- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

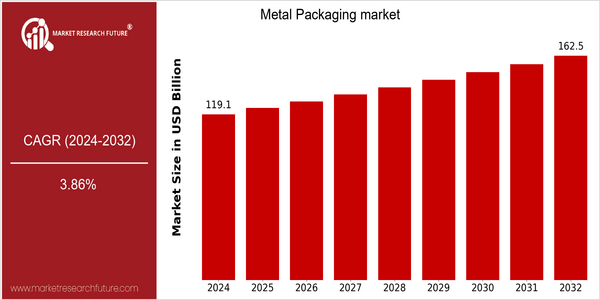

| Year | Value |

|---|---|

| 2024 | USD 119.06 Billion |

| 2032 | USD 162.48 Billion |

| CAGR (2024-2032) | 3.86 % |

Note – Market size depicts the revenue generated over the financial year

The global metal packaging market is poised for steady growth, with a current market size of USD 119.06 billion in 2024, projected to reach USD 162.48 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 3.86% over the forecast period. The market's expansion can be attributed to several key factors, including the increasing demand for sustainable packaging solutions, the rise in consumer preference for recyclable materials, and advancements in metal packaging technologies that enhance product preservation and shelf life. Technological innovations, such as the development of lightweight metal packaging and the integration of smart packaging solutions, are further driving market growth. Companies like Ball Corporation and Crown Holdings are at the forefront of these advancements, investing in research and development to create more efficient and environmentally friendly packaging options. Strategic initiatives, including partnerships aimed at expanding product offerings and enhancing supply chain efficiencies, are also contributing to the market's positive outlook. As sustainability continues to be a priority for consumers and manufacturers alike, the metal packaging market is well-positioned to capitalize on these trends in the coming years.

Regional Market Size

Regional Deep Dive

The Metal Packaging market is experiencing significant growth across various regions, driven by increasing consumer demand for sustainable and recyclable packaging solutions. In North America, Europe, and Asia-Pacific, the market is characterized by a shift towards eco-friendly materials and innovative designs that enhance product shelf life. The rise in e-commerce and the food and beverage sector's expansion are also contributing to the market dynamics, with a focus on lightweight and durable packaging options. Each region presents unique challenges and opportunities, influenced by local regulations, cultural preferences, and economic conditions.

Europe

- The European Union's Circular Economy Action Plan is driving the metal packaging industry towards increased recyclability, with companies such as Rexam and Novelis investing in advanced recycling technologies to meet stringent sustainability targets.

- The rise of plant-based and organic products in Europe is influencing packaging choices, with brands like Coca-Cola and Heineken adopting metal packaging to enhance product appeal and align with consumer preferences for sustainable options.

Asia Pacific

- China's rapid urbanization and growing middle class are fueling demand for metal packaging, particularly in the food and beverage sector, prompting companies like Toyo Seikan Group and Nippon Steel to expand their operations in the region.

- India's government initiatives promoting 'Make in India' are encouraging local production of metal packaging, with firms like Hindalco Industries investing in new manufacturing facilities to cater to the increasing demand for packaged goods.

Latin America

- Brazil's National Solid Waste Policy is encouraging the use of recyclable materials, prompting companies like Amcor and Metalfrio Solutions to innovate in metal packaging to align with environmental regulations.

- The increasing consumption of canned beverages in Latin America, particularly in Mexico and Brazil, is leading to a surge in demand for aluminum cans, with local manufacturers ramping up production to meet this trend.

North America

- The U.S. Environmental Protection Agency (EPA) has introduced new regulations aimed at reducing packaging waste, which is pushing companies like Ball Corporation and Crown Holdings to innovate in sustainable metal packaging solutions.

- The growing trend of craft beverages, particularly in the beer and cider segments, has led to an increase in demand for aluminum cans, with companies like Canpack and Ardagh Group expanding their production capabilities to meet this demand.

Middle East And Africa

- The UAE's Vision 2021 aims to promote sustainable practices, leading to increased investments in metal packaging solutions, with companies like Alufoil and Emirates Can Manufacturing expanding their product lines to meet local demand.

- The growing popularity of ready-to-eat meals in the region is driving the demand for metal packaging, with firms like Gulf Can Manufacturing adapting their offerings to cater to this emerging consumer trend.

Did You Know?

“Did you know that aluminum cans are one of the most recycled consumer products in the world, with a recycling rate of over 75% in many countries?” — Aluminum Association

Segmental Market Size

The Metal Packaging segment plays a crucial role in the overall packaging market, currently experiencing stable growth driven by increasing consumer demand for sustainable and recyclable materials. Key factors propelling this segment include heightened consumer awareness regarding environmental issues and stringent regulatory policies aimed at reducing plastic waste. Additionally, technological advancements in metal packaging production enhance durability and design flexibility, further boosting demand. Currently, the adoption of metal packaging is in a mature stage, with companies like Ball Corporation and Crown Holdings leading the way in innovation and sustainability initiatives. Primary applications include beverage cans, food containers, and aerosol packaging, with notable examples being Coca-Cola's use of aluminum cans and Nestlé's commitment to recyclable metal packaging. Trends such as the global shift towards sustainability and government mandates for reduced plastic usage catalyze growth in this segment. Technologies like advanced coating methods and smart packaging solutions are shaping the evolution of metal packaging, ensuring it meets modern consumer needs while maintaining product integrity.

Future Outlook

The Metal Packaging market is poised for steady growth from 2024 to 2032, with a projected market value increase from $119.06 billion to $162.48 billion, reflecting a compound annual growth rate (CAGR) of 3.86%. This growth trajectory is underpinned by the rising demand for sustainable packaging solutions, as consumers and manufacturers alike prioritize eco-friendly materials. The metal packaging sector is expected to capture an increasing share of the overall packaging market, driven by its recyclability and durability, which align with global sustainability goals. By 2032, it is anticipated that metal packaging will account for approximately 25% of the total packaging market, up from around 20% in 2024, indicating a significant shift towards more sustainable practices in the industry. Key technological advancements, such as the development of lightweight metal alloys and innovative coating technologies, are expected to enhance the performance and appeal of metal packaging. Additionally, regulatory policies aimed at reducing plastic waste will further bolster the adoption of metal packaging across various sectors, including food and beverage, personal care, and pharmaceuticals. Emerging trends, such as the rise of e-commerce and the demand for premium packaging solutions, will also contribute to the market's expansion. As brands increasingly seek to differentiate themselves through packaging, the metal packaging market is well-positioned to benefit from these evolving consumer preferences and regulatory landscapes.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 95,723.94 Billion |

| Growth Rate | 3.50% (2022-2030) |

Metal Packaging Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.