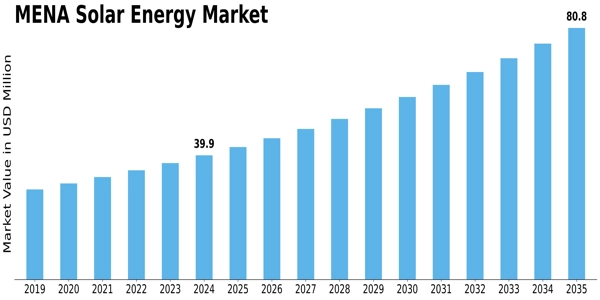

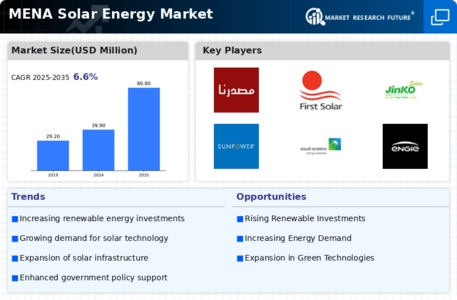

Mena Solar Energy Size

MENA Solar Energy Market Growth Projections and Opportunities

The MENA (Middle East and North Africa) region has emerged as a significant player in the global solar energy market, driven by various market factors. One prominent factor is the abundant solar resource available throughout the region. With its vast deserts and sunny climates, countries in the MENA region possess ideal conditions for solar energy generation. This abundant sunlight presents a compelling opportunity for governments and businesses to harness clean and renewable energy sources to meet their growing energy demands.

Another crucial market factor is the increasing emphasis on renewable energy and sustainability. Many countries in the MENA region have set ambitious renewable energy targets as part of their broader strategies to diversify their energy mix and reduce their reliance on fossil fuels. These targets often include significant proportions of solar energy capacity, driving investment and development in the solar sector. Additionally, the global shift towards combating climate change has spurred greater interest and investment in renewable energy sources like solar power across the MENA region.

Government policies and incentives also play a pivotal role in shaping the MENA solar energy market. Many governments in the region have implemented supportive policies and regulatory frameworks to encourage the growth of the solar industry. These policies often include feed-in tariffs, tax incentives, and renewable energy targets, which provide stability and predictability for investors and developers in the solar sector. Furthermore, government-led initiatives and programs aimed at promoting solar energy adoption, such as public awareness campaigns and funding for research and development, contribute to the market's growth.

The declining cost of solar technology is another significant market factor driving the expansion of the MENA solar energy market. Over the past decade, the cost of solar photovoltaic (PV) panels and related components has plummeted, making solar energy increasingly competitive with conventional forms of electricity generation. This cost reduction has made solar projects more economically viable and attractive to investors, leading to a surge in solar installations across the MENA region. Additionally, advancements in solar technology, such as improved efficiency and energy storage solutions, further enhance the value proposition of solar energy systems in the region.

Infrastructure development and grid integration are critical considerations for the MENA solar energy market. As countries in the region seek to integrate more solar power into their energy systems, they must invest in the necessary infrastructure to support large-scale solar projects. This includes expanding and upgrading transmission and distribution networks to accommodate the variable nature of solar energy generation. Furthermore, grid modernization efforts, such as smart grid technologies and energy management systems, are essential for optimizing the integration of solar power and ensuring grid stability and reliability.

International partnerships and collaborations also play a significant role in driving the growth of the MENA solar energy market. Many countries in the region are leveraging partnerships with international organizations, development banks, and foreign investors to access financing, technology, and expertise for solar energy projects. These collaborations facilitate knowledge transfer, capacity building, and technology transfer, accelerating the deployment of solar energy infrastructure across the MENA region.

The MENA solar energy market is influenced by various market factors, including abundant solar resources, increasing emphasis on renewable energy and sustainability, supportive government policies and incentives, declining costs of solar technology, infrastructure development and grid integration, and international partnerships and collaborations. These factors collectively contribute to the rapid expansion of the solar energy market in the MENA region, driving investment, innovation, and sustainable development.

Leave a Comment