Health and Wellness Trends

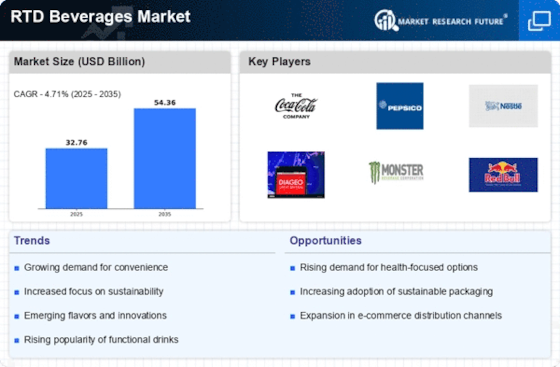

The RTD Beverages Market is experiencing a paradigm shift driven by health and wellness trends. Consumers are increasingly prioritizing beverages that align with their health goals, leading to a rise in demand for low-calorie, functional, and organic options. This shift is not only reshaping product formulations but also influencing marketing strategies. Brands are now focusing on transparency and ingredient integrity, appealing to health-conscious consumers. Recent statistics suggest that the health-oriented segment of the RTD Beverages Market is projected to grow by approximately 10% annually, as more consumers seek beverages that offer nutritional benefits alongside taste. This trend underscores the importance of innovation in product development to meet evolving consumer expectations.

Innovative Flavor Profiles

The RTD Beverages Market is witnessing a surge in demand for innovative flavor profiles that cater to diverse consumer preferences. As consumers increasingly seek unique and adventurous taste experiences, manufacturers are responding by introducing a variety of flavors, including exotic fruits, herbal infusions, and fusion blends. This trend is not merely a passing fad; it reflects a broader shift towards personalization in beverage choices. According to recent data, the introduction of new flavors has contributed to a notable increase in sales, with certain segments reporting growth rates exceeding 15% annually. This dynamic environment encourages brands to experiment and differentiate themselves, thereby enhancing their market presence in the RTD Beverages Market.

Convenience and On-the-Go Consumption

The RTD Beverages Market is significantly influenced by the growing consumer preference for convenience and on-the-go consumption. As lifestyles become increasingly fast-paced, consumers are gravitating towards ready-to-drink options that offer immediate satisfaction without the need for preparation. This trend is particularly pronounced among younger demographics, who prioritize convenience in their purchasing decisions. Data indicates that the convenience segment of the RTD Beverages Market has expanded rapidly, with sales projected to rise by over 20% in the coming years. Brands that effectively position their products as convenient solutions are likely to capture a larger share of this burgeoning market, thereby reinforcing their competitive advantage.

E-commerce and Digital Transformation

The RTD Beverages Market is undergoing a transformation driven by the rise of e-commerce and digital platforms. As consumers increasingly turn to online shopping for convenience and variety, brands are adapting their distribution strategies to include robust online presence. This shift has been accelerated by advancements in technology and changing consumer behaviors, with e-commerce sales in the RTD Beverages Market projected to grow by over 30% in the next few years. Companies that effectively leverage digital marketing and e-commerce platforms are likely to enhance their reach and accessibility, thereby capitalizing on the growing trend of online purchasing. This evolution presents both challenges and opportunities for brands within the RTD Beverages Market.

Sustainability and Eco-Friendly Packaging

The RTD Beverages Market is increasingly shaped by sustainability and eco-friendly packaging initiatives. As environmental concerns gain prominence among consumers, brands are compelled to adopt sustainable practices in their production and packaging processes. This includes the use of recyclable materials, reduced plastic usage, and transparent sourcing of ingredients. Data indicates that products marketed with sustainability credentials are witnessing higher consumer engagement, with sales in this category growing by nearly 25%. Companies that prioritize sustainability not only enhance their brand image but also align themselves with the values of a growing segment of environmentally conscious consumers, thereby positioning themselves favorably within the RTD Beverages Market.