Mexico Semiconductor IP Market Overview:

As per MRFR analysis, the Mexico Semiconductor IP Market Size was estimated at 200 (USD Million) in 2024. The Mexico Semiconductor IP Market Industry is expected to grow from 232 (USD Million) in 2025 to 450 (USD Million) by 2035. The Mexico Semiconductor IP Market CAGR (growth rate) is expected to be around 6.208% during the forecast period (2025 - 2035).

Key Mexico Semiconductor IP Market Trends Highlighted

The Mexico Semiconductor IP Market is witnessing significant trends driven by the growing demand for advanced semiconductor technologies. A key market driver in this region is the surge in local manufacturing capabilities supported by government initiatives aimed at promoting the semiconductor industry. Mexico's strategic location near the United States facilitates easier supply chain management, further attracting foreign investment. The country is increasingly recognized as a pivotal player in semiconductor manufacturing, bolstered by a skilled workforce and favorable economic policies that aim to enhance local production.

Opportunities to be explored include collaborations between international firms and local companies to accelerate innovation in semiconductor design and development. The establishment of technology parks and innovation hubs, particularly in cities like Guadalajara, is fostering a collaborative environment where startups can thrive. Additionally, the Mexican government is promoting the use of digital technologies across various sectors, creating a favorable backdrop for the growth of the semiconductor IP market. In recent times, the trend towards electrification and the rising adoption of IoT devices are also shaping the Semiconductor IP landscape in Mexico.

Several tech firms are adapting their strategies to meet the increasing demand for smart and connected devices. Moreover, as the automotive industry in Mexico transitions towards electric vehicles, the need for specialized semiconductor solutions is becoming more pronounced.This evolving landscape positions Mexico as a central hub for the development of semiconductor intellectual property, making it a noteworthy market to watch in the coming years.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Mexico Semiconductor IP Market Drivers

Increased Demand for Advanced Electronics

The Mexico Semiconductor IP Market Industry is experiencing a significant surge in demand for advanced electronics, driven by the increasing adoption of smart devices and Internet of Things (IoT) technology. According to the Mexican government, the electronic sector contributes nearly 24% of the country's total manufacturing exports, with a notable increase in production of smart devices projected to reach over 175 million units by 2025.

As companies like Intel and AMD expand their operations in Mexico, the supply of semiconductor intellectual property (IP) is being optimized to meet the needs of these advanced electronics, driving growth in the market. The rising integration of artificial intelligence and machine learning in various applications further enhances the need for advanced semiconductor IP solutions, thereby creating a robust environment for market expansion.

Government Support and Investment

The Mexican government is actively supporting the growth of the semiconductor industry through favorable policies and initiatives aimed at attracting foreign investment. In recent years, Mexico has established several regulatory frameworks that encourage research and development (R&D) in semiconductor technology. For instance, the National Development Plan prioritizes technological innovation and aims to increase investment in the electronics sector by 30% over the next decade.

This government support fosters the development of semiconductor IP creators and also attracts important companies, such as Texas Instruments and Broadcom, to bolster their IMD (International Market Development) activities, thus directly stimulating the expansion of the Mexico Semiconductor IP Market.

Growing Trend of Localization

As multinationals seek to localize their supply chains, there is an increasing trend toward establishing semiconductor manufacturing capabilities in Mexico. Companies like Huawei and Qualcomm have started investing in local teams to develop semiconductor IP solutions tailored to the North American market. According to industry reports, approximately 60% of semiconductor companies operating in Mexico plan to expand their local presence by 2025, thus enhancing collaboration and innovation within the Mexico Semiconductor IP Market Industry.This trend toward localization not only shortens supply chains but also fosters innovation, ultimately leading to a more robust market landscape.

Emergence of Electric Vehicles

The rise of the electric vehicle (EV) market is significantly contributing to the expansion of the Mexico Semiconductor IP Market Industry. The Mexican government has set ambitious targets, aiming for 30% of all registered vehicles in the country to be electric by 2030. This initiative is supported by major automobile manufacturers like Volkswagen and General Motors, who are investing heavily in the development of electric and hybrid models in Mexico.

The increasing demand for electric vehicles necessitates advanced semiconductor IP for battery management systems, power distribution, and electric drive systems, thus serving as a potent driver for market growth in Mexico.

