-

Report Prologue

-

Scope Of The Report

-

Market Definition 13

-

Scope Of The Study 13

- Research Objectives 13

- Assumptions 14

- Limitations 14

-

Markets Structure 14

-

Research Methodology

-

Research Process 16

-

Primary Research 17

-

Secondary Research 17

-

Market Size Estimation 17

-

Market Dynamics

-

Introduction 20

-

Drivers 21

- Increasing Tire Manufacturing Across The Globe Is A Key Factor Driving Demand Of Liquid Polybutadiene (65% Impact Weightage) 21

- Growing Construction Industry Driving Liquid Polybutadiene Market (35% Impact Weightage) 22

-

Restraints 23

- Fluctuation In Raw Material Prices 23

-

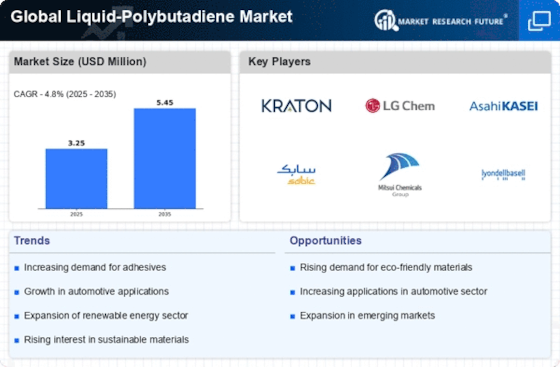

Trends & Opportunities 24

- Rising Demand Of Bio Based Liquid Polybutadiene In Tire Manufacturing 24

- Upsurge In Construction Activities In Asia And Middle East & Africa To Offer Lucarative Opportunities 24

-

Macroeconomic Indicators 24

- Rise In Disposable Income Coupled With Increased Spending On Automotive And Construction Activities. 24

-

Market Factor Analysis

-

Supply Chain Analysis 26

- Raw Material Suppliers 26

- Liquid Polybutadiene Producers 27

- Liquid Polybutadiene Distributors 27

- End User 27

-

Porter''s 5 Forces Analysis 27

- Threat Of New Entrants 27

- Threat Of Rivalry 27

- Threat Of Substitute 28

- Bargaining Power Of Supplier 28

- Bargaining Power Of Buyer 28

-

Global Liquid Polybutadiene Market, By Application

-

Introduction 29

-

Tire Manufacturing 33

-

Industrial Rubber 34

-

Polymer Modification 35

-

Protective Films 36

-

Chemicals 37

-

Coatings 37

-

Adhesives & Sealants 38

-

Others 39

-

Global Liquid Polybutadiene Market, By End Use

-

Introduction 42

-

Transportation 45

-

Construction 46

-

Industrial 47

-

Others 47

-

Global Liquid Polybutadiene Market, By Region

-

Introduction 49

-

North America 51

- U.S. 55

- Canada 58

-

Europe 61

- Germany 65

- UK 67

- Spain 70

- France 73

- Italy 76

- Rest Of The Europe 79

-

Asia Pacific 82

- China 86

- India 89

- Japan 92

- Rest Of The Asia Pacific 95

-

Latin America 98

- Mexico 102

- Brazil 105

- Rest Of The Latin America 108

-

Middle East & Africa 111

- UAE 115

- Saudi Arabia 118

- Rest Of The Middle East & Africa 121

-

Competitive Landscape

-

Introduction 124

-

Key Development & Strategies 124

-

Company Profile

-

Kuraray Co. Ltd. 126

- Company Overview 126

- Product/Business Segment Overview 126

- Financial Updates 127

- Key Developments 127

-

SIBUR International GmbH 128

- Company Overview 128

- Product/Business Segment Overview 128

- Production Capacity Of Business Segment 128

- Financial Updates 129

- Key Developments 129

-

Idemitsu Kosan Co.,Ltd. (Japan) 130

- Company Overview 130

- Product/Business Segment Overview 130

- Sales Volume Of Business Segment 130

- Financial Updates 131

- Key Developments 131

-

Versalis S.P.A (Italy) 132

- Company Overview 132

- Product/Business Segment Overview 132

- Sales And Production Business Segment 132

- Financial Updates 132

- Key Developments 133

-

Evonik Industries AG (Germany) 133

- Company Overview 133

- Product/Business Segment Overview 134

- Financial Updates 135

- Key Developments 135

-

Cray Valley (France) 136

- Company Overview 136

- Product/Business Segment Overview 136

- Financial Updates 136

- Key Developments 137

-

NIPPON SODA CO., LTD (Japan) 138

- Company Overview 138

- Product/Business Segment Overview 138

- Financial Updates 138

- Key Developments 138

-

Conclusion

-

List Of Tables

-

GLOBAL LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 ( USD MILLION) 30

-

GLOBAL LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 ( KT) 32

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, TIRE MANUFACTURING 2020-2027 (USD MILLION) 33

