- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

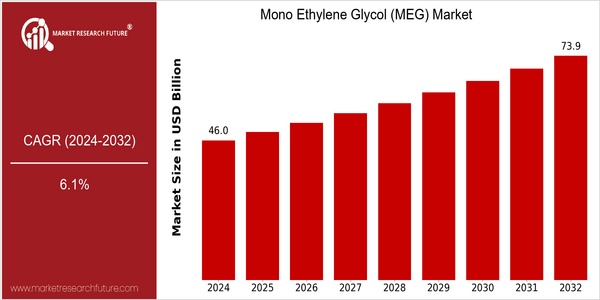

| Year | Value |

|---|---|

| 2024 | USD 46.04 Billion |

| 2032 | USD 73.94 Billion |

| CAGR (2024-2032) | 6.1 % |

Note – Market size depicts the revenue generated over the financial year

The MEG market is expected to grow significantly from $46.84 billion in 2024 to $ 73.94 billion in 2032. This growth will be achieved at a CAGR of 6.1% over the forecast period. The main driver of this market is the increasing demand for MEG in various applications, especially in the manufacture of polyester fibers and antifreeze solutions. MEG is a versatile and inexpensive raw material, which is in high demand as industries continue to develop and search for more efficient raw materials. There are several factors contributing to the growth of the MEG market. The growth of the automobile and construction industries, along with the growing demand for sustainable and eco-friendly products, is driving the need for MEG-based solutions. Also, technological advancements in the production process, such as the development of bio-based MEG, are expected to boost market growth. The key players in the industry, such as Dow, BASF, and Sinopec, are actively engaged in strategic collaborations to increase their production capacity and product offerings. These collaborations not only strengthen their market positions, but also help them to meet the needs of consumers and industries.

Regional Market Size

Regional Deep Dive

The mono ethylene glycol (MEG) market is characterized by the diverse dynamics of different regions, owing to varying industrial demand, economic conditions and regulatory frameworks. In North America, the market is driven by the petrochemical industry and rising demand from the automobile and textile industries. Europe is shifting towards a more sustainable MEG production process, while Asia-Pacific is characterized by a rapid rise in industrialization and urbanization, resulting in the largest demand for MEG. The Middle East and Africa are seeing strong growth, driven by petrochemical industry investment. MEG production in Latin America is slowly expanding, driven by rising domestic demand and export opportunities.

Europe

- In Europe, the MEG market is increasingly influenced by the European Union's Green Deal, which aims to make the region climate-neutral by 2050, pushing companies to adopt greener production technologies.

- Notable developments include BASF's investment in bio-based MEG production, which aligns with the region's sustainability goals and is expected to enhance market competitiveness.

Asia Pacific

- The Asia-Pacific region is witnessing rapid industrial growth, particularly in China and India, where the demand for MEG in the textile and packaging industries is soaring.

- Recent investments by companies like Sinopec and Reliance Industries in expanding MEG production facilities are expected to significantly increase supply and meet the growing regional demand.

Latin America

- Latin America is gradually developing its MEG production capabilities, with Brazil and Argentina leading the way, driven by local demand in the automotive and textile sectors.

- Government initiatives aimed at boosting the chemical industry, such as tax incentives and infrastructure development, are expected to enhance MEG production and market accessibility.

North America

- The North American MEG market is experiencing a surge in demand from the automotive sector, particularly for antifreeze and coolant applications, driven by the increasing production of electric vehicles.

- Recent regulatory changes aimed at reducing carbon emissions are prompting companies like Dow and LyondellBasell to invest in more sustainable MEG production processes, which could reshape the competitive landscape.

Middle East And Africa

- The Middle East is seeing increased investments in petrochemical projects, with companies like SABIC expanding their MEG production capabilities to cater to both local and international markets.

- Regulatory support for petrochemical industries in countries like Saudi Arabia is fostering a conducive environment for MEG market growth, enhancing the region's position as a key supplier.

Did You Know?

“Did you know that Mono Ethylene Glycol is not only used in antifreeze but also plays a crucial role in the production of polyester fibers, which are essential for the textile industry?” — International Energy Agency (IEA)

Segmental Market Size

MEG - The mono ethyl glycerol market is stable at the moment, mainly driven by the extensive use of MEG in the manufacture of polymers and antifreeze solutions. The demand for PET (poly ethylene terephthalate) in the textile and packaging industry and the rising production of automobiles in need of coolants and antifreeze solutions are the main driving forces of this market. Regulations promoting the use of sustainable materials are also driving the industry to seek out more sustainable alternatives, which is also a driver for the MEG market. MEG is now widely used, and the main players in the market, such as BASF and Dow, are leading the way in research and development. The main applications of MEG are in textiles, antifreeze solutions and as a solvent in various industrial processes. The MEG market is mainly driven by developments in technology and the increasing use of bio-based MEG. All of these factors are influencing the market, and MEG will continue to be used in a wide range of industries.

Future Outlook

The Mono Ethylene Glycol (MEG) market is forecast to experience a significant growth from 2024 to 2032, when it is expected to increase from 46 billion to 73 billion, at a strong compound annual growth rate (CAGR) of 6.1%. The main driving force for this growth is the growing demand for MEG in various applications, such as antifreeze, fibers, and packaging materials. Also, as the industries increasingly focus on the concept of sustainability, the shift towards bio-based MEG is expected to gain momentum, which will increase the penetration of MEG in the market. In 2032, it is estimated that bio-based MEG will represent 15 to 20% of the total MEG market, driven by the development of new production methods and the introduction of supportive government policies aimed at reducing the carbon footprint.The report also examines the future of MEG technology, such as the development of more efficient catalytic processes and the integration of circular economy principles. The report also explains how the expansion of the textile and automobile industries in emerging countries will help to maintain the stability of MEG demand. Government support for the use of sustainable materials and the introduction of stricter environmental regulations are expected to further stimulate the market. As a result, the players in the MEG market need to strategically position themselves to seize the opportunities and remain competitive in the long run.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 43.3949 Billion |

| Growth Rate | 6.10% (2023-2030) |

Mono Ethylene Glycol Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.