Non Alcoholic RTD Beverages Market Summary

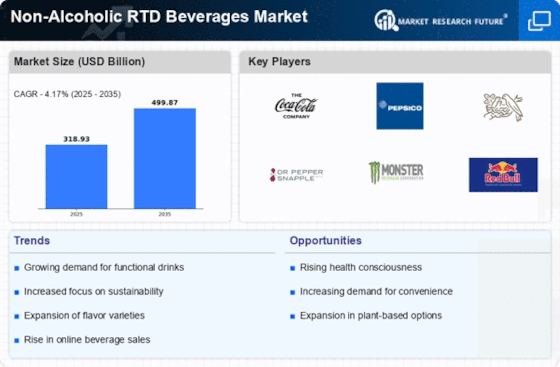

As per Market Research Future analysis, the Non-Alcoholic RTD Beverages Market Size was estimated at 318.93 USD Billion in 2024. The Non-Alcoholic RTD Beverages industry is projected to grow from 332.23 USD Billion in 2025 to 499.87 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.17% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Non-Alcoholic RTD Beverages Market is experiencing a dynamic shift towards health-conscious and sustainable options.

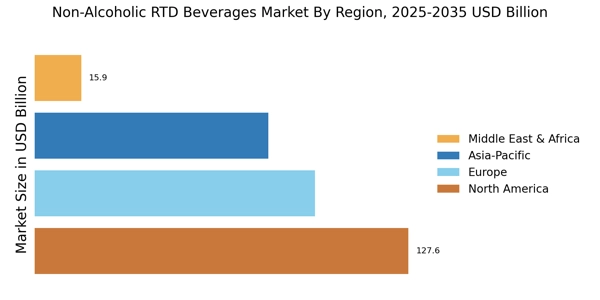

- The market is increasingly driven by a focus on health and wellness, particularly in North America, the largest market.

- Asia-Pacific emerges as the fastest-growing region, showcasing a rising demand for innovative beverage options.

- Soft drinks remain the largest segment, while juices are rapidly gaining traction due to changing consumer preferences.

- Key market drivers include heightened health consciousness and sustainability trends, influencing product development and marketing strategies.

Market Size & Forecast

| 2024 Market Size | 318.93 (USD Billion) |

| 2035 Market Size | 499.87 (USD Billion) |

| CAGR (2025 - 2035) | 4.17% |

Major Players

Coca-Cola (US), PepsiCo (US), Nestle (CH), Dr Pepper Snapple Group (US), Monster Beverage Corporation (US), Red Bull GmbH (AT), Unilever (GB), Kraft Heinz (US), Danone (FR)