Market Analysis

In-depth Analysis of Minimal Residual Disease Testing Market Industry Landscape

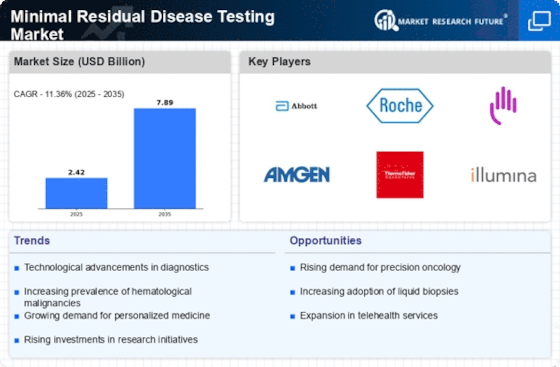

The Minimal Residual Disease (MRD) Testing Market is influenced by a combination of factors that collectively shape its dynamics within the healthcare and diagnostics industry. A significant driver for this market is the increasing focus on personalized and targeted cancer therapies, where MRD testing plays a crucial role in monitoring residual cancer cells after treatment. MRD testing offers sensitive and specific techniques for diagnosing minute cancer cells quantities and enables doctors to evaluate the patient treatment response, prognosis by relapse and make an informed therapeutic decision accordingly.

Mounting technological breakthroughs in molecular diagnostics and next-generation sequencing technologies are more crucial for the market than ever. Research primary runs aim are at producing minimal residual disease detection more sensitive and specific methods that include next-generation sequencing, polymerase chain reaction (PCR) assays and flow cytometry. Technological developments in these instruments literally narrow the molecular testing margins, consequently, extending MRD applications in all hematological and solid tumor types and changing the market perspectives.

Regulatory recognition is among the key aspects that ought to be taken into account whenever new MRD testing methods are being developed and applied. Strict regulatory standards guarantee correct assessment, reliability and validity of the characterization among Stemrentals. For this reason MRDs have become widely accepted tools in clinical settings and in scientific research. Cancer diagnostics and personalized medicine are regulated space. Compliance with regulatory requirements is central for market players (diagnostic companies and laboratories) to establish their presence in this dynamic and specialized landscape.

Economic considerations do to the MRD testing market matters a lot. Cancer research and technology, usually difficult to be accessed for healthcare institutes, become better due to the economic growth and stability, which in turn lead to increased funding for the cancer research. On the contrary, economic difficulty can impact testing allocation, deciding the practice use in some clinical settings. From this standpoint, the cost-effectiveness as well as reimbursement landscape become the main factors to be taken in mind, in the regions where money is a crucial factor that determines medical spending.

For a specific laboratory, the always changing competitive landscape from other diagnostic companies, molecular diagnostic laboratories, and research institutions is also an imperative market factor. High competitiveness stimulates new technological innovations where MRD testing providers come up with the clinical-grade machines, automatic-platform and the overall testing services. Collaborations, partnerships and research initiatives are the flavors of the moment in a competitive landscape, where firms strive to advance their MRD testing capabilities, to expand market reach, and much more, to retain a competitive edge in the field which is under rapid change.

Different consumers who are oncologists, hematologists, and cancer researchers have different in the MRD testing market. Healthcare professionals may find it more appealing when the immunity analysis platforms have high sensitivity, specificity, and streamlined use for day-to-day clinical practice. Sensitivity in MRD detection may become overall with assays capable of exposure to different cancer types and yielding information on therapy efficacy and disease progression.

Related with it further, the general trends of cancer treatment and the rapid adoption of personalized medicine are responsible for the growth of MRD testing market. By using MRD testing along with the principles of precision medicine, health care providers can actually design custom treatment plans that have been uniquely tailored to the specific responses of an individual patient and even to the disease symptoms.. The integration of MRD testing into clinical trials and treatment guidelines reflects the growing importance of this diagnostic approach in modern oncology.

Leave a Comment