Mexico Semiconductor IP Market Segment Insights:

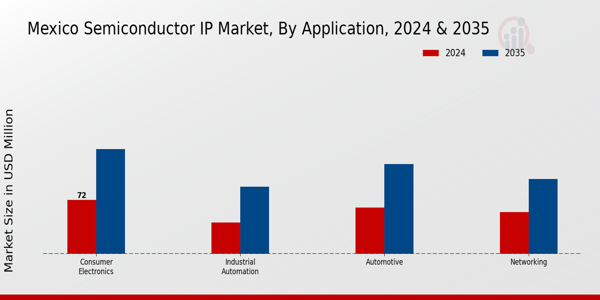

Semiconductor IP Market Application Insights

The Application segment of the Mexico Semiconductor IP Market is a vital area that underlines the country's robust technological advancements and developing economy. With Mexico’s strategic position as a manufacturing hub, this segment has showcased significant relevance across various domains. The automotive sector, for instance, is experiencing a pronounced transformation driven by trends such as electric vehicles and autonomous driving technology. These developments necessitate advanced semiconductor technologies, which play a crucial role in enhancing vehicle safety, improving performance, and reducing emissions, marking this sector as a key player in the Mexico Semiconductor IP Market landscape.

In the realm of consumer electronics, Mexico's thriving demand for smart devices and home appliances propels the need for semiconductor IP, which is pivotal for functionalities like connectivity, multimedia processing, and energy efficiency. As the country’s middle class expands, the consumption of digital gadgets increases, thereby giving rise to new opportunities for innovation in semiconductor technologies tailored consumer needs. Networking also stands as a critical aspect due to the growing necessity for high-speed data transfer and reliable communication infrastructure. This is particularly significant in the context of 5G technology implementation, further pushing the demand for sophisticated semiconductor solutions that can support enhanced connectivity and lower latency.

Industrial automation represents another significant area within the Application segment, fueled by the increasing need for efficient and smart manufacturing solutions. As manufacturers in Mexico adopt Industry 4.0 practices, there is an escalation in the need for automation technologies, wherein semiconductor IP plays an essential role in robotics, process control, and IoT integration. The prevalence of intelligent systems and digital twins in production workflows emphasizes the importance of reliable semiconductor technologies to maintain competitive advantages.

As these segments grow, they are characterized by different growth drivers and present varied challenges. For instance, the automotive sector must navigate regulatory standards and sustainability goals, while consumer electronics face the challenge of rapid technological changes along with shorter product lifespans. In the same vein, networking and industrial automation sectors contend with cybersecurity threats, making innovation in semiconductor IP paramount.

Overall, the Application segment of the Mexico Semiconductor IP Market encapsulates a diverse array of growth opportunities characterized by continual advancements, regulatory pressures, and the ongoing quest for technological excellence. As the landscape continues to evolve, stakeholders in Mexico are poised to leverage these trends to maintain growth and ensure that the semiconductor ecosystem remains resilient and competitive on a global scale.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Semiconductor IP Market Type Insights

The Mexico Semiconductor IP Market offers a diverse array of Type segments, with Microprocessors and Digital Signal Processors being pivotal in driving innovation and efficiency within the industry. Microprocessors play a critical role as the brain of modern electronic devices, enabling complex computations and functionalities, which makes them indispensable in sectors ranging from consumer electronics to automotive applications. This segment benefits from Mexico's robust manufacturing ecosystem, fostering significant expansion in Research and Development capabilities.

On the other hand, Digital Signal Processors specialize in handling and manipulating analog signals, crucial for applications in telecommunications, audio processing, and multimedia systems. The importance of this segment is underscored by the growing demand for high-performance processing solutions in consumer electronics and automotive technologies. As a result, both segments contribute significantly to the overall evolution of the Mexico Semiconductor IP Market, supporting the country's strategic focus on enhancing technological advancements and positioning itself as a competitive player in the global semiconductor landscape.The integration of these technologies not only reflects market trends but also highlights the opportunities for innovation in Mexico's growing semiconductor industry.

Mexico Semiconductor IP Market Key Players and Competitive Insights:

The Mexico Semiconductor IP Market is characterized by a dynamic and rapidly evolving landscape that caters to an increasing demand for innovative solutions across various industries. As Mexico emerges as a vital player in the global technology supply chain, its semiconductor market experiences heightened competition from both local and international entities. Companies operating in this sector leverage advanced technologies and invest in research and development to maintain a significant edge. The growing integration of semiconductor technology in areas such as automotive, telecommunications, and consumer electronics has intensified the competition, prompting firms to refine their strategies and enhance their product offerings to respond effectively to customer demands and market trends.

Texas Instruments has established a strong foothold in the Mexico Semiconductor IP Market, primarily recognized for its strengths in analog electronics and embedded processing. The company's extensive portfolio addresses diverse application needs, making it a key player in sectors such as automotive, industrial, and consumer electronics. Texas Instruments benefits from a well-established reputation for reliability and quality, which bolsters customer loyalty and expands its market presence in Mexico. Furthermore, the company emphasizes innovation through robust investment in research and development, enabling it to meet evolving market requirements and maintain a competitive advantage over its rivals. This strategic focus on technology enhancements, combined with its widespread distribution network, allows Texas Instruments to effectively serve its customers and capitalize on emerging opportunities within the Mexican semiconductor landscape.

