Metal Plating Finishing Size

Metal Plating Finishing Market Growth Projections and Opportunities

The Metal Plating and Finishing Market are shaped by various factors that collectively influence its trends and growth dynamics. A primary driver is the consistent demand from industries such as automotive, electronics, and aerospace, where metal plating and finishing play crucial roles in enhancing aesthetics, corrosion resistance, and functional properties of components. In the automotive sector, metal plating is essential for various parts, including decorative trims and functional components, contributing significantly to the market's growth. As the automotive industry continually evolves, the demand for advanced and visually appealing metal finishes remains a constant factor driving the market.

Global economic conditions are pivotal in the Metal Plating and Finishing Market. Economic growth and industrialization contribute to increased manufacturing activities, fostering the need for high-quality metal finishes. Developing economies, undergoing rapid industrial expansion, play a substantial role in propelling the market's growth, emerging as significant contributors to the global manufacturing landscape.

Technological advancements in plating and finishing processes have a substantial impact on the market dynamics. Ongoing research and development efforts lead to innovations that enhance the efficiency, sustainability, and environmental friendliness of metal plating and finishing technologies. Companies investing in these advancements gain a competitive edge by offering cutting-edge plating solutions that meet the evolving needs of various industries while addressing environmental concerns. The continuous pursuit of more sustainable and efficient plating methods is a significant factor influencing market trends.

Environmental and regulatory considerations are critical aspects of the Metal Plating and Finishing Market. The use of certain chemicals and processes in metal plating can have environmental implications, leading to increased scrutiny and regulation. Companies in the market are compelled to adopt environmentally friendly practices, invest in waste treatment and recycling technologies, and comply with stringent environmental standards. Environmental responsibility has become a key factor shaping industry practices and influencing the choices of both businesses and consumers.

Geopolitical factors and trade dynamics also play a role in shaping the Metal Plating and Finishing Market. Fluctuations in trade relations, changes in tariffs, and geopolitical tensions can impact the supply chain and pricing of metal plating services. Companies in the market need to stay informed about global trade developments and adjust their strategies to navigate potential risks and capitalize on emerging opportunities in the global market. The ability to adapt to changing geopolitical landscapes is crucial for sustained success in the industry.

Moreover, the electronics industry significantly contributes to the demand for metal plating and finishing. As electronic devices become more compact and sophisticated, the need for precise and high-quality metal finishes for connectors, circuits, and casings grows. The rapid evolution of consumer electronics, coupled with the expansion of technologies like 5G and IoT, fuels the demand for advanced metal plating and finishing solutions in the electronics sector. The intricacies of electronic components demand specialized plating processes to ensure functionality and longevity.

The aerospace and defense sector is another key driver of the Metal Plating and Finishing Market. The stringent requirements for corrosion resistance, wear resistance, and precise finishes in aircraft components make metal plating a critical process in aerospace manufacturing. As the aerospace industry continues to grow globally, the demand for specialized metal plating and finishing services rises. The aerospace sector's reliance on high-performance materials and finishes positions it as a significant market influencer.

Raw material prices, particularly those of plating chemicals and metal substrates, play a role in shaping the Metal Plating and Finishing Market. Fluctuations in the costs of these raw materials impact the production costs and pricing of metal plating services. Companies in the market must implement effective supply chain strategies and cost management practices to navigate these raw material price dynamics. The ability to manage and optimize costs is essential for maintaining competitiveness in the market.

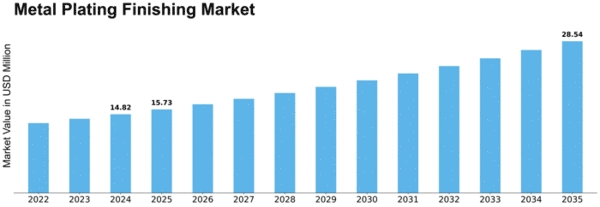

The Metal Plating and Finishing Market will hold USD 11.490.7 million with a CAGr of 4.23% between 2020 and 2027. The market held USD 9,134.8 million in 2017.

Leave a Comment