Membranes Market Summary

The Global Membranes Market was valued at USD 7.38 billion in 2023 and is projected to grow to USD 14.17 billion by 2032, with a CAGR of 7.40% from 2024 to 2032. The growth is driven by the increasing demand for high-quality water across various industries and the establishment of desalination plants to address water scarcity. The market is characterized by a rising need for membrane systems that produce purified water, which enhances agricultural productivity and reduces operational costs.

Key Market Trends & Highlights

Key trends driving the membranes market include technological advancements and increasing applications in various sectors.

- Membranes Market Size in 2023: USD 7.38 billion.

- Projected Market Size by 2035: USD 14.17 billion.

- CAGR from 2024 to 2035: 8.9%.

- Asia-Pacific region expected to dominate the market due to rapid industrialization.

Market Size & Forecast

2024 Market Size: USD 10.20 billion

2025 Market Size: USD 11.21 billion

2035 Market Size: USD 28.46 billion

CAGR (2024-2032): 8.9%

Largest Regional Market Share in 2024: Asia-Pacific.

Major Players

Key players include Dupont (US), Toray Industries (Japan), Hydranautics (China), Koch Separation Solutions (US), Pentair (US), Asahi Kasei Corporation (Japan), and LG Chem (South Korea).

The rising demand for water treatment and desalination and increasing adoption in the food & beverage industry are driving the growth of the Membranes Market.

As per the Analyst at MRFR, Globally, 42.2% of wastewater generated by households was not safely treated in 2022, highlighting the urgent need for advanced wastewater treatment solutions. The disparity in treatment rates is significant, with North America and Europe safely treating 86.5% of household wastewater, whereas less than 25% is treated in Sub-Saharan Africa and Central and Southern Asia. This rising need for wastewater treatment is a critical driver for the membrane market, as membrane-based filtration technologies are increasingly being adopted to address global water pollution challenges.

FIGURE 1: MEMBRANES MARKET VALUE (2019-2035) USD BILLION

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Membranes Market Opportunity

INCREASING USE IN PHARMACEUTICAL INDUSTRY

The increasing use of membrane technology in the pharmaceutical industry is a critical driver for the growth of the Global Membrane Market. Membrane technologies such as microfiltration, ultrafiltration, nanofiltration, reverse osmosis, membrane bioreactors, and electrodialysis play an essential role in pharmaceutical manufacturing, wastewater treatment, and the recovery of valuable products from effluents. The pharmaceutical industry demands high purity, sterility, and precise separation processes, making membranes an ideal solution due to their efficiency, reliability, and cost-effectiveness.

Microfiltration is one of the most established membrane technologies used in the pharmaceutical industry. It operates through a sieving mechanism with a pore size of 0.01–1 µm, allowing macromolecular organic compounds and dissolved solids to pass while filtering out bacteria, particles, and viruses. Pharmaceutical applications of microfiltration include sterilization filtration, clarification of solutions, removal of contaminants, and purification of medical water. The technology is extensively used for ensuring the sterility of injectable drugs, filtering biopharmaceutical solutions, and pre-treating water for ultrafiltration and reverse osmosis.

Microfiltration membranes with a pore size of 0.2 µm are widely used for sterilizing liquid medicines, while those with a pore size of 0.45 µm are common in liquid purification applications.

Ultrafiltration is another essential membrane separation technology in the pharmaceutical industry. It utilizes membranes with a pore size of 10–100 nm to selectively separate solutes based on molecular weight, making it ideal for removing bacteria, viruses, pyrogens, and proteins. Ultrafiltration is widely applied in the fractionation and concentration of macromolecules, purification of small molecular pharmaceuticals, and depyrogenation of biochemical products. The pharmaceutical industry employs ultrafiltration for vaccine production, blood plasma processing, and protein purification, where high separation precision is required to maintain product efficacy and safety.

