Mobile Workforce Management Size

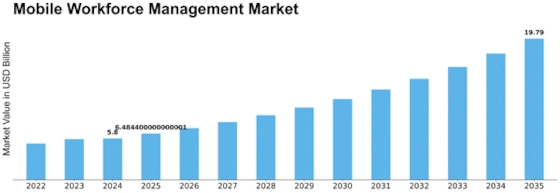

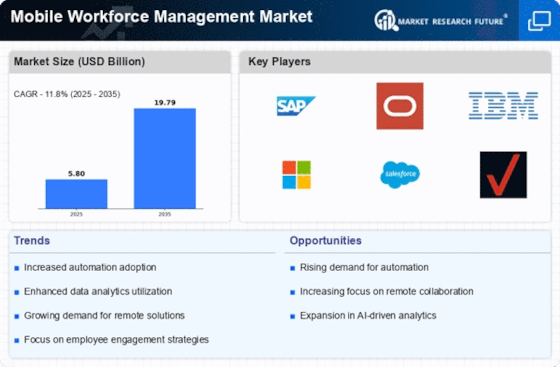

Mobile Workforce Management Market Growth Projections and Opportunities

The Mobile Workforce Management market is subject to influence by many market factors that drive its growth and shape the industry. These factors play a critical role in determining demand, acceptance, and emergence of mobile work force management solutions. Understanding these factors are important for businesses when making informed decisions about the mobile workforce management market’s potential. Another key factor affecting the Mobile Workforce Management market is enhancing operational efficiency while reducing costs. Organizations are always looking for better ways to optimize their operations with less cost implications. Some features offered by mobile workforce management solutions include automated scheduling, route optimization, real-time data collection etc., which help in streamlining processes thereby minimizing inefficiencies and reducing operational costs. Additionally, these solutions provide organizations with better visibility on their workforce hence allowing effective resource allocation and improved decision-making as well. The growing focus on operational efficiency and cost-effectiveness propels adoption of mobile work force solutions to achieve these goals. Also driving the Mobile Workforce Management Market are concerns over improved customer experience as well as service delivery. In today’s competitive business environment it is necessary for organizations to distinguish themselves among others by delivering excellent customer services as a way retaining customers within them; hence this creates need for continuous interaction with customers so as to keep them engaged always though it also insists on giving right responses at right time. Field employees facilitating trade promotion activities should be empowered with field forces’ supporting systems so that they can deliver services within shortest possible periods without having any delay due distant offices.

Moreover, the Mobile Workforce Management market is driven by a growing focus on compliance and regulatory requirements. In order to operate within the boundaries of regulatory frameworks and statutory legal requirements, many companies in the healthcare and utilities sectors must comply with such standards. Mobile workforce management solutions have features like electronic documentation, audit trails and real-time reporting which are necessary for fulfilling the requirements of regulators. These solutions also help organizations to keep accurate records, monitor compliance activities and generate relevant reports easily.

Additionally, other market factors driving the Mobile work force market include an increase in number of employees opting for remote or flexible work schedules. Remote work arrangements are today being embraced by most organizations due to advancements in technology as well as changes in employment patterns. Consequently mobile work force management solutions are critical for enabling organizations to effectively manage and optimize their remote labor pools while supporting them to maintain effective communication channels across various departments. Task related tools like performance tracking; collaboration tools: For instance, when dealing with remoteness there is always need for teamwork since every employee’s contribution towards achieving certain objective is very important hence it is crucially important that all those who belong to one company should stay connected through different software.

Leave a Comment