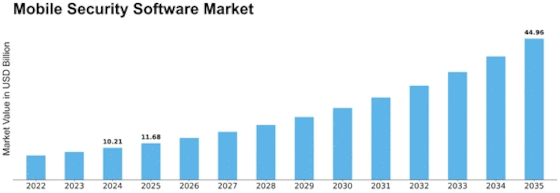

Mobile Security Software Size

Mobile Security Software Market Growth Projections and Opportunities

The Mobile Security Software market is intensely impacted by a huge number of elements that all in all shape its elements and development direction. One of the essential drivers is the raising expansion of cell phones and mobile gadgets around the world. With the advent of a modern population across borders and increased storing up sensitive information on these devices, robust security measures have become an imperative necessity to address this alarming need. This flood is additionally fuelled by the growing phenomenon of remote work, through which employees make use of mobile devices to access corporate data and applications thus increasing demand for mobile security software products.

The other important factor that is affecting the mobile security software market are the cybersecurity threats and ever-growing landscape of malicious activities. In view of the ascent in ongoing and inconspicuous computerized assaults, there is additionally a rising cognizance among people and associations about mobile gadget vulnerabilities. Afterwards, the attention is directed towards making investments in advanced security solutions that would protect from hazards such as malware attacks, phishing attack etc. This mindfulness can be said to be one of the biggest drivers for continuous growth and improvement within mobile security software industry.

Informal laws and consistent requirements also play an important role in shaping the mobile security software market. With increased concern over information protection and insurance, states around the world are enacting strict regulations assuring that companies follow specific security requirements. This directly impacts the mobile security software market as organizations seek to comply with these regulations by adopting end-to-end solutions aimed at protecting client information and maintain regulatory compliance, respectively.

Important market factors are deep serious scene and key players’ essential drives. The mobile security software industry is characterised by vigorous competition following increased incidences of establishments in the sector. Throughout the Central participants try to isolate themselves through development, key organisations and mergers as well as acquisitions. These exercises contribute to the evolution of classical security technologies and develop overall market growth.

Innovative advancements and the incorporation of emerging technologies also shape this market for mobile security software. The emergence of technological consciousness and AI has distorted the powers of security systems, making them detect threats in real time. In addition the biometric confirmation techniques coupled with receiving secure parts of equipment only improve mobile security software efficiency.

Buyer behavior and preferences also influence the mobile security software market. As people become more aware of the potential dangers related with mobile utilization, there is a developing interest for easy to use and non-nosy security arrangements.

Leave a Comment