-

Executive Summary

-

Market Attractiveness Analysis

- Military Aerospace Sensors Market, by Type

- Military Aerospace Sensors Market, by Platform

- Military Aerospace Sensors Market, by Application

- Military Aerospace Sensors Market, by End Use

- Military Aerospace Sensors Market, by Region

-

Market Introduction

-

Market Definition

-

Scope of the Study

-

Market Structure

-

Key Buying Criteria

-

Market Factor Indicator Analysis

-

Research Methodology

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

List of Assumptions

-

Market Insights

-

Market Dynamics

-

Introduction

-

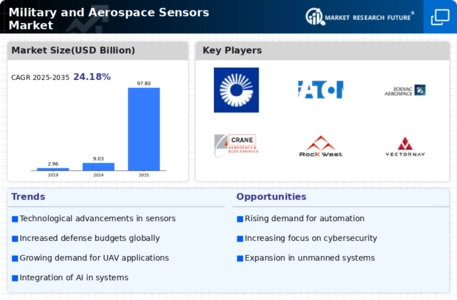

Drivers

- Ongoing advancements in sensor technology

- Increasing demand for new aircraft across the globe

- Drivers Impact Analysis

-

Restraints

- Restricted defense budgets

- Restraint Impact Analysis

-

Opportunities

- Increasing adoption of the internet of things in the aviation industry

-

Market/Technological Trends

-

Patent Trends

-

Regulatory Landscape/Standards

-

Market Factor Analysis

-

Value Chain/Supply Chain Analysis

- R&D

- Manufacturing

- Distribution & Sales

- Post-Sales Monitoring

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Threat of Substitutes

- Segment Rivalry

- Bargaining Power of Suppliers

-

Military Aerospace Sensors Market, by Type

-

Introduction

-

Pressure Sensors

-

Temperature Sensors

-

Torque Sensors

-

Speed Sensors

-

Accelerometers

-

Level Sensors

-

Flow Sensors

-

Proximity Sensors

-

Gyroscopes

-

Radar Sensors

-

Magnetic Sensors

-

Others

-

Military Aerospace Sensors Market, by Platform

-

Introduction

-

Airborne

-

Land

-

Naval

-

Space

-

Military Aerospace Sensors Market, by Application

-

Introduction

-

Intelligence & Reconnaissance

-

Communication & Navigation

-

Combat Operations

-

Electronic Warfare

-

Target Recognition

-

Command and Control

-

Surveillance & Monitoring

-

Military Aerospace Sensors Market, by End Use

-

Introduction

-

OEM

-

Aftermarket

-

Military Aerospace Sensors Market, by Region

-

Introduction

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Australia

- Rest of Asia-Pacific

-

Middle East & Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Rest of Latin America

-

Competitive Landscape

-

Competitive Overview

-

Competitor Dashboard

-

Major Growth Key Strategies in the Global Military and Aerospace Sensors Market

-

Competitive Benchmarking

-

Market Share Analysis

-

Leading Player in terms of the Number of Developments in the Global Military and Aerospace Sensors Market

-

Key Developments & Growth Strategies

- New Product Launch/Service Platform

- Merger & Acquisition

- Joint Ventures

-

Company Profiles

-

Key Market Players

- Honeywell International Inc.

- Ametek, Inc.

- Thales Group

- TE Connectivity Ltd.

- Raytheon Company

- Lockheed Martin Corporation

- Safran Electronics & Defense

- BAE Systems PLC

- General Electric Company

- Ultra-Electronics

-

(Company overview, financial updates, products & service offered, key developments, SWOT analysis, and key strategies to be provided for all the listed companies)

-

Key Market Players

- UTC Aerospace Systems

- Meggitt PLC

- Kongsberg Gruppen

- Crane Aerospace

- Eaton Corporation

- Zodiac Aerospace

- Viooa Imaging Technology

- Rockwest Solutions

- Microflown Avisa B.V.

