- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

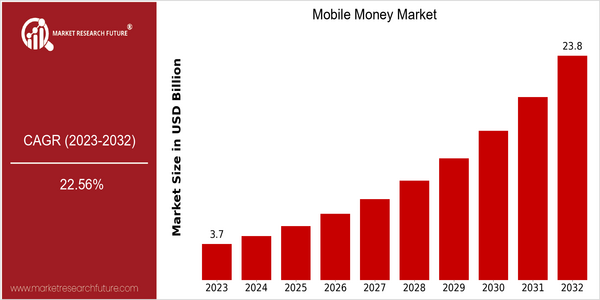

| Year | Value |

|---|---|

| 2023 | USD 3.7 Billion |

| 2032 | USD 23.8 Billion |

| CAGR (2024-2032) | 22.56 % |

Note – Market size depicts the revenue generated over the financial year

The global mobile money market is expected to be worth $ 3.7 billion in 2023, and is expected to grow rapidly to reach $23 billion by 2032. The annual growth rate from 2024 to 2032 is 22.56%. The growth of the mobile money market is strong, and the number of mobile money users is increasing rapidly. The penetration rate of mobile phones is increasing, and the demand for convenient and safe payment solutions is increasing. The digital transformation of various industries has also accelerated the development of the mobile money industry. Business. The development of technology, such as the introduction of block chain technology and the improvement of security standards, is also a major growth driver. The major players in the mobile money industry, such as PayPal, Square, and M-Pesa, are actively investing in innovation and establishing strategic alliances to meet the needs of users. These companies are also investing in the development of digital wallets. The industry is still evolving, and the mobile money industry will continue to grow.

Regional Market Size

Regional Deep Dive

The Mobile Money Market is growing at a fast rate in many regions, owing to the increasing use of smart phones and the growing popularity of digital payment systems. North America is characterized by a mature financial eco-system that is focused on security and regulatory compliance. Europe is characterized by its diversity, with regulations varying from country to country. Asia-Pacific is characterized by rapid growth, with a large number of unbanked people and the emergence of fintech companies. Middle East and Africa are characterized by their rapid growth, which is driven by the need for financial inclusion and the spread of mobile technology. Latin America is also becoming a major player, with a growing number of start-ups and government initiatives to improve the digital payment systems.

Europe

- The European Union's Digital Finance Strategy aims to promote the use of digital payments, which is encouraging traditional banks to collaborate with fintech firms to enhance their mobile money offerings.

- Countries like Sweden are leading the way in cashless transactions, with initiatives such as the Riksbank's e-krona project exploring the potential of central bank digital currencies (CBDCs) to complement mobile money services.

Asia Pacific

- Countries like India and China are witnessing explosive growth in mobile money adoption, driven by government initiatives such as Digital India and the rapid expansion of mobile internet access.

- Innovative platforms like Alipay and WeChat Pay in China are setting global benchmarks for mobile payment solutions, integrating social media and e-commerce functionalities that enhance user engagement.

Latin America

- The rise of digital wallets like Mercado Pago and PicPay is reshaping the mobile money landscape in Latin America, providing users with seamless payment solutions and financial services.

- Government programs aimed at increasing financial literacy and access to banking services are driving mobile money adoption, particularly in underserved communities.

North America

- The rise of fintech companies like Square and PayPal has transformed the mobile money landscape, offering innovative solutions that cater to both consumers and businesses, enhancing transaction efficiency.

- Regulatory changes, such as the implementation of the Payment Services Directive 2 (PSD2) in the EU, are influencing North American companies to adopt more secure and transparent payment methods, fostering consumer trust.

Middle East And Africa

- The launch of mobile money services by telecom giants like MTN and Safaricom has revolutionized financial access in regions like Sub-Saharan Africa, where traditional banking infrastructure is limited.

- Government initiatives, such as the Central Bank of Nigeria's regulatory framework for mobile payments, are fostering a conducive environment for mobile money growth, enhancing financial inclusion.

Did You Know?

“As of 2023, over 1.7 billion people worldwide are unbanked, and mobile money services are playing a crucial role in providing them with access to financial services.” — World Bank

Segmental Market Size

Mobile money is a very fast growing sector, mainly because of the rise in smartphone penetration and the growing need for financial services. This is largely due to the move towards cashless payments, and the availability of mobile money services in countries with a weak banking sector. In countries like Kenya, mobile money has proved to be a very successful way of filling financial gaps. The current state of the market is characterized by a large-scale deployment of products, with notable players such as PayPal, Venmo, and other fintech companies. In terms of applications, the most common are peer-to-peer payments, remittances, and merchant payments, which are becoming more and more integrated into the daily lives of consumers. Also, the pandemic of COV19 has accelerated the shift to digital payments, and governments are pushing for cashless economies. The introduction of newer payment methods, such as QR codes and blockchain, are reshaping the industry, improving security and the customer experience.

Future Outlook

During the forecast period, the mobile money market will grow at a CAGR of 22.56% from $ 3.7 billion to $23,8 billion. This growth is based on the increasing penetration of smart phones, improved Internet access and the increasing preference for cashless payments, especially in emerging economies. In regions such as Sub-Saharan Africa and Southeast Asia, where the banking system is still underdeveloped, mobile money penetration will be over 60% among adults by 2032. In addition, technological developments such as the integration of blockchain for increased security and the growing use of artificial intelligence in fraud detection are expected to drive market growth. The growth of digital payment systems will also play an important role in driving market growth. By 2032, mobile money will be a major part of the world's financial system.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 2.9 Billion |

| Market Size Value In 2023 | USD 3.7 Billion |

| Growth Rate | 26.33% (2023-2032) |

Mobile Money Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.