Market Share

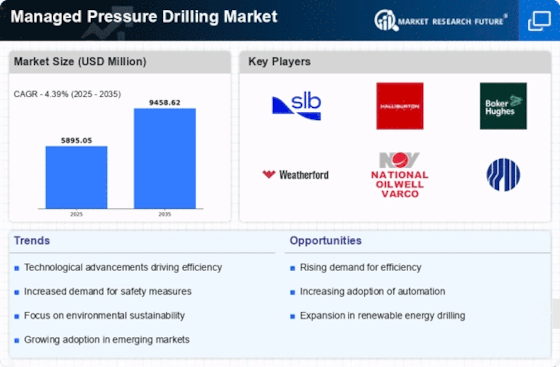

Managed Pressure drilling Market Share Analysis

This market is highly competitive since the companies serving this industry use different strategies to achieve a comparative advantage. A common method is the differentiation through technology and innovation. Companies spend huge amounts of money on research and development to improve the MPD technologies and hence make their systems more efficient, reliable working in varying drilling setting. This not only attracts clients looking for innovative solutions but also creates brand recognition as a leader in technology. Cost leadership is another central positioning strategy. It is for this reason that some market players seek to improve their operations in order of providing MPD services at a lower price than others. This includes simplifying processes, enhancing efficiency of equipment, and utilizing economies of scale. Giving cost-effective solutions, companies can attract price conscious clients and have a large market share. Nevertheless, there should be a balance between cost-cutting mechanisms and ensuring the integrity of MPD services. An approach widely used by the MPD industry is market segmentation. Companies target niche markets or geographic areas where they can do well and enhance their services for them. For example, a firm may focus on providing MPD solutions to unconventional reservoirs or target areas with difficult drilling. By using a focused approach, companies can position themselves as experts in specific areas and gain competitive advantage while increasing their market share. There is a growing trend of collaboration and strategic partnerships in the MPD market. Companies frequently establish partnerships with other organizations that could be technology providers, drilling contractors, and oil & gas operators. However, these joint ventures enable knowledge transfer with respect to expertise, resources and capacities needed for companies that provide MPD solutions. Companies could and gain market shares, share costs of development, enter new markets by means of strategic partnerships. Geographical expansion is a simple but effective positioning strategy of the market share. Everywhere in the world, as MPD services grow increasingly popular. This could mean setting up local operations, forging alliances with regional actors or the acquisition of existing businesses in target markets. Through internationalization, businesses can better capitalize on new opportunities and gain competitive advantages over other companies having a more limited scope of operation. The customer-focused strategies are significant in the MPD market. In fact, forming good relationships with clients so that they understand their needs and receive customized solutions will result in loyal customers who come back again.

Leave a Comment