Nanofiltration, with a pore size of 1–10 nm, operates on an adsorption-diffusion principle and is used for sterilization, protein removal, and the purification of fermentation broths containing antibiotics, vitamins, amino acids, and enzymes. Nanofiltration membranes are particularly effective in separating small organic molecules, reducing bacterial and viral contamination, and concentrating pharmaceutical compounds. In antibiotic production, nanofiltration plays a crucial role in the desalination and purification of intermediates such as 6-APA, 7-ACA, and 7-ADCA, which are essential for the synthesis of semisynthetic antibiotics.

Reverse osmosis (RO) is a widely used membrane filtration process in the pharmaceutical industry due to its ability to remove ionic substances and achieve ultrapure water quality. With a membrane pore size of less than 1 nm, RO effectively separates organic and inorganic contaminants, ensuring the purity of water used in drug formulation, injection solutions, and dialysis. The pharmaceutical industry relies on RO technology for drug concentration, desalination, and purification, ensuring compliance with stringent regulatory requirements for pharmaceutical-grade water.

RO systems are indispensable for the production of water for injection (WFI) and dialysis water, where the highest levels of purity are required to prevent adverse effects on patients.

Membrane bioreactors (MBRs) have revolutionized wastewater treatment in the pharmaceutical industry. These systems integrate biological treatment with membrane filtration to efficiently remove organic pollutants, bacteria, and pharmaceutical residues from wastewater. The use of MBR technology ensures that pharmaceutical manufacturing facilities comply with stringent environmental regulations by reducing the discharge of hazardous contaminants. The ability of MBRs to achieve high levels of purification makes them a preferred choice for treating complex pharmaceutical waste streams, reducing the industry's environmental footprint, and facilitating the recovery of valuable byproducts.

Electrodialysis is another membrane-based process gaining traction in the pharmaceutical sector. It is used for desalination, acid recovery, and separation of charged pharmaceutical compounds. Electrodialysis is particularly useful in the purification of amino acids, peptides, and nucleotides, which are critical components in drug manufacturing and biopharmaceutical applications. By offering precise ion separation and concentration capabilities, electrodialysis enhances the efficiency of pharmaceutical production processes and ensures high product purity.

Leading international membrane technology enterprises, such as Pall Corporation, Novasep, and Millipore, have made significant advancements in pharmaceutical membrane applications. Pall Corporation is a global leader in fluid purification and separation technologies, supplying high-performance filtration systems for pharmaceutical manufacturing. Pall’s pharmaceutical-grade filters are widely adopted by major pharmaceutical companies, including GSK, Baxter, and Fresenius. Novasep specializes in downstream separation and purification solutions, leveraging high-performance chromatography and membrane filtration technologies to optimize pharmaceutical production processes.

Millipore, now part of Merck, offers a comprehensive range of filtration, ultrafiltration, and chromatography solutions for pharmaceutical and biopharmaceutical industries. The growing emphasis on biopharmaceuticals, gene therapy, and personalized medicine is further driving the demand for advanced membrane technologies. Biopharmaceutical manufacturing requires stringent sterility and purity standards, making membranes indispensable in processes such as monoclonal antibody production, vaccine development, and cell culture filtration. The expansion of biopharmaceutical facilities worldwide is expected to create substantial growth opportunities for membrane technology providers.

Furthermore, the increasing regulatory scrutiny on pharmaceutical wastewater disposal is accelerating the adoption of membrane-based treatment solutions. Governments and environmental agencies worldwide are implementing strict discharge limits for pharmaceutical effluents to prevent water contamination and ecosystem disruption. As a result, pharmaceutical companies are investing in membrane technologies such as MBRs, nanofiltration, and RO to achieve compliance with environmental regulations while optimizing resource recovery.

The industry’s demand for high-purity water, efficient separation processes, and sustainable wastewater management is fueling the expansion of membrane applications. Innovations in membrane materials, improved filtration efficiency, and increasing investments in biopharmaceutical manufacturing are expected to further propel the growth of the membrane market. As pharmaceutical companies continue to prioritize product quality, regulatory compliance, and environmental sustainability, membrane technologies will remain at the forefront of pharmaceutical production and wastewater treatment solutions.