STMicroelectronics also holds a significant position in the Mexico Semiconductor IP Market, providing a variety of key products and services that cater to a broad spectrum of applications. The company's offerings include microcontrollers, power management ICs, and various high-performance integrated circuits that are tailored for automotive, industrial, and consumer markets. STMicroelectronics is recognized for its commitment to quality and innovation, which is reflected in its ongoing research collaborations and strategic partnerships in Mexico. Through targeted mergers and acquisitions, the company has expanded its technological capabilities and market reach, reinforcing its presence in the region. By tapping into the growing demand for smart technologies and sustainable solutions, STMicroelectronics continues to strengthen its competitive positioning in the Mexican semiconductor sector, showcasing robust growth potential driven by an evolving landscape and customer expectations.

Key Companies in the Mexico Semiconductor IP Market Include:

- Texas Instruments

- STMicroelectronics

- Intel

- Arm

- Analog Devices

- Broadcom

- Imagination Technologies

- Maxim Integrated

- Synopsys

- Rambus

- Microchip Technology

- NXP Semiconductors

- Silicon Labs

- Cadence Design Systems

Mexico Semiconductor IP Industry Developments

The Mexico Semiconductor IP Market has shown notable developments and significant activity in recent months. Companies like Texas Instruments and NXP Semiconductors have been expanding their production capabilities in Mexico, reflecting the growing demand for semiconductor solutions. In September 2023, STMicroelectronics announced plans for a new manufacturing site aimed at bolstering their semiconductor fabrication efforts in the region. Additionally, Intel has been focusing on enhancing its workforce in Mexico, actively hiring engineers and technicians to support its Research and Development initiatives. In terms of mergers and acquisitions, there have been notable movements, such as Devices acquiring a smaller firm to strengthen its capability in sensor technology in August 2023.

Growth in the market valuation is evident, with companies like Synopsys reporting increased revenue due to rising demand for design services and intellectual property solutions in Mexico. In the broader context, the Mexican government has been actively promoting initiatives to bolster local semiconductor production, which has resulted in heightened investment activity from key players in the semiconductor space over the past two to three years. This government support is expected to further heal the supply chain disruptions seen earlier and boost the country’s semiconductor IP landscape.

Mexico Semiconductor IP Market Segmentation Insights

Semiconductor IP Market Application Outlook

- Automotive

- Consumer Electronics

- Networking

- Industrial Automation

Semiconductor IP Market Type Outlook

- Microprocessor

- Digital Signal Processors

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

200.0 (USD Million) |

| MARKET SIZE 2024 |

232.0 (USD Million) |

| MARKET SIZE 2035 |

450.0 (USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

6.208% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

Texas Instruments, STMicroelectronics, Intel, Arm, Analog Devices, Broadcom, Imagination Technologies, Maxim Integrated, Synopsys, Rambus, Microchip Technology, NXP Semiconductors, Silicon Labs, Cadence Design Systems |

| SEGMENTS COVERED |

Application, Type |

| KEY MARKET OPPORTUNITIES |

Growing demand for localized designs, Expansion of automotive electronics sector, Rising investment in smart technologies, Emergence of AI and IoT applications, Increased focus on renewable energy solutions |

| KEY MARKET DYNAMICS |

Rising demand for IoT applications, Increased investment in R&D, Growing local semiconductor manufacturing, Strategic partnerships and collaborations, Skilled workforce availability |

| COUNTRIES COVERED |

Mexico |

Frequently Asked Questions (FAQ) :

The Mexico Semiconductor IP Market is expected to be valued at 232.0 million USD in 2024.

By 2035, the Mexico Semiconductor IP Market is anticipated to reach a valuation of 450.0 million USD.

The market is expected to grow at a CAGR of 6.208% from 2025 to 2035.

The Automotive segment is expected to hold a significant share, valued at 120.0 million USD by 2035.

The Consumer Electronics application is projected to be valued at 140.0 million USD in 2035.

Major players in the market include Texas Instruments, STMicroelectronics, Intel, and Arm.

The Networking application is expected to reach a market value of 100.0 million USD by 2035.

The Industrial Automation segment is projected to be valued at 90.0 million USD by 2035.

The market presents growth opportunities driven by the advancements in automotive and consumer electronics applications.

The Mexico Semiconductor IP Market is expected to exhibit resilience, maintaining its growth trajectory despite global challenges.