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, TIRE MANUFACTURING 2020-2027 (KT) 33

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, INDUSTRIAL RUBBER 2020-2027 (USD MILLION) 34

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, INDUSTRIAL & SKYLIGHTS 2020-2027 (KT) 34

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, POLYMER MODIFICANTION 2020-2027 (USD MILLION) 35

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, POLYMER MODIFICANTION 2020-2027 (KT) 35

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, PROTECTIVE FILMS 2020-2027 (USD MILLION) 36

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, PROTECTIVE FILMS 2020-2027 (KT) 36

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, CHEMICALS 2020-2027 (USD MILLION) 37

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, CHEMICALS 2020-2027 (KT) 37

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, COATINGS 2020-2027 (USD MILLION) 37

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, COATINGS 2020-2027 (KT) 38

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, ADHESIVES & SEALANTS 2020-2027 (USD MILLION) 38

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, ADHESIVES & SEALANTS 2020-2027 (KT) 39

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, OTHERS 2020-2027 (USD MILLION) 39

-

GLOBAL LIQUID POLYBUTADIENE MARKET FOR, OTHERS 2020-2027 (KT) 40

-

GLOBALN LIQUID POLUBUTADIENE MARKET BY, END USE 2020-2027 (USD MILLION) 43

-

GLOBALN LIQUID POLUBUTADIENE MARKET BY, END USE 2020-2027 (KT) 44

-

GLOBAL LIQUID POLUBUTADIENE MARKET FOR TRANSPORTATION 2020-2027 (USD MILLION) 45

-

GLOBAL LIQUID POLUBUTADIENE MARKET FOR TRANSPORTATION 2020-2027 (KT) 45

-

GLOBAL LIQUID POLUBUTADIENE MARKET FOR CONSTRUCTION 2020-2027 (USD MILLION) 46

-

GLOBAL LIQUID POLUBUTADIENE MARKET FOR CONSTRUCTION 2020-2027 (KT) 46

-

GLOBAL LIQUID POLUBUTADIENE MARKET FOR INDUSTRIAL 2020-2027 (USD MILLION) 47

-

GLOBAL LIQUID POLUBUTADIENE MARKET FOR INDUSTRIAL 2020-2027 (KT) 47

-

GLOBAL LIQUID POLUBUTADIENE MARKET FOR OTHERS 2020-2027 (USD MILLION) 47

-

GLOBAL LIQUID POLUBUTADIENE MARKET FOR OTHERS 2020-2027 (KT) 48

-

GLOBAL LIQUID POLYBUTADIENE MARKET, BY REGION 2020-2027 (USD MILLION) 50

-

GLOBAL LIQUID POLYBUTADIENE MARKET, BY REGION 2020-2027 (KT) 50

-

NORTH AMERICA LIQUID POLYBUTADIENE MARKET BY COUNTRY (USD MILLION) 51

-

NORTH AMERICA LIQUID POLYBUTADIENE MARKET BY COUNTRY (KT) 51

-

NORTH AMERICA LIQUID POLYBUTADIENE MARKET BY APPLICATION (USD MILLION) 52

-

NORTH AMERICA LIQUID POLYBUTADIENE MARKET BY APPLICATION (KT) 53

-

NORTH AMERICA LIQUID POLYBUTADIENE MARKET BY END USE (USD MILLION) 53

-

NORTH AMERICA LIQUID POLYBUTADIENE MARKET BY END USE (KT) 53

-

U.S. LIQUID POLYBUTADIENE MARKET BY APPLICATION (USD MILLION) 55

-

U.S. LIQUID POLYBUTADIENE MARKET BY APPLICATION (KT) 56

-

U.S. LIQUID POLYBUTADIENE MARKET BY END USE (USD MILLION) 56

-

U.S. LIQUID POLYBUTADIENE MARKET BY END USE (KT) 56

-

CANADA LIQUID POLYBUTADIENE MARKET BY APPLICATION (USD MILLION) 58

-

CANADA LIQUID POLYBUTADIENE MARKET BY APPLICATION (KT) 59

-

CANADA LIQUID POLYBUTADIENE MARKET BY END USE (USD MILLION) 60

-

CANADA LIQUID POLYBUTADIENE MARKET BY END USE (KT) 60

-

EUROPE LIQUID POLYBUTADIENE MARKET BY COUNTRY 2020-2027(USD MILLION) 61

-

EUROPE LIQUID POLYBUTADIENE MARKET BY COUNTRY 2020-2027 (KT) 62

-

EUROPE LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (USD MILLION) 62

-

EUROPE LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (KT) 63

-

EUROPE LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (USD MILLION) 64

-

EUROPE LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (KT) 64

-

GERMANY LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (USD MILLION) 65

-

GERMANY LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (KT) 66

-

GERMANY LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (USD MILLION) 66

-

GERMANY LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (KT) 66

-

UK LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (USD MILLION) 67

-

UK LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (KT) 67

-

UK LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (USD MILLION) 68

-

UK LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (KT) 68

-