Membranes Market Segment Insights

Membranes by Material Insights

Based on Material, this segment includes Polymeric Materials (Polyamide (PA), Polyethersulfone (PES), Polysulfone (PS), Polyvinylidene Fluoride (PVDF), Cellulose Acetate (CA), Others), Ceramic (Alumina (Al₂O₃), Titania (TiO₂), Zirconia (ZrO₂), Others), Others. The Polymeric Materials segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period.

Polymeric membranes are the most widely used type in the global membrane market due to their affordability, ease of manufacturing, and versatility across multiple applications, including water treatment, pharmaceuticals, food and beverage processing, biotechnology, and medical filtration. These membranes’ function based on pore size, allowing them to perform processes such as microfiltration (MF), ultrafiltration (UF), nanofiltration (NF), and reverse osmosis (RO). They are primarily composed of synthetic polymers, each offering distinct advantages and limitations.

FIGURE 2: MEMBRANES MARKET SHARE BY MATERIAL 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Membranes by Production Technology Insights

Based on Production Technology, this segment includes Phase Inversion Processes (Non-Solvent Induced Phase Separation (NIPS) and Thermally Induced Phase Separation (TIPS)), Spinning Methods (Dry-Jet Wet Spinning, Melt Spinning, Other). The Phase Inversion Processes segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period. Phase inversion is a versatile membrane fabrication technique that involves the transformation of a homogeneous polymer solution into a solid membrane structure through controlled phase separation.

This technique allows for the creation of asymmetric or symmetric membranes with tunable pore structures. The two primary types of phase inversion processes are Non-Solvent Induced Phase Separation (NIPS) and Thermally Induced Phase Separation (TIPS), both of which play a significant role in the production of polymeric membranes for filtration and separation processes.

Membranes by Membrane Type Insights

Based on Membrane Type, this segment includes (Microfiltration (MF), Ultrafiltration (UF), Nanofiltration (NF), Reverse Osmosis (RO). The Reverse Osmosis (RO) segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period. Reverse osmosis membranes are designed for molecular-level filtration, with pore sizes smaller than 0.001 microns.

They are capable of removing salt, heavy metals, and dissolved contaminants, making them the preferred choice for desalination, ultrapure water production, and industrial wastewater treatment. RO membranes are widely utilized in seawater desalination plants, semiconductor manufacturing, pharmaceutical production, and beverage processing. Their ability to remove up to 99% of dissolved solids and contaminants makes them critical in industries where high-purity water is essential. Advancements in membrane materials, anti-fouling coatings, and low-energy RO systems are further enhancing the efficiency and sustainability of reverse osmosis technology.

Membranes by Configuration Insights

Based on Configuration, this segment includes Hollow Fiber, Flat Sheet and Others. The Hollow Fiber segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period. Hollow fiber membranes consist of thin, capillary-like fibers that provide a large surface area for filtration while maintaining a compact design. These membranes are widely used in water treatment, medical applications (such as hemodialysis), and gas separation processes.

Due to their unique structure, hollow fiber membranes offer high flow rates and efficient separation of contaminants while being cost-effective and easy to scale for industrial applications. Industries such as municipal water treatment, industrial wastewater recycling, and pharmaceutical manufacturing benefit from hollow fiber membranes because they can handle large fluid volumes with minimal pressure requirements. These membranes are commonly employed in ultrafiltration (UF) and microfiltration (MF) processes, where they efficiently remove bacteria, suspended solids, and macromolecules from liquids.

Membranes by Modification Techniques Insights

Based on Modification Techniques, this segment includes Surface Treatments (Plasma Treatment, Grafting, Nanoparticle Coating, Others), Others. The Surface Treatments segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period.

Surface treatment techniques modify the outer layer of membranes, enhancing hydrophilicity, chemical resistance, and fouling resistance. These methods ensure that membranes function effectively under harsh chemical, biological, and operational conditions, making them suitable for advanced filtration, gas separation, and biomedical applications.

Membranes by Distribution Channel Insights

Based on Distribution Channel, this segment includes Direct OEMs, Distributors & Dealers, Online Retailers, Others. The Direct OEMs segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period. Direct OEMs are the primary and most significant distribution channel in the global membrane market. Manufacturers supply membranes directly to OEMs, who integrate them into filtration systems, medical devices, energy storage solutions, and industrial processing equipment.

