Rising Demand for Solvent Recovery

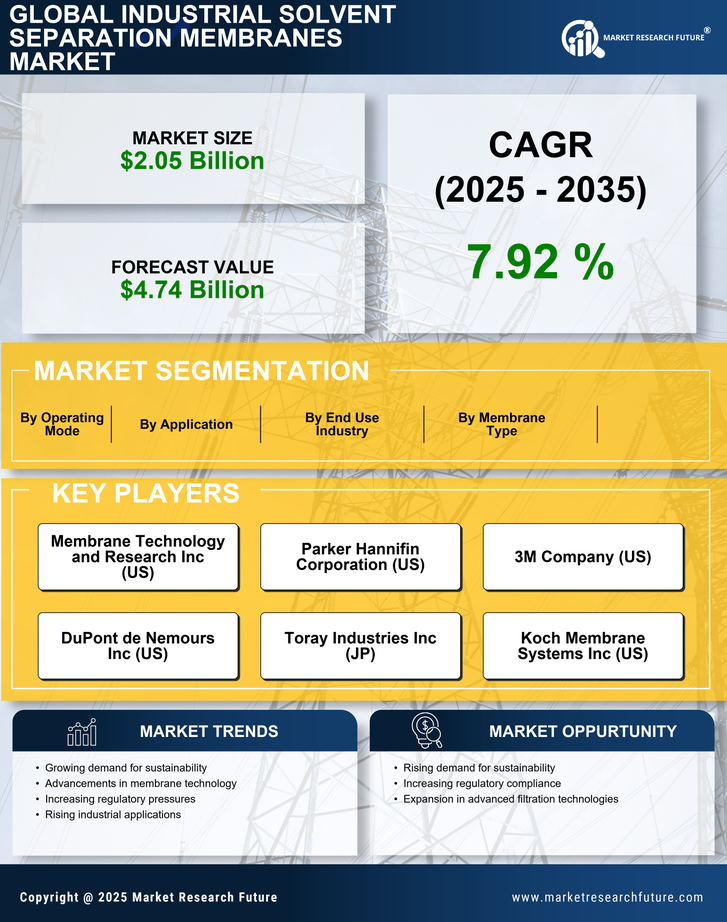

The Industrial Solvent Separation Membranes Market is experiencing a notable increase in demand for solvent recovery solutions. Industries such as pharmaceuticals, chemicals, and food processing are increasingly adopting membrane technology to recover solvents efficiently. This trend is driven by the need to minimize waste and reduce operational costs. According to recent data, the solvent recovery market is projected to grow at a compound annual growth rate of approximately 6% over the next few years. This growth is indicative of a broader shift towards more sustainable practices within various sectors, thereby enhancing the relevance of the Industrial Solvent Separation Membranes Market.

Growing Awareness of Sustainable Practices

The Industrial Solvent Separation Membranes Market is witnessing a surge in awareness regarding sustainable practices among manufacturers. As companies strive to enhance their environmental credentials, the adoption of solvent separation membranes is becoming increasingly attractive. These membranes not only facilitate efficient solvent recovery but also contribute to waste reduction and resource conservation. The rising consumer demand for environmentally friendly products is prompting industries to adopt greener technologies. This shift towards sustainability is expected to significantly influence the growth trajectory of the Industrial Solvent Separation Membranes Market, as more companies recognize the long-term benefits of sustainable operations.

Cost-Effectiveness of Membrane Technologies

Cost-effectiveness is a pivotal driver for the Industrial Solvent Separation Membranes Market. Membrane technologies are increasingly recognized for their ability to reduce operational costs associated with solvent separation processes. By minimizing energy consumption and maximizing solvent recovery rates, these technologies present a financially viable option for many industries. Recent analyses suggest that companies utilizing membrane systems can achieve up to 30% savings in operational costs compared to conventional methods. This economic advantage is likely to encourage more industries to invest in membrane technologies, thereby propelling the growth of the Industrial Solvent Separation Membranes Market.

Technological Innovations in Membrane Materials

Innovations in membrane materials are transforming the Industrial Solvent Separation Membranes Market. The development of advanced polymeric and ceramic membranes has enhanced separation efficiency and durability. These innovations allow for better selectivity and permeability, which are crucial for effective solvent separation. As industries seek to improve their processes, the adoption of these advanced materials is expected to rise. Furthermore, ongoing research and development efforts are likely to yield even more efficient membrane technologies, further driving the growth of the Industrial Solvent Separation Membranes Market. This trend indicates a promising future for membrane applications across various sectors.

Regulatory Compliance and Environmental Standards

The Industrial Solvent Separation Membranes Market is significantly influenced by stringent regulatory frameworks aimed at reducing environmental pollution. Governments worldwide are implementing regulations that mandate the reduction of volatile organic compounds (VOCs) and other hazardous emissions. As a result, industries are compelled to adopt advanced separation technologies, including membrane systems, to comply with these regulations. The increasing focus on environmental sustainability is likely to drive the adoption of solvent separation membranes, as they offer a more eco-friendly alternative to traditional separation methods. This regulatory pressure is expected to bolster the growth of the Industrial Solvent Separation Membranes Market in the coming years.