- Vectornav Technologies, LLC

-

Appendix

-

References

-

Related Reports

-

List of Abbreviation

-

List of Tables

-

LIST OF ASSUMPTIONS

-

MAJOR PATENTS GRANTED FOR MILITARY AND AEROSPACE SENSORS (2024-2032)

-

TYPE: GLOBAL MILITARY AND AEROSPACE SENSORS MARKET, 2024-2032 (USD MILLION)

-

PLATFORM: GLOBAL MILITARY AND AEROSPACE SENSORS MARKET, 2024-2032 (USD MILLION)

-

APPLICATION: GLOBAL MILITARY AND AEROSPACE SENSORS MARKET, 2024-2032 (USD MILLION)

-

END USE: GLOBAL MILITARY AND AEROSPACE SENSORS MARKET, 2024-2032 (USD MILLION)

-

Military Aerospace Sensors Market, BY REGION, 2024-2032 (USD MILLION)

-

NORTH AMERICA: Military Aerospace Sensors Market, BY COUNTRY, 2024-2032 (USD MILLION)

-

NORTH AMERICA: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

NORTH AMERICA: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

NORTH AMERICA: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

NORTH AMERICA: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

US: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

US: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

US: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

US: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

CANADA: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

CANADA: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

CANADA: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

CANADA: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

EUROPE: Military Aerospace Sensors Market, BY COUNTRY, 2024-2032 (USD MILLION)

-

EUROPE: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

EUROPE: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

EUROPE: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

EUROPE: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

UK: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

UK: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

UK: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

UK: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

GERMANY: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

GERMANY: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

GERMANY: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

GERMANY: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

FRANCE: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

FRANCE: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

FRANCE: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

FRANCE: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

ITALY: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

ITALY: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

ITALY: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

ITALY: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

REST OF EUROPE: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

REST OF EUROPE: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

REST OF EUROPE: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

REST OF EUROPE: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

ASIA-PACIFIC: Military Aerospace Sensors Market, BY COUNTRY, 2024-2032 (USD MILLION)

-

ASIA-PACIFIC: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

ASIA-PACIFIC: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

ASIA-PACIFIC: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

ASIA-PACIFIC: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

CHINA: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

CHINA: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

CHINA: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

CHINA: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

INDIA: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

INDIA: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

INDIA: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

INDIA: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

JAPAN: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

JAPAN: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

JAPAN: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

JAPAN: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

AUSTRALIA: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

AUSTRALIA: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

AUSTRALIA: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

AUSTRALIA: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

REST OF ASIA-PACIFIC: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

REST OF ASIA-PACIFIC: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

REST OF ASIA-PACIFIC: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

REST OF ASIA-PACIFIC: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

MIDDLE EAST & AFRICA: Military Aerospace Sensors Market, BY COUNTRY, 2024-2032 (USD MILLION)

-

MIDDLE EAST & AFRICA: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

MIDDLE EAST & AFRICA: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

MIDDLE EAST & AFRICA: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

MIDDLE EAST & AFRICA: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

SAUDI ARABIA: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

SAUDI ARABIA: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

SAUDI ARABIA: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

SAUDI ARABIA: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

UAE: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

UAE: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

UAE: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

UAE: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

LATIN AMERICA: Military Aerospace Sensors Market, BY COUNTRY, 2024-2032 (USD MILLION)

-

LATIN AMERICA: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

LATIN AMERICA: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

LATIN AMERICA: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

LATIN AMERICA: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

BRAZIL: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

BRAZIL: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

BRAZIL: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

BRAZIL: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

REST OF LATIN AMERICA: Military Aerospace Sensors Market, BY TYPE, 2024-2032 (USD MILLION)

-

REST OF LATIN AMERICA: Military Aerospace Sensors Market, BY PLATFORM, 2024-2032 (USD MILLION)

-

REST OF LATIN AMERICA: Military Aerospace Sensors Market, BY APPLICATION, 2024-2032 (USD MILLION)

-

REST OF LATIN AMERICA: Military Aerospace Sensors Market, BY END USE, 2024-2032 (USD MILLION)

