Market Analysis

In-depth Analysis of Medically prescribed apps Market Industry Landscape

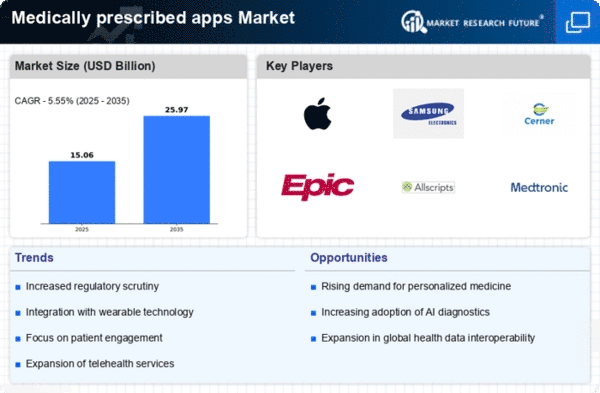

The growing demand for virtual health solutions strongly inspires the market dynamics of Medically prescribed apps. With an increasing emphasis on affected person-focused care and the integration of generations in healthcare, medically prescribed apps play a critical role in offering customized and handy fitness interventions. The occurrence of persistent sicknesses, which include diabetes, high blood pressure, and cardiovascular conditions, contributes notably to market dynamics. Medically prescribed apps provide equipment for monitoring and managing continual conditions, empowering patients to take part in their healthcare actively. This developing burden of persistent diseases propels the adoption of these apps. The endorsement and prescription of fitness apps via physicians and healthcare carriers are crucial elements in market dynamics. As healthcare specialists understand the fee of these apps in enhancing patient results and facilitating remote care, the adoption of a Medically prescribed app becomes extra substantial. Medically prescribed apps make contributions to the affected person's empowerment and engagement in healthcare decision-making. These apps often provide instructional sources, customized remedy plans, and gear for self-monitoring, encouraging patients to take an active position in dealing with their health. This awareness of patient engagement impacts market alternatives. Market dynamics are suffering from concerns associated with records safety and privacy. As fitness apps deal with touchy personal health statistics, making sure robust security measures and compliance with privacy guidelines is critical for consumer belief. Developers and carriers want to address those worries to foster massive adoption. Stringent regulatory frameworks and compliance necessities impact market dynamics. Medically prescribed apps need to adhere to regulatory standards to ensure their protection, effectiveness, and data protection. Regulatory compliance is crucial attention for healthcare professionals prescribing those apps and for patients who use them. Economic elements and reimbursement rules contribute to market dynamics. The affordability and repayment of Medically prescribed apps play a role in their accessibility to a broader populace. The alignment of compensation regulations with the value and effectiveness of those apps impacts their integration into healthcare transport. Collaborations in the digital health environment, such as partnerships between app developers, healthcare vendors, and technology groups, form market dynamics.

Leave a Comment