- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

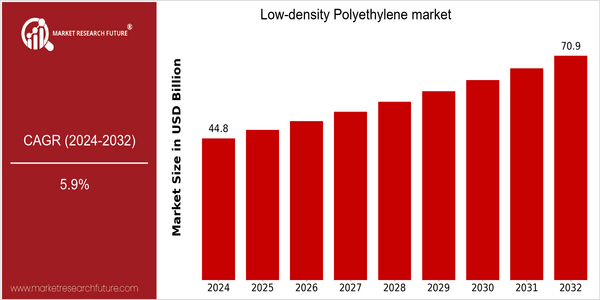

| Year | Value |

|---|---|

| 2024 | USD 44.84 Billion |

| 2032 | USD 70.94 Billion |

| CAGR (2024-2032) | 5.9 % |

Note – Market size depicts the revenue generated over the financial year

The LDPE market is set to grow significantly, with a current market value of $ 44.84 billion in 2024, expected to reach $ 70.94 billion by 2032. The market is projected to grow at a CAGR of 5.9 per cent over the forecast period. The growth in demand for LDPE in various applications, such as packaging, consumer goods, and construction, is the primary factor driving the market growth. In addition, LDPE is a lightweight and flexible material that has excellent chemical resistance and low density. The advancements in the production of LDPE are also driving the market growth. The companies are investing in the research and development of LDPE to increase the efficiency of LDPE production and reduce the impact on the environment. ExxonMobil and LyondellBasell are collaborating to improve the products and the production of LDPE. The growing demand for eco-friendly packaging solutions is also creating new opportunities for LDPE as it can be recycled and re-used, which aligns with the sustainable development goals.

Regional Market Size

Regional Deep Dive

The LDPE market is characterized by varied dynamics in the various regions, which are mainly driven by the demand of end-use industries, such as packaging, automobiles and construction. In North America, the market is driven by the strong manufacturing industry and the rising demand for sustainable packaging solutions. In Europe, the trend towards bio-based LDPE and the stricter regulations on waste disposal are driving the market. In Asia-Pacific, rapid urbanization and industrialization are causing the demand for LDPE to grow. The Middle East and Africa are growing due to the investments in petrochemicals. Latin America is mainly focusing on increasing its production capacity to meet the local and export demand.

Europe

- European market is increasingly influenced by the European Union’s Circular Economy Action Plan, which encourages the use of recycled materials in production. In this context, companies such as BASF and LyondellBasell are leading the way with sustainable LDPE solutions.

- Innovations in bio-based LDPE are gaining traction, with firms like Braskem launching products derived from renewable resources, catering to the growing consumer demand for environmentally friendly packaging.

Asia Pacific

- China's rapid urbanization and industrial growth are driving significant demand for LDPE, particularly in the packaging and construction sectors. Major players like Sinopec are expanding their production capacities to meet this rising demand.

- India is witnessing a shift towards sustainable packaging solutions, with government initiatives promoting the use of recyclable materials, which is expected to boost the LDPE market as manufacturers adapt to these changes.

Latin America

- Brazil is enhancing its LDPE production capabilities through investments in new technologies, with companies like Braskem leading the charge to meet both local and export demands.

- The region is also seeing a rise in initiatives aimed at reducing plastic waste, with governments implementing stricter regulations that encourage the use of recycled LDPE in various applications.

North America

- The United States is now experiencing a boom in the use of LDPE in the packaging industry, a result of the e-commerce boom and the growing consumer preference for lightweight materials. ExxonMobil and Dow are investing in new production processes to increase the efficiency of their plants and reduce their carbon footprint.

- Recent regulatory changes in California, aimed at reducing plastic waste, are pushing manufacturers to innovate in biodegradable and recyclable LDPE products, which is expected to reshape the market landscape significantly.

Middle East And Africa

- The Middle East is focusing on expanding its petrochemical sector, with countries like Saudi Arabia investing heavily in LDPE production facilities to cater to both domestic and international markets.

- Regulatory frameworks in several African nations are evolving to support the use of recyclable materials, which is expected to drive innovation in LDPE applications, particularly in packaging.

Did You Know?

“Did you know that LDPE was the first type of polyethylene ever produced, back in 1933, and it remains one of the most widely used plastics today due to its versatility and low-density properties?” — PlasticsEurope

Segmental Market Size

The LDPE segment is a major part of the plastics market, where it is subject to a steady demand due to its versatility and low price. The emergence of light-weight packaging is a major driver for this segment, as is the demand for flexible materials in various industries, such as food and beverage, health care, and construction. In addition, regulatory policies promoting sustainable packaging have bolstered the segment, since LDPE is often favored for its recyclability. In the current market, LDPE is in a mature phase of development, with Dow and LyondellBasell leading in both production and innovation. The main applications are in the food and beverage industry, where it is used in packaging films, containers, and insulating materials. The drive toward sustainable development and the circular economy are also increasing the demand for LDPE, and government regulations on plastic waste are further encouraging this trend. LDPE is a versatile polymer, and its development is driven by new developments in technology. Recent developments in the field of biopolymers and advanced methods of recycling will shape the future of LDPE in a rapidly changing market.

Future Outlook

The low-density polyethene (LDPE) market is expected to grow at a rapid rate from 2024 to 2032. The market is expected to rise from $44,842,580,587 to $70,893,568. , at a CAGR of 5.9 percent. The demand for LDPE in the packaging, consumer goods and construction industries is expected to increase during this period. Moreover, as the industries focus on achieving a higher level of sustainability, the use of LDPE, which is characterized by its recyclability and lightness, will increase, which will drive the market. The use of LDPE in packaging alone is expected to account for more than 40 percent of the total market by 2032. The LDPE market will be driven by several key technological developments and government regulations. The development of bio-based LDPE and improved recycling technology will increase the material's appeal and reduce its negative impact on the environment. Also, government regulations encouraging the use of recyclability and the reduction of plastic waste will encourage a shift towards LDPE. Further driving the market will be the rise in e-commerce and the demand for flexible packaging solutions.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 39 Billion |

| Market Size Value In 2023 | USD 45 Billion |

| Growth Rate | 5.00% (2023-2030) |

Low-density Polyethylene Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.