Medical Device Packaging Size

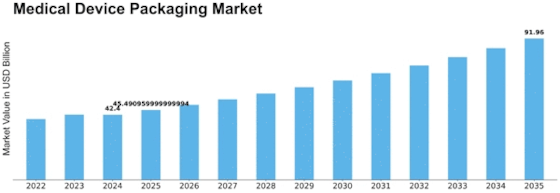

Medical Device Packaging Market Growth Projections and Opportunities

The global medical device packaging market is influenced by various factors that shape its dynamics and determine its performance. Medical device packaging plays a critical role in ensuring the safety, sterility, and integrity of medical devices throughout their lifecycle, from manufacturing to patient use. One of the primary market factors impacting the global medical device packaging market is the increasing demand for healthcare services and medical devices worldwide. As the global population grows, ages, and becomes more health-conscious, there is a rising demand for medical devices across various healthcare settings, including hospitals, clinics, and home healthcare. This increasing demand for medical devices drives the need for reliable and compliant packaging solutions that meet regulatory standards and ensure product safety.

Packaging as a process includes all the functions related to designing and developing the outer covering for a product. The product is a bundle of utility so it becomes necessary to pack it in such a material that safeguards it, and adds to its quality. Packaging of medical devices becomes important because they are to be preserved in a specialized environment and are not meant to be exposed. Medical devices are preserved in sterile packaging and are handled with care.

Moreover, advancements in medical device technologies and materials significantly influence the global medical device packaging market. Manufacturers are constantly innovating to develop new medical devices with advanced functionalities, smaller footprints, and improved patient outcomes. These technological advancements in medical devices drive corresponding innovations in packaging materials and designs to ensure compatibility, protection, and usability. For example, the development of biocompatible and sterilizable packaging materials, such as medical-grade plastics and barrier films, meets the stringent requirements of medical device packaging, ensuring product sterility and integrity.

Furthermore, regulatory factors play a crucial role in shaping the global medical device packaging market. Governments around the world have implemented stringent regulations and standards to ensure the safety, efficacy, and quality of medical devices and their packaging. Regulatory requirements vary by region and can include standards such as the Food and Drug Administration (FDA) regulations in the United States or the European Union Medical Device Regulation (EU MDR) in Europe. Compliance with these regulations is essential for medical device manufacturers to market their products and ensure patient safety, driving the adoption of compliant packaging solutions in the global market.

Market dynamics such as supply chain considerations and technological advancements also impact the global medical device packaging market. The medical device packaging supply chain involves multiple stages, including the sourcing of raw materials, manufacturing of packaging components, assembly of packaging systems, and distribution to medical device manufacturers. Disruptions at any stage of the supply chain, such as raw material shortages, transportation bottlenecks, or regulatory challenges, can affect the availability and pricing of medical device packaging. Additionally, advancements in packaging technologies, such as smart packaging with integrated sensors for monitoring product integrity or tamper-evident seals for security, drive innovation in the medical device packaging market, meeting the evolving needs of manufacturers and healthcare providers.

Moreover, market factors such as globalization and trade policies influence the global medical device packaging market. As medical device manufacturers expand their operations to new markets and regions, there is a growing demand for packaging solutions that comply with local regulatory requirements and cultural preferences. Additionally, trade policies, tariffs, and international agreements related to packaging materials and technologies can impact the competitiveness of medical device packaging manufacturers in global markets, affecting market dynamics and pricing. Understanding these market factors and adapting packaging strategies accordingly is essential for manufacturers to remain competitive in the dynamic and evolving global medical device packaging market.

Leave a Comment