Top Industry Leaders in the Mercury Market

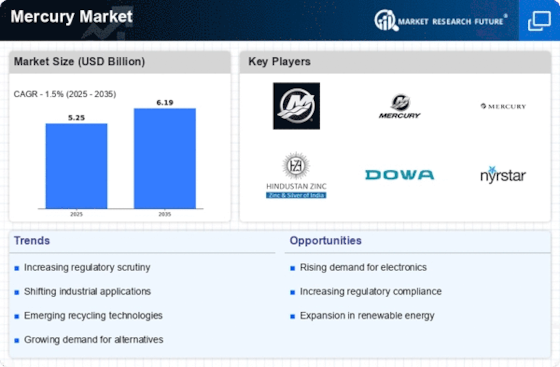

The mercury market, despite its hazardous nature, persists as a complex and dynamic realm due to its niche applications across various industries. However, the landscape is constantly evolving, shaped by stringent regulations, technological advancements, and growing environmental concerns. Understanding the competitive landscape requires a deep dive into the strategies employed by key players, the factors influencing market share, recent industry news, and emerging trends.

Strategies for Survival:

Mercury market players navigate a tightrope walk between profitability and compliance. Here are some key strategies adopted:

Diversification: Companies like ESPI Metals and OPHRAM Laboratoire excel by catering to multiple segments like high-purity mercury for electronics and dental fillings, while minimizing reliance on traditional applications facing phaseouts.

Technological innovation: Developing efficient recycling and recovery technologies like those by Boliden Metals are crucial for minimizing waste and meeting stringent green regulations.

Partnerships and acquisitions: Strategic collaborations like Solvay's joint venture with China Nonferrous Mining Corporation enable access to resources and market expansion.

Regulatory compliance: Adherence to the Minamata Convention on Mercury and regional waste management laws is paramount to avoid penalties and maintain legitimacy.

Factors Dictating Market Share:

Production capacity: Established miners like Kyrgyzstan's Ala Archa deposit and Chinese players like Guizhou Huaneng Mercury Industry Co. Ltd. hold a significant share due to their large reserves and production capabilities.

Geographical positioning: Proximity to high-demand regions like Asia-Pacific offers logistical advantages to regional players compared to distant competitors.

Product quality and purity: Companies like ESPI Metals, known for their high-purity mercury, cater to specialized demand in electronics and scientific applications, commanding premium prices.

Sustainability initiatives: Demonstrating responsible mercury management practices through recycling and closed-loop systems attracts environmentally conscious consumers and investors.

Key Companies in the Mercury market include

-

Avantor Performance Materials

-

Globe Chemicals

-

Mayasa

-

Aldrett Hermanos

-

Bethlehem Apparatus

-

China Jin Run Industrial

-

Merck KGaA

-

Wake Group

-

Acton Technologies

-

DF Goldsmith Chemical & Metal Corp

Recent Development

-

August 2023: The European Union announces a complete ban on the use of mercury in medical devices by 2025, further accelerating the shift towards mercury-free alternatives. -

October 2023: A new study published in Nature reveals the development of a highly efficient mercury-free catalyst for chlor-alkali production, a major industrial application of mercury. -

November 2023: ESPI Metals, a leading high-purity mercury producer, announces a partnership with a research institute to develop a closed-loop recycling system for mercury used in electronics production.