SPAIN LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (USD MILLION) 70

-

SPAIN LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (KT) 71

-

SPAIN LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (USD MILLION) 71

-

SPAIN LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (KT) 71

-

FRANCE LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (USD MILLION) 73

-

FRANCE LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (KT) 74

-

FRANCE LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (USD MILLION) 74

-

FRANCE LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (KT) 74

-

ITALY LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (USD MILLION) 76

-

ITALY LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (KT) 77

-

ITALY LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (USD MILLION) 77

-

ITALY LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (KT) 77

-

RESRT OF THE EUROPE LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (USD MILLION) 79

-

RESRT OF THE EUROPE LIQUID POLYBUTADIENE MARKET BY APPLICATION 2020-2027 (KT) 80

-

RESRT OF THE EUROPE LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (USD MILLION) 80

-

RESRT OF THE EUROPE LIQUID POLYBUTADIENE MARKET BY END USE 2020-2027 (KT) 81

-

ASIA PACIFIC LIQUID POLYBUTADIENE MARKET, BY COUNTRY 2020-2027N (USD MILLION) 82

-

ASIA PACIFIC LIQUID POLYBUTADIENE MARKET, BY COUNTRY 2020-2027N (KT) 82

-

ASIA PACIFIC LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027N (USD MILLION) 83

-

ASIA PACIFIC LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027N (KT) 84

-

ASIA PACIFIC LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027N (USD MILLION) 84

-

ASIA PACIFIC LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027N (KT) 84

-

CHINA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027N (USD MILLION) 86

-

CHINA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027N (KT) 87

-

CHINA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027N (USD MILLION) 87

-

CHINA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (KT) 87

-

INDIA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (USD MILLION) 89

-

INDIA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (KT) 90

-

INDIA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (USD MILLION) 90

-

INDIA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (KT) 90

-

JAPAN LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (USD MILLION) 92

-

JAPAN LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (KT) 93

-

JAPAN LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (USD MILLION) 93

-

JAPAN LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (KT) 93

-

REST OF THE ASIA PACIFIC LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (USD MILLION) 95

-

REST OF THE ASIA PACIFIC LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (KT) 96

-

REST OF THE ASIA PACIFIC LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (USD MILLION) 96

-

REST OF THE ASIA PACIFIC LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (KT) 97

-

LATIN AMERICA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (USD MILLION) 98

-

LATIN AMERICA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (KT) 98

-

LATIN AMERICA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (USD MILLION) 99

-

LATIN AMERICA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (KT) 100

-

LATIN AMERICA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (USD MILLION 100

-

LATIN AMERICA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (USD MILLION) 101

-

MEXICO LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (USD MILLION) 102

-

MEXICO LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (KT) 103

-

MEXICO LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (USD MILLION) 103

-

MEXICO LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (KT) 103

-

BRAZIL LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (USD MILLION) 105

-

BRAZIL LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (KT) 106

-

BRAZIL LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (USD MILLION) 106

-

BRAZIL LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (KT) 106

-

REST OF THE LATIN AMERICA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (USD MILLION) 108

