Top Industry Leaders in the Narrowband IoT Market

Competitive Landscape of the Narrowband-IoT (NB-IoT) Market:

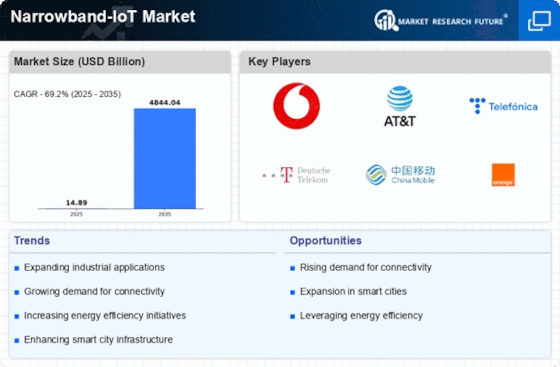

Narrowband - IoT Market is rapidly transforming the Internet of Things (IoT) landscape. Its low power consumption, wide network coverage, and cost-effectiveness make it ideal for connecting countless remote and battery-powered devices. Understanding the competitive dynamics of this burgeoning market is crucial for established players and new entrants alike.

Key Players:

- Huawei Technologies Co. Ltd. (China)

- Vodafone Group PLC (U.K.)

- Emirates Telecommunications Corporation (UAE)

- Telecom Italia (Italy)

- Qualcomm Incorporated (U.S.)

- China Unicom (China)

- Intel Corporation (U.S.)

- Ericsson (Sweden)

- Nokia Networks (Finland)

- Verizon Communication (U.S.)

Factors for Market Share Analysis:

- Technology Leadership: Continuous innovation in chipset design, network optimization, and security protocols can create a dominant position.

- Cost Competitiveness: Offering affordable modules and network access is key to wider adoption, especially in price-sensitive segments.

- Vertical Penetration: Strong partnerships with solution providers and early entry into key verticals like smart cities, utilities, and agriculture can drive market share gains.

- Global Reach: Having a presence in major regional markets and offering tailored solutions for local needs creates an advantage.

- Ecosystem Development: Fostering a collaborative ecosystem with technology partners, module makers, and solution providers enables faster innovation and broader market reach.

New and Emerging Companies:

- LoRaWAN-based Providers: LoRaWAN offers an alternative low-power network technology competing with NB-IoT in some segments. Startups like Actility and Senet are focusing on niche applications where LoRaWAN excels.

- Cloud-based Solution Providers: Companies like ThingSpeak and Azure IoT Hub are creating cloud platforms specifically designed for managing and analyzing NB-IoT data, catering to smaller players and vertical-specific needs.

- Open-source NB-IoT Software Developers: Projects like The Things Network and Chirpstack are creating open-source software platforms for NB-IoT networks and devices, potentially disrupting traditional vendor lock-in and lowering entry barriers.

Current Investment Trends:

- Chipset Miniaturization and Integration: Manufacturers are investing in smaller, more power-efficient chipsets with enhanced features like multi-band support and edge computing capabilities.

- Software Standardization and Security: Efforts are underway to create standardized software platforms and robust security protocols across the NB-IoT ecosystem, enhancing interoperability and trust.

- Vertical-specific Solutions: Investment is increasing in developing pre-packaged solutions for key verticals like asset tracking, environmental monitoring, and smart agriculture, simplifying adoption for users.

- AI and Machine Learning Integration: Integrating AI and machine learning capabilities into NB-IoT devices and cloud platforms is gaining traction, enabling real-time data analysis and predictive maintenance.

Latest Company Updates:

Dec 2023, Major cities like Amsterdam and Barcelona are expanding their NB-IoT infrastructure for smart parking, waste management, and environmental monitoring.

Nov 2023, Leading manufacturers like Siemens and GE are using NB-IoT for remote asset tracking, predictive maintenance, and supply chain optimization.

Oct 2023, Mobile network operators are collaborating with chipmakers and solution providers to accelerate NB-IoT adoption across various segments.