-

Executive Summary

-

Market Attractiveness Analysis

- Global Military UAV Sensor Market, by Application

- Global Military UAV Sensor Market, by Technology Type

- Global Military UAV Sensor Market, by UAV Type

- Global Military UAV Sensor Market, by Platform

- Global Military UAV Sensor Market, by Region

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Definition

- Research Objective

- Assumptions

- Limitations

-

Research Process

- Primary Research

- Secondary Research

-

Market Size Estimation

-

Forecast Model

-

Market Landscape

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Threat of Substitutes

- Segment Rivalry

- Bargaining Power of Buyers

-

Value Chain/Supply Chain Analysis

-

Market Dynamics

-

Introduction

-

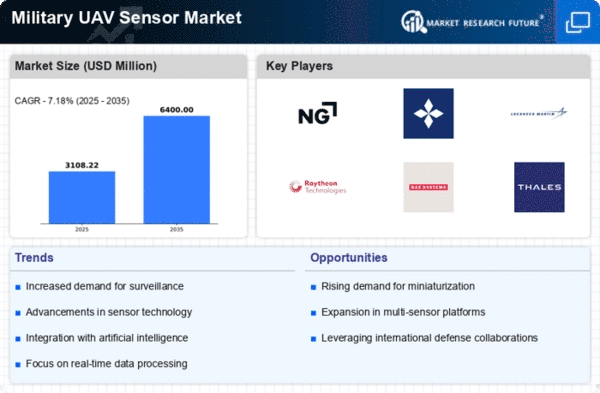

Market Drivers

-

Market Restraints

-

Market Opportunities

-

Market Trends

-

Military UAV Sensors Market, by UAV Type

-

Introduction

-

High-Altitude Long Endurance (HALE)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Medium-Altitude Long Endurance (MALE)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Tactical

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Small

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Military UAV Sensors Market, by Platform

-

Introduction

-

Radar Sensor

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Image Sensor

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Motion & Position Sensor

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Others

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Military UAV Sensors Market, by Technology Type

-

Introduction

-

Complementary Metal Oxide Semiconductor (CMOS)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Micro-Electro-Mechanical Semiconductor (MEMS)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Nano-Electro-Mechanical Semiconductor (NEMS)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Others

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Military UAV Sensors Market, by Application

-

Introduction

-

Collision Avoidance

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Navigation

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

3D Scanner

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Data Acquisition

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

LIDAR

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Others

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Military UAV Sensors Market, by Region

-

Introduction

-

North America

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by UAV Type, 2020–2027

- Market Estimates & Forecast, by Platform, 2020–2027

- Market Estimates & Forecast, by Technology Type, 2020–2027

- Market Estimates & Forecast, by Application, 2020–2027

- U.S.

- Canada

-

Europe

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by UAV Type, 2020–2027

- Market Estimates & Forecast, by Platform, 2020–2027

- Market Estimates & Forecast, by Technology Type, 2020–2027

- Market Estimates & Forecast, by Application, 2020–2027

- UK

- Germany

- France

- Russia

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by UAV Type, 2020–2027

- Market Estimates & Forecast, by Platform, 2020–2027

- Market Estimates & Forecast, by Technology Type, 2020–2027

- Market Estimates & Forecast, by Application, 2020–2027

- China

- Japan

- India

- Rest of Asia-Pacific

-

Middle East & Africa

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by UAV Type, 2020–2027

- Market Estimates & Forecast, by Platform, 2020–2027

- Market Estimates & Forecast, by Technology Type, 2020–2027

- Market Estimates & Forecast, by Application, 2020–2027

-

Latin America

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by UAV Type, 2020–2027

- Market Estimates & Forecast, by Platform, 2020–2027

- Market Estimates & Forecast, by Technology Type, 2020–2027

- Market Estimates & Forecast, by Application, 2020–2027

-

Competitive Landscape

-

Company Profile

-

TE Connectivity

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Raytheon Company

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Thales Group

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Lockheed Martin

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

AeroVironment

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

General Atomics

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

FLIR Systems

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Elbit Systems

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Kratos Defense & Security Solutions

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Safran Electronics & Defense

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Northrop Grumman Corporation

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Honeywell International Inc.

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Appendix

-

References

-

Related Reports

-

List of Abbreviations

-

Industry Insights

-

Note: This table of contents is tentative and subject to change as the research progresses.

