Rising Demand for Genomic Research

The life science-analytics market is significantly influenced by the increasing demand for genomic research in Japan. With the advent of personalized medicine, there is a growing need for analytics that can interpret complex genomic data. The market for genomic analytics is expected to reach $2 billion by 2026, reflecting a robust growth trajectory. This demand is driven by the need for tailored therapies and the ability to predict disease susceptibility based on genetic information. Consequently, organizations are investing in analytics platforms that can provide insights into genomic data, thereby enhancing their research capabilities. This trend is likely to bolster the life science-analytics market as more entities recognize the value of genomic insights in drug development and patient care.

Government Initiatives Supporting Research

Government initiatives in Japan are playing a pivotal role in shaping the life science-analytics market. The Japanese government has been actively promoting research and development in the life sciences sector through funding and policy support. For instance, the government allocated approximately $1.5 billion in 2025 to support innovative research projects. Such initiatives not only enhance the research landscape but also encourage collaboration between academic institutions and private companies. This collaborative environment fosters the development of advanced analytics solutions tailored to the needs of the life sciences sector. As a result, the life science-analytics market is likely to benefit from increased investment and innovation driven by these government efforts.

Growing Focus on Drug Development Efficiency

The life science-analytics market is witnessing a growing focus on improving drug development efficiency in Japan. Pharmaceutical companies are increasingly adopting analytics to streamline their research processes and reduce time-to-market for new drugs. The average cost of developing a new drug has reached approximately $2.6 billion, prompting organizations to seek more efficient methodologies. By leveraging analytics, companies can optimize clinical trial designs and enhance patient recruitment strategies, ultimately leading to faster and more cost-effective drug development. This emphasis on efficiency is expected to drive demand for advanced analytics solutions, thereby propelling growth in the life science-analytics market as organizations strive to remain competitive in a challenging environment.

Technological Advancements in Data Processing

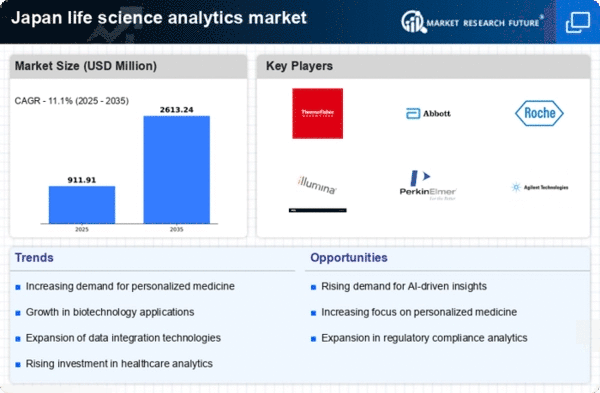

The life science-analytics market in Japan is experiencing a surge due to rapid technological advancements in data processing capabilities. Innovations in big data analytics and cloud computing are enabling organizations to handle vast amounts of biological and clinical data efficiently. This is particularly relevant as the market is projected to grow at a CAGR of 12.5% from 2025 to 2030. Enhanced data processing tools allow for more accurate insights, which are crucial for research and development in pharmaceuticals and biotechnology. As a result, companies are increasingly investing in advanced analytics solutions to improve their operational efficiency and decision-making processes. This trend is likely to continue, driving further growth in the life science-analytics market as organizations seek to leverage technology for competitive advantage.

Increased Collaboration Between Academia and Industry

The life science-analytics market is benefiting from increased collaboration between academia and industry in Japan. Universities and research institutions are partnering with biotech and pharmaceutical companies to leverage their analytical capabilities. This collaboration is fostering innovation and the development of new analytics tools tailored to the specific needs of the life sciences sector. As a result, the market is witnessing a rise in the availability of specialized analytics solutions that address unique challenges in research and development. This trend is likely to enhance the overall landscape of the life science-analytics market, as collaborative efforts lead to the creation of more effective and efficient analytical methodologies.