Lithium Titanate Battery Size

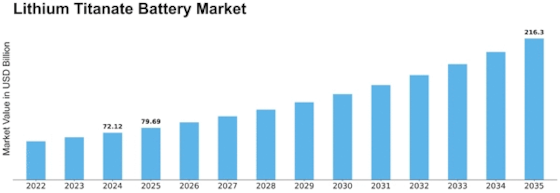

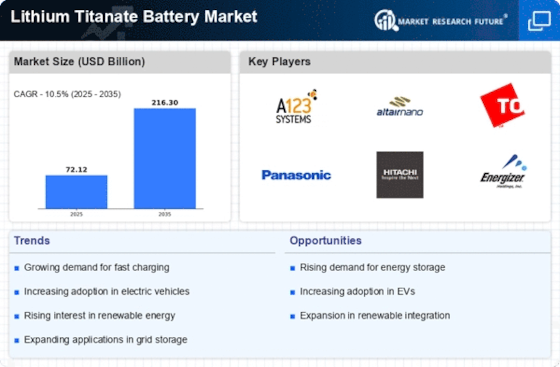

Lithium Titanate Battery Market Growth Projections and Opportunities

The Lithium Titanate Battery market is influenced by various market factors that significantly impact its growth and development. To gain insights into the dynamics of this market, it's crucial to examine key factors shaping the Lithium Titanate Battery industry. Here are the critical market factors presented in a clear and concise pointer format: Rising Demand for Electric Vehicles (EVs): The Lithium Titanate Battery market is closely tied to the increasing adoption of electric vehicles. As the automotive industry shifts towards cleaner and more sustainable transportation solutions, Lithium Titanate Batteries are gaining popularity due to their rapid charging capabilities, long cycle life, and enhanced safety features. Fast Charging Capabilities: Lithium Titanate Batteries are known for their remarkable fast-charging capabilities, making them a preferred choice for applications where quick charging is essential, such as electric vehicles and energy storage systems. This feature addresses one of the key challenges associated with electric vehicles, contributing to the market's growth. Long Cycle Life: The extended cycle life of Lithium Titanate Batteries, characterized by a high number of charge-discharge cycles before capacity degradation, makes them suitable for applications demanding durability and reliability. This factor positions these batteries favorably in markets requiring long-lasting and robust energy storage solutions. Applications in Energy Storage Systems (ESS): The demand for energy storage systems, both in grid-level applications and residential settings, contributes to the growth of the Lithium Titanate Battery market. These batteries are suitable for ESS due to their safety features, fast charging, and long cycle life, addressing the needs of renewable energy integration and grid stabilization. Safety Features and Thermal Stability: Lithium Titanate Batteries are known for their safety features and thermal stability, reducing the risk of overheating or combustion. This aspect is critical, especially in applications where safety is paramount, such as electric vehicles and stationary energy storage systems. Advancements in Battery Technology: Ongoing advancements in battery technology, including improvements in energy density and efficiency, influence the adoption of Lithium Titanate Batteries. Companies investing in research and development to enhance the performance and characteristics of these batteries contribute to market evolution. Government Policies and Incentives: Government policies promoting the adoption of electric vehicles and renewable energy technologies play a significant role in the Lithium Titanate Battery market. Incentives, subsidies, and regulations encouraging the use of clean energy solutions contribute to increased demand for these batteries. Global Expansion of Renewable Energy: The global focus on renewable energy sources, such as solar and wind, has a direct impact on the demand for energy storage solutions, including Lithium Titanate Batteries. These batteries facilitate the efficient storage and utilization of renewable energy, supporting the growth of clean energy initiatives. Competitive Landscape in Battery Market: The competitive landscape within the broader battery market influences the positioning of Lithium Titanate Batteries. Companies operating in this market must navigate competition from other lithium-ion battery technologies, each offering unique advantages and trade-offs in terms of performance and cost. Supply Chain Considerations: The Lithium Titanate Battery market is influenced by supply chain dynamics, including the availability and pricing of raw materials. Lithium and titanium, key components of these batteries, are subject to market fluctuations, impacting overall production costs and market competitiveness.

Leave a Comment