-

REST OF THE LATIN AMERICA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (KT) 109

-

REST OF THE LATIN AMERICA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (USD MILLION) 109

-

REST OF THE LATIN AMERICA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (KT) 110

-

MIDDLE EAST & AFRICA LIQUID POLYBUTADIENE MARKET, BY COUNTRIES 2020-2027 (USD MILLION) 111

-

MIDDLE EAST & AFRICA LIQUID POLYBUTADIENE MARKET, BY COUNTRIES 2020-2027 (KT) 111

-

MIDDLE EAST & AFRICA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (USD MILLION) 112

-

MIDDLE EAST & AFRICA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (KT) 113

-

MIDDLE EAST & AFRICA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (USD MILLION) 113

-

MIDDLE EAST & AFRICA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (KT) 114

-

UAE LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (USD MILLION) 115

-

UAE LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (KT) 116

-

UAE LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (USD MILLION) 116

-

UAE LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (KT) 116

-

SAUDI ARABIA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (USD MILLION) 118

-

SAUDI ARABIA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (KT) 119

-

SAUDI ARABIA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (USD MILLION) 119

-

SAUDI ARABIA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (KT) 119

-

REST OF THE MIDDLE EAST & AFRICA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (USD MILLION) 121

-

REST OF THE MIDDLE EAST & AFRICA LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 (KT) 122

-

REST OF THE MIDDLE EAST & AFRICA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (USD MILLION) 122

-

REST OF THE MIDDLE EAST & AFRICA LIQUID POLYBUTADIENE MARKET, BY END USE 2020-2027 (KT) 123

-

KEY DEVELOPMENT (2012-2020) 124

-

KURARAY CO. LTD: SEGMENT OVERVIEW 126

-

KURARAY CO. LTD:KEY DEVELOPMENTS 127

-

SIBUR INTERNATIONAL GMBH: SEGMENT OVERVIEW 128

-

SIBUR INTERNATIONAL GMBH: PRODUCTION ANALYSIS 128

-

SIBUR INTERNATIONAL GMBH:KEY DEVELOPMENTS 129

-

IDEMITSU KOSAN CO.,LTD.: SEGMENT OVERVIEW 130

-

IDEMITSU KOSAN CO.,LTD.: SALES AND PRODUCTION ANALYSIS 130

-

VERSALIS: SEGMENT OVERVIEW 132

-

VERSALIS: SALES AND PRODUCTION ANALYSIS 132

-

VERSALIS:KEY DEVELOPMENTS 133

-

EVONIK INDUSTRIES AG: SEGMENT OVERVIEW 134

-

EVONIK INDUSTRIES AG:KEY DEVELOPMENTS 135

-

CRAY VALLEY: SEGMENT OVERVIEW 136

-

CRAY VALLEY S.A:KEY DEVELOPMENTS 137

-

NIPPON SODA CO., LTD: SEGMENT OVERVIEW 138

-

-

List Of Figures

-

TOP DOWN & BOTTOM UP APPROACH 18

-

FORECAST MODEL 19

-

MARKET DYNAMICS 20

-

SUPPLY CHAIN ANALYSIS 26

-

GLOBAL LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 ( USD MILLION) 29

-

GLOBAL LIQUID POLYBUTADIENE MARKET, BY APPLICATION 2020-2027 ( KT) 31

-

GLOBALN LIQUID POLUBUTADIENE MARKET BY, END USE 2020-2027 (USD MILLION) 42

-

GLOBALN LIQUID POLUBUTADIENE MARKET BY, END USE 2020-2027 (KT) 43

-

GLOBAL LIQUID POLYBUTADIENE MARKET, BY REGION 2020 (%) 49

-

KURARAY CO. LTD: RECENT FINANCIAL 127

-

SIBUR INTERNATIONAL GMBH: RECENT FINANCIAL 129

-

IDEMITSU KOSAN CO.,LTD.: RECENT FINANCIAL 131

-

VERSALIS: RECENT FINANCIALS 132

-

EVONIK INDUSTRIES AG: RECENT FINANCIALS 135

-

NIPPON SODA CO., LTD: RECENT FINANCIALS 138

Leave a Comment