-

List of Tables

-

Global Military UAV Sensor Market, by Region, 2020–2027

-

North America Military UAV Sensor Market, by Country, 2020–2027

-

Europe Military UAV Sensor Market, by Country, 2020–2027

-

Asia-Pacific Military UAV Sensor Market, by Country, 2020–2027

-

Middle East & Africa Military UAV Sensor Market, by Country, 2020–2027

-

Latin America Military UAV Sensor Market, by Country, 2020–2027

-

Global Military UAV Sensor Market, by Region, 2020–2027

-

Global Military UAV Sensor Market, by Technology Type, 2020–2027

-

Global Military UAV Sensor Market, by UAV Type, 2020–2027

-

Global Military UAV Sensor Market, by Platform, 2020–2027

-

Global Military UAV Sensor Market, by Application, 2020–2027

-

North America: Military UAV Sensor Market, by Country, 2020–2027

-

North America: Military UAV Sensor Market, by Technology Type, 2020–2027

-

North America: Military UAV Sensor Market, by UAV Type, 2020–2027

-

North America: Military UAV Sensor Market, by Platform, 2020–2027

-

North America: Military UAV Sensor Market, by Application, 2020–2027

-

Europe: Military UAV Sensor Market, by Country, 2020–2027

-

Europe: Military UAV Sensor Market, by Technology Type, 2020–2027

-

Europe: Military UAV Sensor Market, by UAV Type, 2020–2027

-

Europe: Military UAV Sensor Market, by Platform, 2020–2027

-

Europe: Military UAV Sensor Market, by Application, 2020–2027

-

Asia-Pacific: Military UAV Sensor Market, by Country, 2020–2027

-

Asia-Pacific: Military UAV Sensor Market, by Technology Type, 2020–2027

-

Asia-Pacific: Military UAV Sensor Market, by UAV Type, 2020–2027

-

Asia-Pacific: Military UAV Sensor Market, by Platform, 2020–2027

-

Asia-Pacific: Military UAV Sensor Market, by Application, 2020–2027

-

Middle East & Africa: Military UAV Sensor Market, by Region, 2020–2027

-

Middle East & Africa: Military UAV Sensor Market, by Technology Type, 2020–2027

-

Middle East & Africa: Military UAV Sensor Market, by UAV Type, 2020–2027

-

Middle East & Africa: Military UAV Sensor Market, by Platform, 2020–2027

-

Middle East & Africa: Military UAV Sensor Market, by Application, 2020–2027

-

Latin America: Military UAV Sensor Market, by Region, 2020–2027

-

Latin America: Military UAV Sensor Market, by Technology Type, 2020–2027

-

Latin America: Military UAV Sensor Market, by UAV Type, 2020–2027

-

Latin America: Military UAV Sensor Market, by Platform, 2020–2027

-

Latin America: Military UAV Sensor Market, by Application, 2020–2027

-

List of Figures

-

Research Process of MRFR

-

Top-Down and Bottom-Up Approaches

-

Market Dynamics

-

Impact Analysis: Market Drivers

-

Impact Analysis: Market Restraints

-

Porter's Five Forces Analysis

-

Value Chain Analysis

-

Global Military UAV Sensor Market Share, by Technology Type, 2020 (%)

-

Global Military UAV Sensor Market, by Technology Type, 2020–2027 (USD Million)

-

Global Military UAV Sensor Market Share, by UAV Type, 2020 (%)

-

Global Military UAV Sensor Market, by UAV Type, 2020–2027 (USD Million)

-

Global Military UAV Sensor Market Share, by Platform, 2020 (%)

-

Global Military UAV Sensor Market, by Platform, 2020–2027 (USD Million)

-

Global Military UAV Sensor Market Share, by Application, 2020 (%)

-

Global Military UAV Sensor Market, by Application, 2020–2027 (USD Million)

-

Global Military UAV Sensor Market Share (%), by Region, 2020

-

Global Military UAV Sensor Market, by Region, 2020–2027 (USD Million)

-

North America: Military UAV Sensor Market Share (%), 2020

-

North America: Military UAV Sensor Market by Country, 2020–2027 (USD Million)

-

Europe: Military UAV Sensor Market Share (%), 2020

-

Europe: Military UAV Sensor Market by Country, 2020–2027 (USD Million)

-

Asia-Pacific: Military UAV Sensor Market Share (%), 2020

-

Asia-Pacific: Military UAV Sensor Market by Country, 2020–2027 (USD Million)

-

Middle East & Africa Military UAV Sensor Market Share (%), 2020

-

Middle East & Africa Military UAV Sensor Market by Region, 2020–2027 (USD Million)

-

Latin America Military UAV Sensor Market Share (%), 2020

-

Latin America Military UAV Sensor Market by Region, 2020–2027 (USD Million)

Leave a Comment