E-commerce Influence

The rise of e-commerce has significantly influenced the metal packaging market. As online shopping continues to gain traction, the demand for durable and secure packaging solutions has increased. Metal packaging offers superior protection against damage during transit, making it an ideal choice for e-commerce businesses. In 2023, the e-commerce sector accounted for over 15% of total retail sales, highlighting the growing importance of effective packaging solutions. Companies are increasingly adopting metal packaging to ensure product integrity and enhance customer satisfaction. Additionally, the aesthetic appeal of metal packaging can attract consumers in a crowded online marketplace, further driving its adoption. As e-commerce continues to expand, the metal packaging market is likely to benefit from the need for reliable and visually appealing packaging solutions that meet the demands of online shoppers.

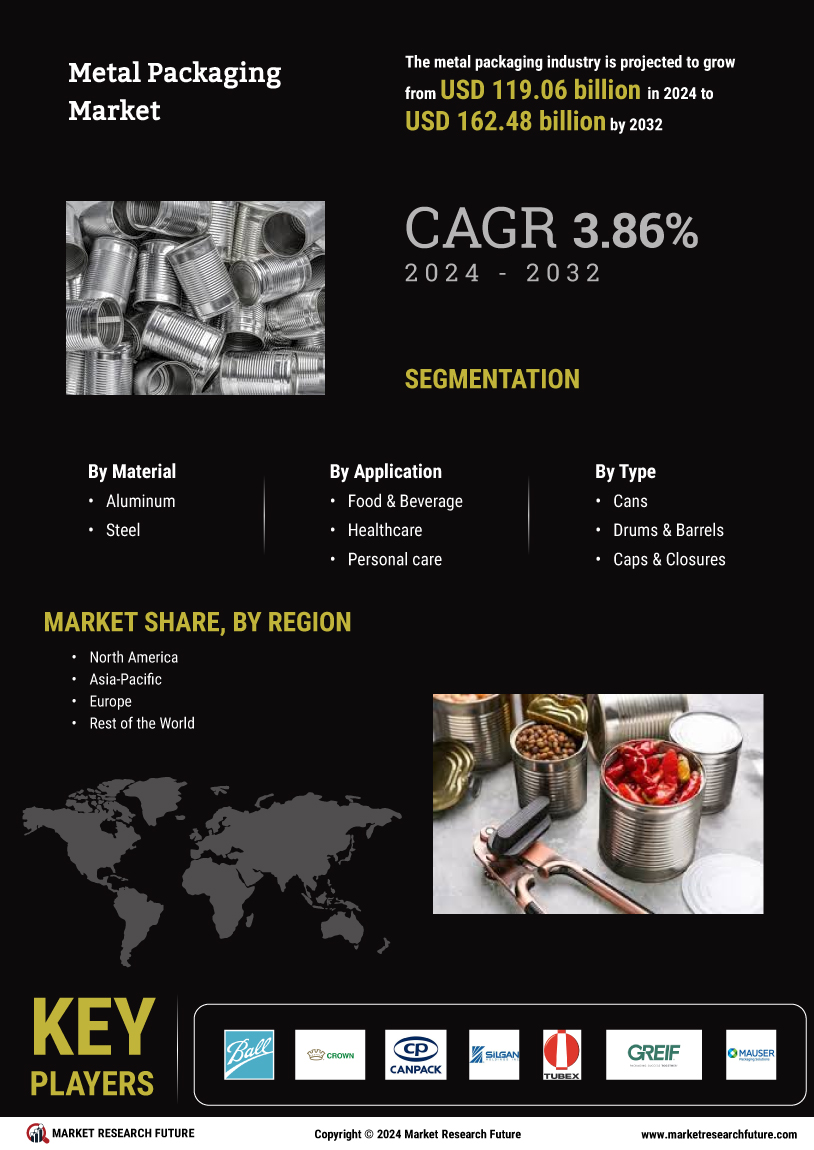

Sustainability Initiatives

The increasing emphasis on sustainability is a pivotal driver for the metal packaging market. As consumers become more environmentally conscious, the demand for recyclable and eco-friendly packaging solutions intensifies. Metal packaging, known for its recyclability, aligns with these sustainability initiatives, making it a preferred choice among manufacturers. In 2023, the metal packaging sector accounted for approximately 30% of the total packaging market, reflecting a growing trend towards sustainable practices. Companies are investing in innovative recycling technologies and sustainable sourcing of materials, which further enhances the appeal of metal packaging. This shift not only meets consumer expectations but also complies with stringent regulations aimed at reducing environmental impact. Consequently, the sustainability initiatives are likely to propel the growth of the metal packaging market, as businesses strive to adopt greener practices and cater to the evolving preferences of eco-conscious consumers.

Technological Advancements

Technological advancements play a crucial role in shaping the metal packaging market. Innovations in manufacturing processes, such as the development of lightweight metals and advanced coating technologies, enhance the efficiency and functionality of metal packaging. These advancements not only improve the durability and shelf life of products but also reduce production costs. In recent years, the introduction of smart packaging technologies, including QR codes and NFC tags, has further transformed the landscape of the metal packaging market. These technologies enable manufacturers to provide consumers with additional product information and enhance the overall user experience. As a result, the metal packaging market is witnessing a surge in demand for technologically advanced solutions that cater to the needs of modern consumers. The integration of these technologies is expected to drive growth in the metal packaging market, as companies seek to differentiate their products and improve operational efficiency.

Health and Safety Regulations

Health and safety regulations are a significant driver for the metal packaging market. Stringent regulations regarding food safety and product integrity necessitate the use of reliable packaging materials. Metal packaging is often preferred in the food and beverage industry due to its ability to preserve product quality and extend shelf life. In 2023, the food and beverage sector represented approximately 40% of the total metal packaging market, underscoring the importance of compliance with health regulations. Manufacturers are increasingly focusing on developing packaging solutions that meet these regulatory standards while ensuring consumer safety. The adherence to health and safety regulations not only protects consumers but also enhances brand reputation, driving demand for metal packaging solutions. As regulations continue to evolve, the metal packaging market is expected to grow in response to the need for compliant and safe packaging options.

Consumer Preferences for Convenience

Consumer preferences for convenience are shaping the dynamics of the metal packaging market. As lifestyles become increasingly fast-paced, there is a growing demand for packaging solutions that offer ease of use and portability. Metal packaging, with its lightweight and resealable features, caters to these consumer needs effectively. In 2023, convenience-oriented products accounted for nearly 25% of the total metal packaging market, indicating a shift towards user-friendly packaging solutions. Manufacturers are responding by designing innovative metal packaging that enhances convenience, such as easy-open cans and portable containers. This trend is likely to continue, as consumers prioritize convenience in their purchasing decisions. The metal packaging market is expected to thrive as companies adapt to these changing preferences and develop packaging solutions that align with the convenience-driven consumer landscape.

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review