Research Methodology on Lung Cancer Market

Introduction

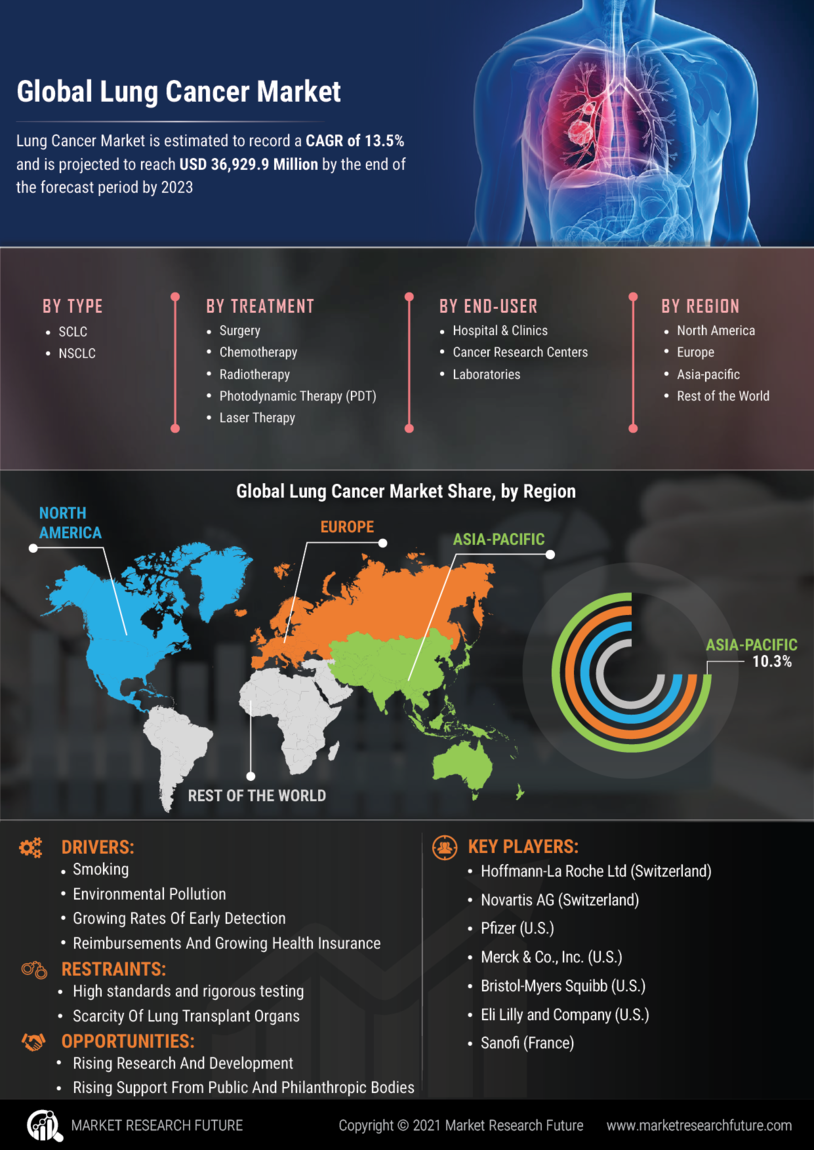

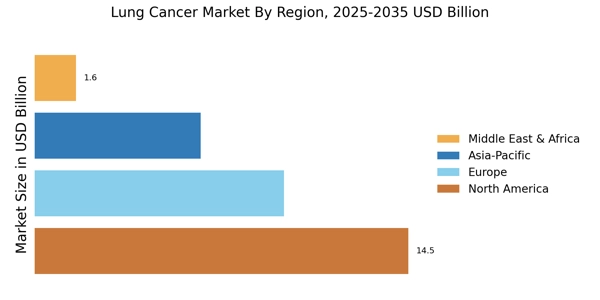

The global lung cancer market is expected to experience significant growth over the forecast period between 2023 and 2030 driven by the increasing prevalence of cancer, technological advancements in diagnosis and treatment processes and the availability of effective therapeutic approaches. This report aims to analyze the current prospects of the market, overview the key technological advancements, and review the innovative treatment strategies and strategies adopted by major players to increase their market potential.

Research Methodology

The research for this report is conducted using a combination of qualitative and quantitative research methods, including both primary and secondary research. The primary research involves in-depth interviews and questionnaires with major players in the field, as well as other industry experts, to gain insider insights and perceptions on the latest technological advancements, market trends, and investment strategies of players in the global lung cancer market. Secondary research entailed collecting data from a range of sources including industry databases, government websites and reports, market reports, leading journals and other relevant literature.

A comprehensive market analysis comprising the macro and micro factors influencing the demand, supply, and outlook of the global lung cancer market was conducted. The market size and CAGR for the forecast period of 2023 to 2030 are determined based on the trend analysis of various factors, such as market dynamics, technological advancements, and competitive strategy analysis. A complete analysis of the competitive scenario is also carried out to identify the major players and their market positions.

In addition, Porter’s Five Forces analysis was conducted to analyze the competitive landscape. This is done to identify the major suppliers and purchasers, their capabilities and limitations, their market strategy and the threats prevalent in the lung cancer market. SWOT analysis was conducted to assess the strengths and weaknesses of the business, the opportunities present, and the potential threats that may hinder the growth of the market.

Furthermore, market simulations were undertaken to evaluate the future growth potential of the lung cancer market. The results of these simulations were used to forecast the CAGR for the period 2023-2030. Additionally, a value chain analysis and PESTLE analysis were conducted to provide a better understanding of the growth prospects of the global lung cancer market and the various factors influencing its growth.

Lastly, other quantitative research was conducted to develop a better appreciation of the market dynamics and their effects on the market segments. The research incorporated data triangulation, corroboration analysis, and market sizing. The information gathered through this approach was combined with insights gleaned from the qualitative research to gain a deeper understanding of the industry.

Conclusion

This report provides a comprehensive overview of the current and future prospects of the global lung cancer market, comprising the various drivers and restraints influencing the market, the key technological advancements, and the strategies adopted by leading players. It further provides the market size, CAGR and a comprehensive macro and micro market analysis, including a comprehensive value chain analysis, Porter’s Five Forces analysis and a PESTLE analysis. The research was carried out using a combination of qualitative and quantitative research methods to gain a deeper understanding of the market’s current and future prospects.