Diverse Culinary Experiences

The Meal Kit Delivery Services Market benefits from the growing consumer interest in diverse culinary experiences. As globalization increases, individuals are more eager to explore international cuisines and cooking techniques from the comfort of their homes. Meal kit services are capitalizing on this trend by offering a wide range of meal options that reflect various cultural influences. Data indicates that meal kits featuring international recipes have seen a rise in popularity, with consumers seeking to expand their culinary horizons. This demand for variety not only enhances the appeal of meal kits but also encourages repeat purchases, as customers are likely to try new dishes regularly. Consequently, the focus on diverse culinary experiences is expected to drive innovation within the meal kit delivery sector, as companies strive to meet the evolving tastes and preferences of their clientele.

Rising Demand for Convenience

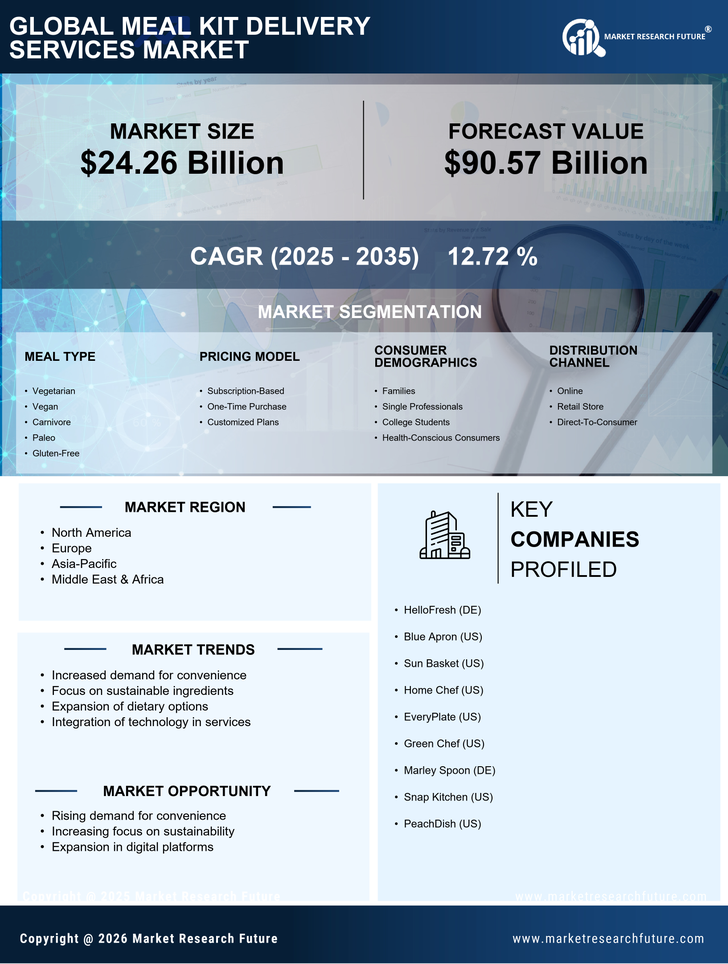

The Meal Kit Delivery Services Market experiences a notable surge in demand for convenience among consumers. As lifestyles become increasingly hectic, individuals seek solutions that save time and effort in meal preparation. This trend is reflected in the growing number of households opting for meal kits, which provide pre-portioned ingredients and easy-to-follow recipes. According to recent data, the meal kit delivery sector has seen a compound annual growth rate of approximately 20% over the past few years. This indicates a strong consumer preference for services that simplify cooking while maintaining quality. The convenience factor is particularly appealing to busy professionals and families, who may find traditional grocery shopping and meal planning cumbersome. As a result, meal kit services are likely to continue expanding their market share, catering to the evolving needs of time-strapped consumers.

Health Consciousness Among Consumers

The Meal Kit Delivery Services Market is significantly influenced by the increasing health consciousness among consumers. As awareness of nutrition and healthy eating habits rises, individuals are more inclined to seek meal options that align with their dietary preferences and health goals. Meal kit services often provide a variety of options, including organic, gluten-free, and low-calorie meals, appealing to health-focused consumers. Recent statistics indicate that nearly 60% of consumers prioritize health when selecting meal options, which has prompted meal kit companies to innovate and diversify their offerings. This trend not only enhances customer satisfaction but also fosters brand loyalty, as consumers are likely to return to services that meet their health needs. Consequently, the emphasis on health and wellness is expected to drive growth in the meal kit delivery sector, as more individuals turn to these services for nutritious meal solutions.

Sustainability and Eco-Friendly Practices

The Meal Kit Delivery Services Market is increasingly shaped by sustainability and eco-friendly practices. As consumers become more environmentally conscious, they are drawn to meal kit services that prioritize sustainable sourcing and packaging. Many companies are adopting practices such as using recyclable materials and sourcing ingredients from local farms, which resonates with eco-aware consumers. Recent surveys indicate that over 70% of consumers are willing to pay a premium for sustainable products, highlighting the potential for growth in this segment. Additionally, meal kit services that emphasize sustainability often report higher customer retention rates, as consumers appreciate brands that align with their values. This trend suggests that sustainability will continue to be a driving force in the meal kit delivery market, influencing purchasing decisions and shaping the future of the industry.

Technological Advancements in Delivery Systems

The Meal Kit Delivery Services Market is witnessing transformative changes due to technological advancements in delivery systems. Innovations such as real-time tracking, automated inventory management, and enhanced user interfaces are streamlining operations and improving customer experiences. These technologies enable meal kit companies to optimize their supply chains, reduce waste, and ensure timely deliveries. Data suggests that companies utilizing advanced logistics solutions can achieve up to a 30% increase in operational efficiency. Furthermore, the integration of mobile applications allows consumers to customize their meal selections and manage subscriptions with ease. As technology continues to evolve, it is likely that meal kit services will adopt even more sophisticated solutions, enhancing their competitive edge in the market. This technological integration not only improves service delivery but also fosters customer engagement, making meal kits a more attractive option for consumers.