Market Analysis

In-depth Analysis of Magnetic Resonance Imaging Systems Market Industry Landscape

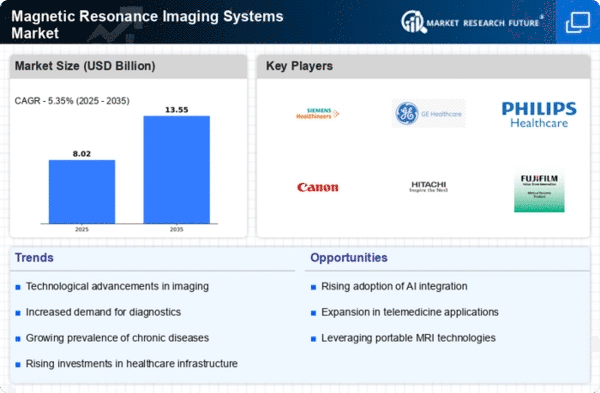

The market for magnetic resonance imaging systems frameworks is an area of the clinical imaging industry that is dynamic and going through speed up change. Without using ionizing radiation, X-ray innovation gives exact pictures of inner designs, which is of basic significance in the field of medication analysis. Drivers of market development incorporate a. The market remains moved by persistent innovative progressions, including upgraded imaging calculations and expanded attractive field qualities. b. The X-ray market is being driven by the rising commonness of ongoing illnesses, for example, those influencing the sensory system and outer muscle framework, which expands the interest for ahead of schedule and precise symptomatic instruments.

Coming up next are worldwide market drifts: a. The remarkable pattern of hybrid imaging includes the mix of magnetic resonance imaging systems with other imaging modalities, including CT and positron emanation tomography (PET). This joining offers extensive indicative data. b. A rising accentuation is being put on the advancement of convenient and minimized X-ray frameworks, which would work with reason behind care imaging and further develop openness across different medical services conditions. Chief Market Members: a. GE Medical care, an unmistakable industry member, reliably presents creative magnetic resonance imaging systems that incorporate man-made reasoning (simulated intelligence) to further develop picture examination and conclusion. b. Siemens Healthineers: Siemens keeps a main situation in the business with its Magnetom series, which focuses on persistent solace and high-goal imaging by means of imaginative plan. Varieties in Territorial Business sectors: a. North America: A powerful medical services foundation, high medical care uses, and early reception of cutting-edge clinical innovations all add to the predominance of the North American market. b. Considering the rising acknowledgment of the benefits related with ideal discovery and the upgrade of medical services framework, the Asia-Pacific region offers significant possibilities for development. Hardships in the commercial center: a. The extensive introductory uses connected to the obtainment and execution of magnetic resonance imaging systems present a trouble, particularly for medical services foundations that work under asset constraints. b. The execution of novel magnetic resonance imaging systems advancements might experience obstructions as administrative obstacles, including thorough endorsement prerequisites and adherence to different guidelines. Results of Coronavirus: The magnetic resonance imaging systems market has been impacted both decidedly and adversely by the Coronavirus pandemic. Defers happened in non-pressing imaging methods because of the expanded accentuation on crisis and basic consideration, in spite of the flood popular for symptomatic imaging administrations.

Leave a Comment