Top Industry Leaders in the Mono Ethylene Glycol Market

Monoethylene glycol (MEG), a versatile chemical with applications ranging from antifreeze to polyester production, sits at the heart of a dynamic and ever-evolving market. Understanding the competitive landscape of this multi-billion dollar industry requires zooming in on key strategies, market share determinants, recent news, and the dynamic developments shaping its future.

Strategies Shaping the MEG Landscape:

Geographic Expansion: Major players like Dow Chemical and SABIC are aggressively expanding production capacities in regions like Asia-Pacific and the Middle East, capitalizing on the surge in demand from these fast-growing economies.

Product Diversification: Companies are moving beyond traditional MEG applications, developing specialty grades for pharmaceuticals and heat transfer fluids, offering higher margins and less market competition.

Vertical Integration: Integrating upstream ethylene production or downstream polyester operations provides cost advantages and control over the entire value chain. Examples include ExxonMobil's integration with its polyethylene production.

Technological Innovation: Advancements in ethylene oxide (EO) conversion technologies and energy-efficient production processes are crucial for cost reduction and sustainability, particularly in regions with stringent environmental regulations.

Mergers and Acquisitions: Consolidation has been a recurring theme in the MEG market, with acquisitions like Lotte Chemical's purchase of BP's North American MEG assets aimed at increasing market share and geographic reach.

Factors Dictating Market Share:

-

Production Capacity and Efficiency: Companies with large, efficient production facilities hold an edge in terms of cost and supply reliability.

-

Geographical Presence: Proximity to key demand centers and access to low-cost feedstock like natural gas offer significant advantages.

-

Brand Reputation and Product Quality: Established players with a proven track record of quality and reliable supply command higher customer loyalty and market share.

-

Innovation and Technical Expertise: Developing differentiated products and production processes fosters a competitive edge and opens up new market segments.

-

Distribution Network and Customer Relationships: Robust logistics and strong customer relationships ensure market visibility and consistent product delivery.

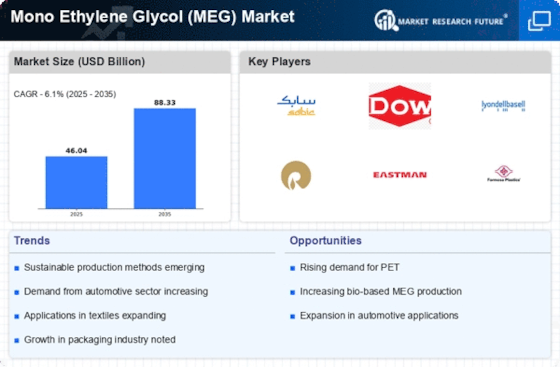

List of Key Players in the Mono Ethylene Glycol Market:

-

Royal Dutch Shell PLC

-

Dow (US)

-

Mitsubishi Chemical Corporation

-

Exxon Mobil Corporation (US)

-

China Petroleum & Chemical Corporation

-

India Glycols Limited (India)

-

ME (UAE)

-

Petro Rabigh (Saudi Arabia)

-

NAN YA PLASTICS CORPORATION

-

LyondellBasell Industries Holdings BV

Recent Developments:

-

August 2023: Rising summer temperatures in Asia and Europe boost demand for antifreeze, causing temporary supply tightness and price spikes.

-

September 2023: India Glycols partners with Indian Oil Corporation to explore joint production of bio-based MEG, leveraging their respective expertise in feedstock and production technologies.

-

October 2023: The Chinese government releases its five-year plan, outlining support for domestic MEG production, raising concerns about potential trade disruptions.

-

November 2023: New production capacities come online in India and Saudi Arabia, easing some of the supply constraints and stabilizing prices.

-

December 2023: The holiday season in the US and Europe drives up demand for polyester clothing and textiles, leading to increased MEG consumption.