This channel ensures strict quality control, consistent performance, and technical reliability, making it a preferred option for industries requiring customized or high-performance membrane solutions. Large-scale industries such as municipal water treatment, pharmaceuticals, biopharmaceuticals, food & beverage, and power generation rely heavily on OEMs to procure membranes that meet specific operational and regulatory standards.

Membranes by Size Insights

Based on Size, this segment includes Large Membrane Modules, Medium Membrane Modules, Small Membrane Modules. The Large Membrane Modules segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period. Large membrane modules are high-capacity filtration systems designed for industries that require bulk separation, purification, or concentration of fluids.

These modules are commonly used in municipal water treatment plants, large-scale desalination facilities, petrochemical processing, pharmaceutical production, and industrial wastewater management. They offer high throughput, extended operational lifespans, and enhanced efficiency in treating large volumes of liquids and gases. Large membrane modules are often preferred in applications where continuous filtration, minimal maintenance, and long-term operational reliability are essential.

Membranes by Application Insights

Based on Application, this segment includes Medical Technology (MedTech) & Healthcare (Hemodialysis Membranes, Drug Delivery Systems, Oxygenation Systems, Tissue Engineering, Plasma Separation, Others), Pharmaceutical & Biotechnology (Biopharmaceutical Production, Plasma Separation, Others), Water and Wastewater Treatment (Industrial Water Treatment and Residential Water Purification), Oil & Gas (Gas Separation, Petrochemical Processing, Biogas Upgrading, Others), Energy Sector (Renewable Energy Systems, Thermoelectric (Thermal Power), Others), Food & Beverage (Food Concentration, Protein Separation, Others), Pollution Control (Air and Water Pollution Mitigation and Others), Specialized Industrial Applications (Metallic Filter Cleaning Systems, Oxygenation Systems, Others).

The Food & Beverage segment dominated the global market in 2024, while the Water and Wastewater Treatment segment is projected to be the fastest–growing segment during the forecast period.

Membranes are widely used in the food & beverage industry for filtration, concentration, purification, and separation processes, ensuring product quality, safety, and nutritional retention. In food concentration, membranes play a crucial role in preserving flavors and nutrients by eliminating the need for high-temperature evaporation. Reverse osmosis (RO), nanofiltration (NF), and ultrafiltration (UF) membranes are used to concentrate fruit juices, dairy products, and alcoholic beverages without compromising taste and aroma.

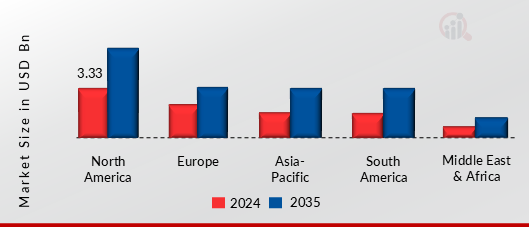

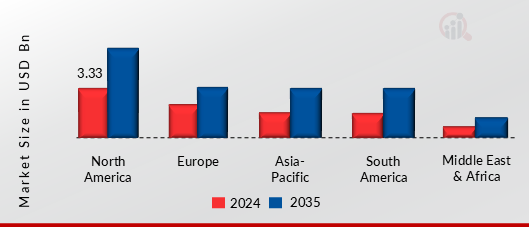

Membranes Regional Insights

Based on the Region, the global Membranes are segmented into North America, Europe, Asia-Pacific, South America and Middle East & Africa. The North America dominated the global market in 2024, while the Asia Pacific is projected to be the fastest–growing segment during the forecast period.

Major demand factors driving the North America market are the rising demand for water treatment and desalination and increasing adoption in the food & beverage industry. North America stands as one of the most advanced markets for membrane technologies, driven by stringent environmental regulations, technological innovations, and increasing demand for clean water and energy-efficient solutions.

The region benefits from strong government initiatives, such as the U.S. Environmental Protection Agency (EPA) regulations on wastewater treatment and industrial discharge limits, which fuel demand for membrane-based filtration and separation processes. The U.S. dominates the North American membrane market, followed by Canada and Mexico.

