Market Share

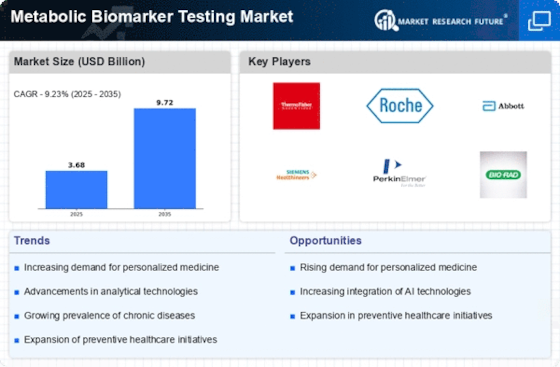

Metabolic Biomarker Testing Market Share Analysis

Thorough comprehension of the metabolic biomarker testing market dynamics is paramount before devising positioning strategies. Factors such as the prevalence of metabolic disorders, technological advancements in testing methods, regulatory landscape, and competitor analysis shape market dynamics. Identification of target segments within the metabolic biomarker testing market is crucial. These segments may include individuals with diabetes, obesity, cardiovascular diseases, or metabolic syndrome. Tailoring positioning strategies to address the specific needs of each segment can enhance market penetration. Product differentiation is key in a competitive market like metabolic biomarker testing. Companies can differentiate their offerings through factors such as accuracy and reliability of testing methods, speed of results delivery, breadth of biomarkers tested, and user-friendly interfaces for healthcare professionals. Establishing a strong brand reputation is essential for gaining market share. Brands can build credibility through factors such as clinical validation of testing methods, endorsements from healthcare professionals or medical associations, and positive patient outcomes, instilling trust among stakeholders.

Strategic pricing plays a pivotal role in market penetration. Companies may opt for premium pricing for advanced testing platforms with comprehensive biomarker panels, value pricing for cost-effective options targeting budget-conscious healthcare providers, or competitive pricing to capture market share. Selecting appropriate distribution channels is essential for reaching target customers efficiently. In the metabolic biomarker testing market, distribution channels may include hospitals, clinics, diagnostic laboratories, research institutions, and online platforms, ensuring broad market coverage and accessibility. Geographical factors such as healthcare infrastructure, prevalence of metabolic disorders, regional treatment guidelines, and reimbursement policies influence market positioning strategies, necessitating tailored approaches for different regions. Educating healthcare professionals and patients about the importance of metabolic biomarker testing in disease management and prevention is crucial. Companies can invest in educational initiatives, workshops, and collaborations with medical societies to raise awareness and improve understanding of biomarker testing benefits. Positioning products with a patient-centric focus, emphasizing factors such as early detection of metabolic abnormalities, personalized treatment recommendations, and support for lifestyle modifications, can enhance patient engagement and adherence to healthcare plans.

Securing endorsements from key opinion leaders and medical societies enhances credibility and market share. Collaborations with renowned researchers, participation in clinical studies, and publication of research findings strengthen confidence in the efficacy and clinical utility of biomarker testing products. Leveraging technological advancements, such as point-of-care testing devices, automated platforms for high-throughput analysis, and integration with electronic health records systems, can differentiate products and improve efficiency in biomarker testing workflows. Continuous innovation is essential for staying competitive in the metabolic biomarker testing market. Companies should invest in research and development to enhance testing methods, expand biomarker panels, and develop predictive algorithms for disease risk assessment, thereby maintaining leadership in the industry. Ongoing monitoring of market trends, customer feedback, regulatory changes, and competitor activities is critical for effective market positioning. Companies must remain agile and responsive, adjusting strategies as needed to capitalize on opportunities and address evolving customer needs effectively.

Leave a Comment