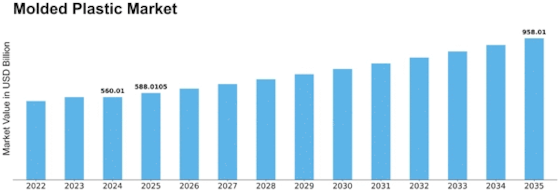

Molded Plastic Size

Molded Plastic Market Growth Projections and Opportunities

The molded plastic market is influenced by various market factors that impact its growth, demand, and dynamics. One of the primary factors driving the market is the increasing demand from end-use industries such as automotive, packaging, construction, electronics, and healthcare. These industries use molded plastic components extensively in their products due to their lightweight, durability, and cost-effectiveness. As these industries continue to expand and innovate, the demand for molded plastic products is expected to rise.

Molded plastic materials are synthetic materials that are molded to form various shapes based on their fiction and their use. Use of various coloring and other additives that enhances the quality of the molded plastics are used in various industries looking for their durability, lightweight and chemical resistance.

Additionally, technological advancements play a crucial role in shaping the molded plastic market. Innovations in manufacturing processes, such as injection molding, blow molding, and thermoforming, have led to increased efficiency, reduced production costs, and improved product quality. Advancements in materials science have also resulted in the development of new types of plastics with enhanced properties, further expanding the application scope of molded plastic products.

Market trends and consumer preferences also influence the molded plastic market. For instance, there is a growing trend towards sustainable and eco-friendly plastics, driven by increasing environmental concerns and regulatory pressure to reduce plastic waste. As a result, there is a growing demand for bio-based plastics, recycled plastics, and biodegradable plastics in various industries. Manufacturers in the molded plastic market are responding to this trend by investing in research and development of sustainable materials and processes.

Global economic conditions also play a significant role in the molded plastic market. Economic growth, consumer spending, and industrial production levels impact the demand for molded plastic products across different regions. For example, rapid urbanization and industrialization in emerging economies such as China, India, and Brazil have fueled the demand for molded plastic products in construction, infrastructure development, and consumer goods manufacturing.

Moreover, regulatory factors and government policies can affect the molded plastic market. Environmental regulations, product safety standards, and waste management policies influence the production, use, and disposal of plastic materials. For instance, bans on single-use plastics, restrictions on plastic packaging, and mandates for recycling and waste reduction initiatives can impact the demand for certain types of molded plastic products.

Competitive dynamics within the molded plastic market also shape its growth and evolution. The market is characterized by a large number of manufacturers, both multinational corporations and small to medium-sized enterprises, competing for market share. Factors such as product quality, pricing, distribution channels, and brand reputation play a crucial role in determining the competitive position of companies in the market.

Furthermore, supply chain factors such as raw material availability, pricing, and logistics also influence the molded plastic market. Fluctuations in the prices of crude oil, which is a key raw material for plastic production, can impact production costs and product pricing in the molded plastic market. Additionally, disruptions in the supply chain, such as natural disasters, geopolitical tensions, or transportation issues, can affect the availability of raw materials and finished products, leading to supply shortages or price volatility.

Leave a Comment