The growth of industries like biopharmaceuticals, food & beverage processing, and municipal water treatment has significantly boosted demand for advanced reverse osmosis (RO), ultrafiltration (UF), and microfiltration (MF) membranes. Additionally, rising investments in desalination plants along the U.S. and Mexican coasts are driving membrane adoption in water purification applications.

FIGURE 3: MEMBRANES MARKET VALUE BY REGION 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Further, the countries considered in the scope of the Application Tracking System Market are the US, Canada, Mexico, Germany, France, UK, Spain, Italy, Russia, Poland, Netherlands, China, India, Japan, South Korea, Australia, Malaysia, Indonesia, Brazil, Argentina, UAE, Saudi Arabia, South Africa and others.

Global Membranes Key Market Players & Competitive Insights

Many global, regional, and local vendors characterize the Membranes Market. The market is highly competitive, with all the players competing to gain market share. Intense competition, rapid advances in technology, frequent changes in government policies, and environmental regulations are key factors that confront market growth. The vendors compete based on cost, product quality, reliability, and government regulations. Vendors must provide cost-efficient, high-quality products to survive and succeed in an intensely competitive market.

The major competitors in the market are Toray Industries, LG Chem, ALSYS Group, Culligan, AXEON Water, Pentair, Asahi Kasei Corporation, Hydranautics, DuPont, Veolia are among others. The Membranes Market is a consolidated market due to increasing competition, acquisitions, mergers and other strategic market developments and decisions to improve operational effectiveness.

Key Companies in the Membranes Market include

- Toray Industries

- LG Chem

- ALSYS Group

- Culligan

- AXEON Water

- Pentair

- Asahi Kasei Corporation

- Hydranautics

- DuPont

- Veolia

Membranes Market Industry Developments

22-January-2025: The Veolia Group has completed the full acquisition of the gas-fired power plant in Gönyű, located in northeastern Hungary, which plays a vital role in regulating the Hungarian electricity grid. The deal, which involved Veolia and the German energy company Uniper Group, was finalized on January 6, according to an announcement by the French company, as reported by Világgazdaság. This transaction was concluded nearly a year after the initial agreement between the two companies.

The plant, with a capacity of 430 megawatts, has become a key part of Veolia’s energy regulation portfolio. In February 2024, Veolia Invest Hungary and Uniper Group had signed a sale and purchase agreement for the acquisition of 100% of Uniper Hungary Energetikai Kft. The transaction was finalized earlier this month following the completion of all necessary permit approvals.

19-January-2024: LG Chem announced the completion of its acquisition of AVEO Oncology, a biopharmaceutical company specializing in oncology treatments. The all-cash transaction, valued at $571 million on a fully diluted basis, strengthens LG Chem Life Sciences' commercial presence in the United States. This merger not only diversifies LG Chem's pipeline but also enhances its capabilities in the oncology field by integrating AVEO's expertise and resources.

15-November-2024: Toray Industries announced the introduction of the Cat XQ330 mobile diesel generator set, a new power solution for standby and prime power applications that meets U.S. EPA Tier 4 Final emission standards.

21-March-2022: Tocopilla, a coastal city in Chile along the Pacific Ocean, faced the challenge of securing a sustainable water source. The city's water supply relied on surface sources from nearby mountains, but these ecosystems are highly sensitive and vulnerable to disturbances caused by heavy rainfall, steep slopes, and erodible soils, which contribute to surface water pollution. To address the growing demand for a reliable drinking water supply, a desalination plant was established to convert seawater into potable water using Nitto Hydranautics' reverse osmosis membrane technology.

This initiative made Tocopilla the first city in Chile to adopt a more sustainable membrane-based approach to water consumption.

