Rising Demand for Data-Driven Insights

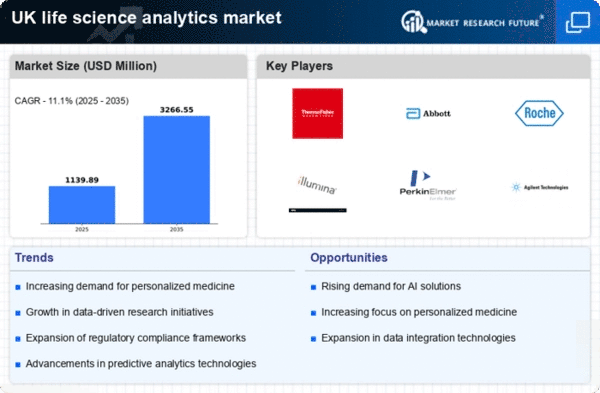

The life science-analytics market is experiencing a notable surge in demand for data-driven insights, primarily due to the increasing complexity of healthcare data. As healthcare providers and pharmaceutical companies seek to enhance decision-making processes, the reliance on analytics tools has intensified. In the UK, the market is projected to grow at a CAGR of approximately 12% over the next five years, driven by the need for actionable insights that can improve patient outcomes and operational efficiency. This trend indicates a shift towards a more analytical approach in life sciences, where data is leveraged to inform strategies and optimize resource allocation. Consequently, the life science-analytics market is positioned to play a pivotal role in transforming healthcare delivery and research methodologies.

Increased Focus on Regulatory Compliance

Regulatory compliance remains a critical driver for the life science-analytics market, particularly in the UK, where stringent regulations govern data management and patient safety. Organizations are increasingly adopting analytics solutions to ensure compliance with regulations such as GDPR and MHRA guidelines. This focus on compliance is likely to propel the market forward, as companies seek to mitigate risks associated with non-compliance. The life science-analytics market is projected to benefit from this trend, with a potential market growth of 10% annually as firms invest in analytics tools that facilitate adherence to regulatory standards while optimizing their operational processes.

Advancements in Technology Infrastructure

Technological advancements are significantly influencing the life science-analytics market, particularly in the UK. The integration of cloud computing, big data technologies, and advanced analytics platforms is enabling organizations to process vast amounts of data efficiently. This infrastructure supports real-time data analysis, which is crucial for timely decision-making in clinical trials and patient care. As organizations invest in these technologies, the life science-analytics market is expected to expand, with estimates suggesting a market value increase to £5 billion by 2027. The ability to harness technology effectively not only enhances operational capabilities but also fosters innovation in research and development, thereby driving growth in the sector.

Emphasis on Collaborative Healthcare Models

The shift towards collaborative healthcare models is influencing the life science-analytics market in the UK. As stakeholders, including healthcare providers, payers, and pharmaceutical companies, increasingly collaborate to improve patient care, the demand for integrated analytics solutions rises. These solutions facilitate data sharing and collaborative decision-making, which are essential for enhancing patient outcomes. The life science-analytics market is likely to see growth as organizations invest in platforms that support these collaborative efforts. This trend may lead to a market expansion of around 15% over the next few years, reflecting the growing recognition of the value of collaboration in healthcare.

Growing Investment in Research and Development

Investment in research and development (R&D) is a significant driver of the life science-analytics market in the UK. As pharmaceutical and biotechnology companies allocate substantial budgets towards R&D, the need for sophisticated analytics tools becomes paramount. These tools assist in identifying trends, predicting outcomes, and streamlining the drug development process. Recent data indicates that R&D spending in the life sciences sector has reached approximately £40 billion annually, underscoring the critical role of analytics in enhancing research efficiency. This trend suggests that the life science-analytics market will continue to thrive as organizations seek to maximize the return on their R&D investments.