Mini Tractors Size

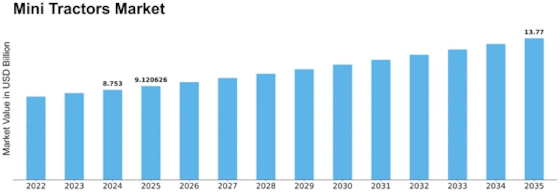

Mini Tractors Market Growth Projections and Opportunities

The dynamics of the mini tractors market are driven by several factors that shape activities and performance in this setting. One of the main motivators is rising demand for small size multipurpose equipment that can be used in such fields as commutative farming and landscape design. Mini tractors, which are easy to maneuver, and smaller than normal ones due to their typical design features meet the demand of small scale land owners such as those who farm for subsistence or hobby. The mini tractors are increasingly viewed as indispensable instruments used in agriculture and non-agriculture activities, particularly where the holdings have smaller land dimensions. The market of mini tractors is significantly influenced by economic conditions and in some cases farming practices. Mini tractors are not only cheap but also operationally efficient, hence ideal for the small and large as well farmers who may find larger agricultural machines uneconomical. The trends are also shaped based on the economic viability of mini tractors, as well as mechanization in agriculture work that promotes a variety of applications such as ploughing and cultivation among others to landscaping materials handling. The government policies and incentives are the vital factor that influences mini-tractor market. The affordability and availability of mini tractor to farmers are influenced by subsidies, grants as well as monetary backing depicted towards the agricultural mechanization programs. The dynamics here are also affected by the level of government support such like programs that encourage use of advanced agricultural equipment to boost productivity and sustainability. The advances in mini tractor designs and features also stand as a driving force influencing the market movements. Development and changes such as efficiency in burn fuel, comfortability designs, precision growfare capabilities, security components ensure the rapidly changing scene. Meanwhile, manufacturers’ endeavours to integrate modern technologies in mini tractors are undergoing changes dependent on how farmers demand various forms of equipment that are efficient and easy-to-use. The market drivers of mini tractors include environmental issues and sustainability in the use of natural resources. Concentration on good agricultural practices and eco-friendly through minimizing over investment of power has inspired the invention of more sustainable mini tractors that use clean energy. The dynamics are driven by the demand for green solutions, whereby manufacturers look at some alternatives in terms of power sources like electrics and hybrid, which help to harmonize with worldwide sustainability goals. Mini tractors are some of the market factors driven by consumer preferences and demographics. End users such as farmers, hobbyists and landscapes influence the dynamics from their distinct requirement.

Leave a Comment