Membranes Market Segmentation

Membranes by Material Outlook

-

Polymeric Materials

- Polyamide (PA)

- Polyethersulfone (PES)

- Polysulfone (PS)

- Polyvinylidene Fluoride (PVDF)

- Cellulose Acetate (CA)

- Others

-

Ceramic

- Alumina (Al₂O₃)

- Titania (TiO₂)

- Zirconia (ZrO₂)

- Others

- Others

Membranes by Product Technology Outlook

-

Phase Inversion Processes

- Non-Solvent Induced Phase Separation (NIPS)

- Thermally Induced Phase Separation (TIPS)

-

Spinning Methods

- Dry-Jet Wet Spinning

- Melt Spinning

- Other

Membranes by Membrane Type Outlook

- Microfiltration (MF)

- Ultrafiltration (UF)

- Nanofiltration (NF)

- Reverse Osmosis (RO)

Membranes by Configuration Outlook

- Hollow Fiber

- Flat Sheet

- Others

Membranes by Modification Techniques Outlook

-

Surface Treatments

- Plasma Treatment

- Grafting

- Nanoparticle Coating

- Others

- Others

Membranes by Distribution Channel Outlook

- Direct OEMs

- Distributors & Dealers

- Online Retailers

- Others

Membranes by Size Outlook

- Large Membrane Modules

- Medium Membrane Modules

- Small Membrane Modules

Membranes by Application Outlook

-

Medical Technology (MedTech) & Healthcare

- Hemodialysis Membranes

- Drug Delivery Systems

- Oxygenation Systems

- Tissue Engineering

- Plasma Separation

- Others

-

Pharmaceutical & Biotechnology

- Biopharmaceutical Production

- Plasma Separation

- Others

-

Water and Wastewater Treatment

- Industrial Water Treatment

- Residential Water Purification

-

Oil & Gas

- Gas Separation

- Petrochemical Processing

- Biogas Upgrading

- Others

-

Energy Sector

- Renewable Energy Systems

- Thermoelectric (Thermal Power)

- Others

-

Food & Beverage

- Food Concentration

- Protein Separation

- Others

-

Pollution Control

- Air and Water Pollution Mitigation

- Others

-

Specialized Industrial Applications

- Metallic Filter Cleaning Systems

- Oxygenation Systems

- Others

Membranes Regional Outlook

-

North America

-

Europe

- Germany

- France

- UK

- Spain

- Italy

- Russia

- Poland

- Netherlands

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Malaysia

- Indonesia

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South America

-

Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

|

Report Attribute/Metric

|

Details

|

|

Market Size 2024

|

USD 10.20 Billion

|

|

Market Size 2025

|

USD 11.21 Billion

|

|

Market Size 2035

|

USD 28.46 Billion

|

|

Compound Annual Growth Rate (CAGR)

|

8.9% (2025-2035)

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2035

|

|

Historical Data

|

2019-2023

|

|

Forecast Units

|

Value, Volume (USD Billion, Billion Meter Square)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Segments Covered

|

By Material, By Product Technology, By Membrane Type, By Configuration, By Modification Techniques, By Distribution Channel, By Size, By Application

|

|

Geographies Covered

|

North America, Europe, Asia Pacific, South America, Middle East & Africa

|

|

Countries Covered

|

The US, Canada, Mexico, Germany, France, UK, Spain, Italy, Russia, Poland, Netherlands, China, India, Japan, South Korea, Australia, Malaysia, Indonesia, Brazil, Argentina, UAE, Saudi Arabia, South Africa

|

|

Key Companies Profiled

|

Toray Industries, LG Chem, ALSYS Group, Culligan, AXEON Water, Pentair, Asahi Kasei Corporation, Hydranautics, DuPont, Veolia

|

|

Key Market Opportunities

|

· Increasing use in the pharmaceutical industry

· Increasing adoption of polymeric membranes

|

|

Key Market Dynamics

|

· Rising demand for water treatment & desalination

· Increasing adoption in the food & beverage industry

|

Membranes Market Highlights:

Frequently Asked Questions (FAQ):

USD 10.20 Billion is the Membranes Market in 2024

The Polymeric Materials segment by Material holds the largest market share and grows at a CAGR of 9.2 % during the forecast period.

North America holds the largest market share in the Membranes Market.

Toray Industries, LG Chem, ALSYS Group, Culligan, AXEON Water, Pentair, Asahi Kasei Corporation, Hydranautics, DuPont, Veolia are prominent players in the Membranes Market.

The Large Membrane Modules segment dominated the market in 2024.