management solutions, to enhance patient outcomes. In October 2023, Siemens Healthineers announced strong quarterly performance, highlighting their robust portfolio in life sciences software, which reflects an increasing demand for integrated solutions in healthcare. Additionally, Thermo Fisher Scientific and Labcorp engaged in discourse for potential collaborations that could streamline laboratory processes and data analytics.

In terms of mergers and acquisitions, in August 2023, Oracle completed its acquisition of Cerner, with implications for life sciences applications and electronic health records. Similarly, recent reports indicated that Medidata Solutions has been pursuing innovative partnerships to integrate AI-driven insights into their cloud platform, enhancing Research and Development efficiencies. The market continues to attract significant investments, reflecting confidence in technology’s role in advancing life science initiatives and research practices globally as governments prioritize healthcare technology enhancements in their strategic plans.

Life Science Software Market Segmentation Insights

Life Science Software Market Application Outlook

- Laboratory Information Management Systems

Life Science Software Market Deployment Model Outlook

Life Science Software Market End User Outlook

- Contract Research Organizations

Life Science Software Market Type Outlook

- Clinical Trial Management Software

- Laboratory Information Management Software

- Research and Development Software

Life Science Software Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

31.98(USD Billion) |

| MARKET SIZE 2024 |

33.95(USD Billion) |

| MARKET SIZE 2035 |

65.4(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

6.14% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Dassault Systemes, Thermo Fisher Scientific, Labcorp, C3S, Wolters Kluwer, Medidata Solutions, Illumina, Veeva Systems, Epic Systems, Agilent Technologies, Bioclinica, SAS Institute, PerkinElmer, Siemens Healthineers, Oracle |

| SEGMENTS COVERED |

Application, Deployment Model, End User, Type, Regional |

| KEY MARKET OPPORTUNITIES |

AI-driven analytics solutions, Cloud-based software adoption, Enhanced regulatory compliance tools, Integration of IoT technologies, Personalized medicine software platforms |

| KEY MARKET DYNAMICS |

Regulatory compliance demands, Increased R&D expenditures, Advanced data analytics adoption, Growing cloud-based solutions, Rising demand for automation |

| COUNTRIES COVERED |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ):

The Global Life Science Software Market is expected to be valued at 33.95 USD Billion in 2024.

By 2035, the Global Life Science Software Market is projected to reach 65.4 USD Billion.

The expected CAGR for the Global Life Science Software Market from 2025 to 2035 is 6.14%.

In 2024, North America is expected to dominate the market, valued at 15.0 USD Billion.

The European market is expected to be valued at 18.0 USD Billion in 2035.

The market size for Drug Discovery applications is estimated to be 10.5 USD Billion in 2024.

The Clinical Trials application segment is expected to be worth 17.0 USD Billion by 2035.

Major players in the market include Dassault Systemes, Thermo Fisher Scientific, and Veeva Systems.

The projected market value for Laboratory Information Management Systems in 2024 is 6.5 USD Billion.

The Asia-Pacific region is expected to experience growth, reaching a market value of 12.0 USD Billion by 2035.