Nano Micro Satellite Size

Nano Micro Satellite Market Growth Projections and Opportunities

The Nano and MicroSatellite market is undergoing a dynamic transformation, fueled by a convergence of market factors that reflect the increasing demand for small satellite solutions in the space industry. One key factor steering this market evolution is the growing trend toward miniaturization and cost-effectiveness in satellite technology. Nano and MicroSatellites as miniature counterparts of the bigger ones, distinguish themselves from traditional larger satellites with their small size and low production costs, making them a worthwhile option to be considered. As these miniature satellites have become increasingly affordable, they provide an avenue of entry for a wide range of players in the space arena such as startups, research institutions and emerging low-cost nations.

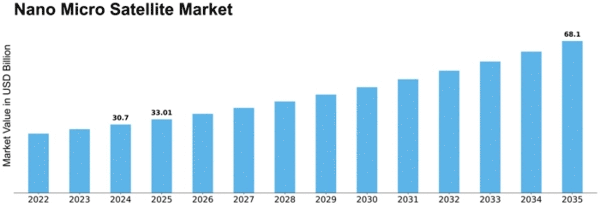

The Nano and Micro Satellite market is anticipated to witness substantial growth, reaching USD 8.69 billion with a Compound Annual Growth Rate (CAGR) of approximately 14.9% by 2030. This surge is propelled by a notable rise in demand for commercial applications, the cost-effectiveness of nano and micro satellites, and their heightened utilization in military and defense sectors. The nano and micro satellites market will proliferate because of the technological advances that constitute another crucial factor. The advancements in the nano-sized components, the light-weighed materials, and the propulsion systems with the high efficiency in the space industry appear to be at a very high pace. This advancement of technology enhances the ability of Nano and MicroSatellites to execute a broad spectrum of gratuitous chores such as Earth observations, telecommunication, science, and global connectivity. As technology is coming with new developments, the niche market for smaller satellites is going to grow along with technological capabilities and added flexibility.

In addition, the market is pulled by the rising number of users requiring real-time information and global connection. Nano and MicroSatellites either individually or in combination with each other support the space-based demand through the affordability of the services that they provide such as continuous observation of the Earth, remote sensing and communication. The fact that these small satellites can function in constellations makes their capacity to transmit data more effective and timely, thus creating an efficient way to provide users in different industries such as agriculture, environment and disaster management with the information that they need.

The policies as well as the space programs of the government are also of great importance for the competitive landscape of the Nan and Microsatellite markets. The governments everywhere see the key role of space-based technologies and they launch space programs that realize the implementation of small satellites. One of these initiatives is to invest in homegrown space industries and promote innovative activities, and as well as enhance national security through advanced satellite operations. Governments’ response plays a role in the enabling conditions for the development of the market by offering regulative frameworks and financial incentives that encourage the deployment of Nano and Micro Satellites.

The commercialization of space activities and the advent of niche space companies are yet others factors of transformation for the Nano and MicroSatellite market. Private sector's participation has also brought a fresh element of rivalry and ingenuity in space business. These companies, driven by a combination of profit motives and a passion for exploration, are actively contributing to the expansion of the Nano and MicroSatellite market. The competitive landscape is fostering the development of novel technologies and driving down launch costs, making small satellite deployments more economically viable.

Leave a Comment