Market Share

Location Analytics Market Share Analysis

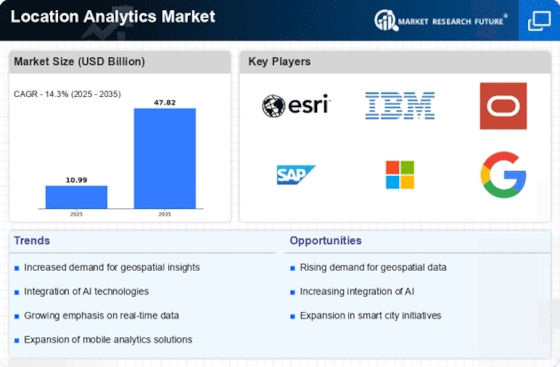

The Location Analytics market presents an environment that is conducive to growth and expansion. Organizations that take advantage of this atmosphere are making moves to seize and grow their respective market shares. The trend of location analysis, which is the use of spatial data to make key choices and enhance the customers’ experience in enterprises such as retail, health care, strategy, and the list goes on, has emerged as a crucial tactic across different industries. The competition in the market has increased as the companies have realized the power of people immersed in the locations, making them introduce new techniques to ensure their market share is captivating, resulting in market stability.

One of the players‘ techniques in this Location Analytics market is to use the mech as a disability removal. Companies tend to overinvest in devices and platforms that have deep learning, high-resolution, and backward-in-time prediction. Collaboration between human intellect, AI, and sensory data analysis over location-based products leads to organizations to obtain more lucrative insights on spatial data. Through being in continuous move at the technological forefront, companies will be placed as pacesetters making the latest and most effective location analytics systems which will attract clients looking for a perfect and reliable stand-in methods.

Also forming key ingredients of spot market analyzing’s strategies through vendor growth and giving importance to critical organizations. The multifaceted form of location information and its possibilities for application are a source of inspiration for organizations. This results in an active creation of alliances with other innovation suppliers, information aggregators, or niche partners. These activities which have incorporated all the strategic moves including the multi functional offices compelled them to provide well thought of configurations which cover the particular of the individual markets. As an example, a place analytics company could team up with a retail analytics being done to discover the likes and dislikes of consumers and as well as the spatial patterns of people in that region. This would definitely add value to an organisation and attract more customers.

Another feature is specific to regions, a characteristic market structuring device. Their area analytics structures are tailored not only to get aware of the specific challenges of roughly areas but also give solutions to them. Single out upgrading the store network or synergizing charge store procedure in production assembly or end-client service experience in retails which proved that the sector-specific arrangement has a deep understanding in the individualized needs of every market segment. Such a "specific approach" does not simply help companies build a good reputation as competent industry leaders, but also allows them to get acquainted with the peculiarities of a particular consumer category's demands.

Leave a Comment