- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

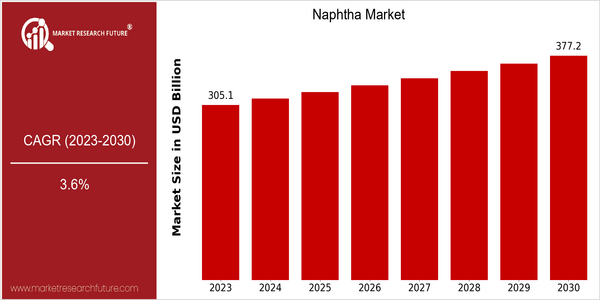

| Year | Value |

|---|---|

| 2023 | USD 305.1 Billion |

| 2030 | USD 377.2 Billion |

| CAGR (2024-2030) | 3.6 % |

Note – Market size depicts the revenue generated over the financial year

The market for petroleum naphtha is expected to reach $314.3 billion in 2023 and to rise to $391.8 billion in 2030, at a CAGR of 3.1 per cent between 2024 and 2030. This growth rate reflects a steady rise in demand for naphtha, driven by its critical role as a feedstock for petrochemicals and its use in gasoline blending. As industries expand and evolve, demand for naphtha as a versatile hydrocarbon source is expected to grow, contributing to overall market growth. A number of factors are driving this market expansion, including the growing demand for petrochemicals in the world’s emerging economies, where the pace of industrialisation is accelerating. In addition, technological advancements in refining and the development of more efficient processes are expected to increase naphtha production. Strategic players, such as ExxonMobil, Royal Dutch Shell and Total, are investing in refining technology to strengthen their market positions. These efforts, which are aimed at improving efficiency and reducing emissions, will help to drive the market for naphtha in the years to come.

Regional Market Size

Regional Deep Dive

The naphtha market is characterized by regional differences, which are determined by the local demand, legal framework, and economic conditions. In North America, the market is mainly driven by the strong petrochemical industry and the rising demand for gasoline blending. In Europe, on the other hand, the stricter environmental regulations are pushing for the use of cleaner alternatives. On the other hand, Asia-Pacific is experiencing rapid urbanization and industrialization, which is driving the consumption of naphtha. The Middle East and Africa, with their abundant oil reserves, are important players in the naphtha production and export business. Latin America is gradually increasing its consumption, especially in Brazil, where biofuels are gaining popularity. Each region has its own growth potential and challenges, which are influenced by the local market and by the general trends.

Europe

- The European Union's Green Deal is driving a shift towards sustainable fuels, impacting naphtha demand as companies like TotalEnergies invest in bio-naphtha production.

- Recent regulatory changes aimed at reducing carbon emissions are prompting refiners to explore alternative feedstocks, which may reshape the naphtha market landscape.

Asia Pacific

- China's rapid industrial growth is leading to increased naphtha consumption, with major players like Sinopec expanding their refining capacities to cater to this demand.

- India's push for infrastructure development and urbanization is expected to significantly boost naphtha usage in the coming years, supported by government initiatives like 'Make in India'.

Latin America

- Brazil is increasingly focusing on biofuels, with naphtha being a critical component in the production of ethanol, supported by government incentives for renewable energy.

- The region is witnessing a gradual shift towards cleaner fuels, influenced by both environmental regulations and consumer preferences, which may alter naphtha's market dynamics.

North America

- The U.S. is experiencing a surge in naphtha production due to the shale gas boom, with companies like ExxonMobil and Chevron ramping up their output to meet domestic and international demand.

- Regulatory changes, particularly the Renewable Fuel Standard (RFS), are influencing naphtha's role in gasoline blending, pushing refiners to innovate and adapt their processes.

Middle East And Africa

- Countries like Saudi Arabia and the UAE are leveraging their vast oil reserves to enhance naphtha production, with companies such as Saudi Aramco investing in advanced refining technologies.

- The region's strategic location as a key exporter of naphtha to Asia is being strengthened by new pipeline projects and trade agreements.

Did You Know?

“Naphtha is not only used as a fuel but also serves as a key feedstock for producing petrochemicals, which are essential for manufacturing plastics, fertilizers, and synthetic fibers.” — International Energy Agency (IEA)

Segmental Market Size

Naphtha plays a vital role in the petrochemical industry, being the main raw material for gasoline and various chemicals. In the current period, the naphtha market is experiencing steady growth, largely owing to the growing demand for petrochemical products and the expansion of refining capacities in emerging markets. Rising demand for energy and transportation fuels in developing economies, together with the growing regulatory pressure to move towards cleaner fuels, also makes naphtha a more attractive energy source. In the current period, naphtha is in the mature adoption stage, with the Middle East and Asia-Pacific playing the leading roles, with the likes of Saudi Aramco and Reliance Industries leading the way in production and innovation. The primary application of naphtha is to produce gasoline, but its main role is to produce ethylen and propylene in steam crackers. The emergence of a sustainable development trend and the implementation of stricter emissions regulations will drive the market. In addition, refinery technology will continue to develop, and more efficient catalytic processes will be developed.

Future Outlook

Naphtha market is expected to grow at a CAGR of 3.6% from 2023 to 2030. The petrochemical industry, especially the production of plastics and synthetic fibers, which are expected to increase consumption across various industries. Naphtha is expected to be a major feedstock for petrochemical industries, especially in emerging economies. With the development of urbanization and industry, especially in emerging economies, the demand for naphtha as a raw material for petrochemicals is expected to rise significantly, and thus the penetration and consumption of naphtha are expected to rise. In the long run, the major factors driving the naphtha market are technological innovations and government policies. The transition to clean energy and the implementation of stricter regulations on the environment will affect the production process of naphtha, which will be pushed towards more sustainable and efficient production methods. In addition, the development of catalytic cracking and reforming technology is expected to increase the yield and quality of naphtha, which will also increase the refiners' interest in naphtha. Naphtha is also expected to be used in the production of hydrogen as a clean fuel alternative, which will also create new opportunities for the market, which is in line with the goals of sustainable development and the transition to clean energy.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 294.5 Billion |

| Market Size Value In 2023 | USD 305.1 Billion |

| Growth Rate | 3.60% (2023-2030) |

Naphtha Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.