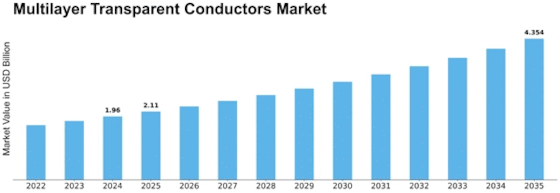

Multilayer Transparent Conductors Size

Multilayer Transparent Conductors Market Growth Projections and Opportunities

The factors that influence the multilayer transparent conductors' market and shape its dynamics are many and varied. Technological advancements are one of the most important parts since constant innovations accelerate the use of expensive and power-consuming transparent conductive materials. This may involve nanotechnology integration as well as new materials investigations for improved conductivity without losing transparency. On the other hand, economic factors also affect this industry. Fluctuations influence the purchasing power of consumers together with that of businesses in global economies. In an economically stable environment, there is a lot of investment in research and development, which leads to modern technologies. Conversely, during economic recessions, investments may be withdrawn, thus slowing down the innovation rate in the market. Alternatively, costs incurred in buying raw materials needed, for example, indium tin oxide (ITO) or graphene, can significantly affect how this market operates. Government policies and regulations represent another set of market factors. As such, environmental issues have led to the imposition of strict rules regarding certain elements, encouraging a range of solutions in the Multilayer Transparent Conductors Market. Indeed, it's worth noting that the consumer electronics industry is a major driver in this type of technology market. There has been a rise in high-performing transparent conductors due to the increased use of smartphones, tablets, and smartwatches, among other gadgets. Hence, there is an increased need for quality display resolutions that include responsiveness capabilities. This also includes the automotive sector, where modern cars increasingly come with touchscreens, interactive screens, and smart windows, among others. Thus; various companies within these industries have focused on innovating their products while differentiating them so as to meet rapidly growing demands. Multilayer Transparent Conductors Landscape is affected by competitive forces. A large number of organizations competing for customers' loyalty build up innovative strategies that will generate separate products tailored towards particular customer segments. Leaders in this field invest heavily in research, while newcomers develop small applications or cheaper substitutes. As per global trends, the growth rate forecast for the next five years is about 20% annually. Transparent conductors that enable touch-sensitive interfaces, transparent antennas, and efficient light harvesting are, therefore, essential enablers of these emerging trends.

Leave a Comment