-

THE MOST ACTIVE PLAYERS IN THE GLOBAL MILITARY AND AEROSPACE SENSORS MARKET

-

CONTRACTS AND AGREEMENTS

-

MERGERS AND ACQUISITIONS

-

PRODUCT DEVELOPMENTS

-

EXPANSIONS AND INVESTMENTS

-

JOINT VENTURES AND PARTNERSHIPS

-

-

List of Figures

-

MARKET SYNOPSIS

-

GLOBAL MILITARY AND AEROSPACE SENSORS MARKET: MARKET ATTRACTIVENESS ANALYSIS

-

Military Aerospace Sensors Market, BY TYPE

-

Military Aerospace Sensors Market, BY END USE

-

Military Aerospace Sensors Market, BY APPLICATION

-

Military Aerospace Sensors Market, BY END USE

-

Military Aerospace Sensors Market, BY REGION

-

GLOBAL MILITARY AND AEROSPACE SENSORS MARKET: MARKET STRUCTURE

-

KEY BUYING CRITERIA FOR MILITARY AND AEROSPACE SENSORS TYPES

-

RESEARCH PROCESS OF MRFR

-

NORTH AMERICA: MARKET SIZE & Military Aerospace Sensors Market, BY COUNTRY, 2024 VS 2032

-

EUROPE: MARKET SIZE & Military Aerospace Sensors Market, BY COUNTRY, 2024 VS 2032

-

ASIA-PACIFIC: MARKET SIZE & Military Aerospace Sensors Market, BY COUNTRY, 2024 VS 2032

-

MIDDLE EAST & AFRICA: MARKET SIZE & Military Aerospace Sensors Market, BY COUNTRY, 2024 VS 2032

-

LATIN AMERICA: MARKET SIZE & Military Aerospace Sensors Market, BY REGION, 2024 VS 2032

-

MARKET DYNAMICS OVERVIEW

-

DRIVERS IMPACT ANALYSIS: GLOBAL MILITARY AND AEROSPACE SENSORS MARKET

-

RESTRAINTS IMPACT ANALYSIS: GLOBAL MILITARY AND AEROSPACE SENSORS MARKET

-

PORTER’S FIVE FORCES ANALYSIS OF THE GLOBAL MILITARY AND AEROSPACE SENSORS MARKET

-

SUPPLY CHAIN: GLOBAL MILITARY AND AEROSPACE SENSORS MARKET

-

Military Aerospace Sensors Market, BY TYPE, 2024 (% SHARE)

-

Military Aerospace Sensors Market, BY END USE, 2024 (% SHARE)

-

Military Aerospace Sensors Market, BY APPLICATION, 2024 (% SHARE)

-

Military Aerospace Sensors Market, BY REGION, 2024 (% SHARE)

-

NORTH AMERICA: Military Aerospace Sensors Market, BY COUNTRY, 2024 (% SHARE)

-

EUROPE: Military Aerospace Sensors Market, BY COUNTRY, 2024 (% SHARE)

-

ASIA-PACIFIC: Military Aerospace Sensors Market, BY COUNTRY, 2024 (% SHARE)

-

MIDDLE EAST & AFRICA: Military Aerospace Sensors Market, BY COUNTRY, 2024 (% SHARE)

-

LATIN AMERICA: Military Aerospace Sensors Market, BY COUNTRY, 2024 (% SHARE)

-

COMPETITOR DASHBOARD: GLOBAL MILITARY AND AEROSPACE SENSORS MARKET

-

CAPITAL MARKET RATIO AND FINANCIAL MATRIX

-

CONTRACTS & AGREEMENTS: THE MAJOR STRATEGY ADOPTED BY KEY PLAYERS IN THE GLOBAL MILITARY AND AEROSPACE SENSORS MARKET

-

BENCHMARKING OF MAJOR COMPETITORS

-

MAJOR MANUFACTURERS MARKET SHARE ANALYSIS, 2024

-

"

Leave a Comment