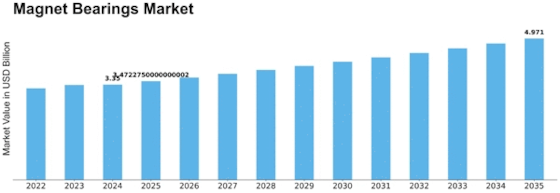

Magnet Bearings Size

Magnet Bearings Market Growth Projections and Opportunities

The magnet bearings market is subject to a range of influential factors that collectively define its landscape and growth trajectory. One key determinant is the increasing demand for high-speed and precision applications in various industries. Magnet bearings, known for their ability to operate without physical contact, find extensive use in applications where minimal friction and high rotational speeds are crucial, such as in industrial machinery, electric motors, and advanced manufacturing processes. Significant drivers for the magnet bearings market are the technological advancements. With more industries clinging on to innovation, there is a growing demand for more efficient and dependable bearings. In the aerospace industry, the healthcare sector, and the renewable energy field, magnetic bearing systems have become increasingly popular because they enable frictionless and maintenance-free operation. R&D activities continue to play a significant role in the further development of magnetic bearing technologies, improving their performance while increasing potential industries of application. The energy landscape plays a critical role in determining the shape of the magnet bearings market. Advanced technologies, such as magnetic bearings, are becoming more popular due to the growing importance of energy efficiency and sustainability. These bearings have benefits including better energy efficiency, increased service life, and easier maintenance compared with traditional mechanical bearings. With industries across the globe racing to comply with stringent energy efficiency regulations and cut down on environmental impact, the demand for magnet bearings is set to rise sharply. The magnet bearings market is also affected by the market regulations and standards. Strict laws concerning emissions and energy efficiency in several sectors drive the integration of technologies that meet these standards. Magnetic bearings that are inherently efficient and eco-friendly make a good choice for companies that want to meet green regulations. Also, safety standards in industries such as aerospace and healthcare promote the increasing popularity of magnet bearings because of their accuracy and durability. Magnet bearings market is played by global economic conditions and industrial activities. Industrial production and capital investments may slow down due to an economic downturn, thus putting a burden on advanced technologies such as magnetic bearings. On the opposite side, phases of economic development and rise of industrial activities motivate the demand for stable and efficient bearing solutions, promoting the market for magnetic bearings. The competitive landscape and industry alliances also play a role in the dynamics of the magnet bearings market. Companies spending their capital to improve their magnetic bearing technologies get a competitive advantage. Strategic collaborations, mergers, and acquisitions within the industry have an impact on market consolidation and the growth of key players. Market leaders in the magnet bearings industry are also distinguished by the fact that they can offer complete solutions such as sophisticated control systems and services.

Moreover, the globalization of industries and the expansion of key end-use sectors impact the magnet bearings market. As manufacturing and production facilities spread across regions, the demand for reliable and efficient bearing solutions transcends geographical boundaries. The ability of magnetic bearings to operate in challenging environments and provide precise control makes them attractive for industries with diverse operational requirements.

Leave a Comment