Mobile Substation Size

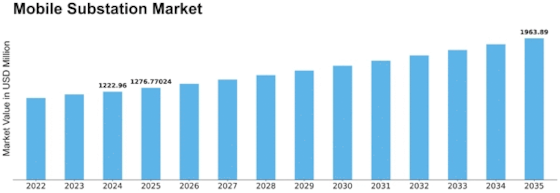

Mobile Substation Market Growth Projections and Opportunities

The mobile substation market has witnessed significant growth in recent years, driven by the evolving landscape of power distribution and the need for flexible and efficient solutions. Mobile substations play a crucial role in ensuring a reliable and uninterrupted power supply, especially in situations where traditional fixed substations may face challenges. These dynamic units are designed to be easily transportable, providing utilities and industries with the ability to quickly respond to changing demands, emergencies, or scheduled maintenance.

One key factor influencing the market dynamics of mobile substations is the increasing emphasis on renewable energy sources. As the world transitions towards a more sustainable and green energy infrastructure, the integration of renewable power generation, such as solar and wind, becomes more prevalent. Mobile substations offer a versatile solution to support the connection of these distributed energy resources to the grid. Their mobility allows for strategic placement in areas with high renewable energy potential, aiding in the efficient integration of clean energy into the power grid.

The rising demand for energy in urban and remote areas is another driving force behind the growth of the mobile substation market. Urbanization and industrialization often lead to increased electricity consumption, and mobile substations offer a quick and viable solution to address the growing power needs. Moreover, in remote or off-grid locations, where establishing a permanent substation may be impractical, mobile substations serve as a temporary yet reliable solution to bridge the energy gap.

Market dynamics are also influenced by the need for rapid deployment during emergencies or natural disasters. When a traditional substation faces damage or disruption due to unforeseen events, mobile substations can be swiftly deployed to restore power and minimize downtime. This adaptability enhances the resilience of the power grid, making it more robust in the face of unexpected challenges.

Technological advancements and innovations in mobile substation designs contribute to market dynamics by enhancing their efficiency and capabilities. Modern mobile substations are equipped with advanced monitoring and control systems, enabling real-time data analysis and remote operation. Additionally, manufacturers are focusing on making these units more compact, lightweight, and environmentally friendly, further boosting their appeal to utilities and industries seeking sustainable solutions.

Regulatory initiatives and government support also play a pivotal role in shaping the market dynamics of mobile substations. Policies aimed at improving the reliability and resilience of power infrastructure, promoting clean energy integration, and addressing energy access challenges contribute to the overall market growth. Government investments in upgrading and expanding power transmission and distribution networks further drive the adoption of mobile substations.

In conclusion, the market dynamics of the mobile substation market are characterized by a combination of factors, including the increasing adoption of renewable energy, the need for quick and flexible power solutions, technological advancements, and supportive regulatory frameworks. As the global energy landscape continues to evolve, mobile substations are likely to play a vital role in ensuring a reliable and resilient power supply, meeting the diverse and dynamic needs of modern power systems.

Leave a Comment