Top Industry Leaders in the Narrowbody Aircraft MRO Market

Strategies Adopted: To thrive in the competitive Narrowbody Aircraft MRO market, key players employ diverse strategies. Continuous investment in research and development (R&D) is paramount, allowing companies to stay ahead of technological advancements and regulatory changes in narrowbody aircraft maintenance. Strategic partnerships with airlines and original equipment manufacturers (OEMs) ensure collaboration on innovative solutions and facilitate the timely implementation of modifications and upgrades. Additionally, a global presence is maintained through acquisitions, joint ventures, and the establishment of MRO facilities strategically located to cater to the needs of narrowbody operators worldwide.

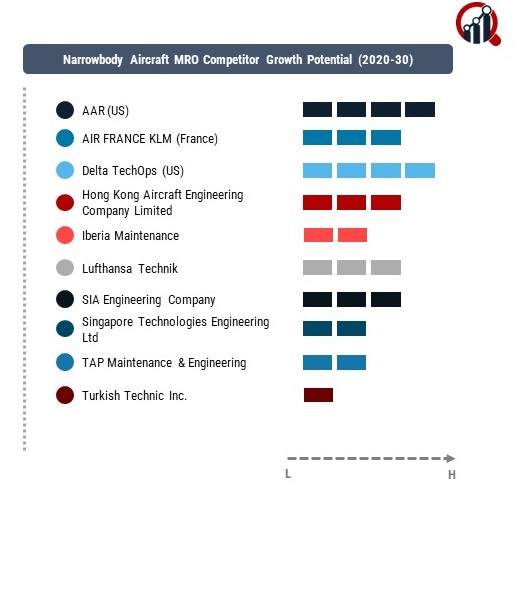

Competitive Landscape of Narrowbody Aircraft MRO Market

- AAR (US)

- AIR FRANCE KLM (France)

- Delta TechOps (US)

- Hong Kong Aircraft Engineering Company Limited (Hong Kong)

- Iberia Maintenance (Spain)

- Lufthansa Technik (Germany)

- SIA Engineering Company (Singapore)

- Singapore Technologies Engineering Ltd (Singapore)

- TAP Maintenance & Engineering (Spain)

- Turkish Technic Inc. (Turkey)

- Indamer Aviation Private Limited (India)

Factors for Market Share Analysis: Market share analysis in the Narrowbody Aircraft MRO market considers various factors, including technical capabilities, adherence to regulatory standards, and the ability to offer a comprehensive suite of services. Companies providing MRO services for a diverse range of narrowbody aircraft, such as the Airbus A320 and Boeing 737 families, have a competitive advantage. The efficiency of maintenance operations, timely turnaround, and reliability in meeting scheduled maintenance checks contribute significantly to market share dynamics. Compliance with stringent aviation regulations from authorities like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) is pivotal for maintaining a trustworthy reputation.

New and Emerging Companies: While established players dominate the market, new and emerging companies are making strides in niche areas and innovative MRO technologies. Companies like GAMECO (Guangzhou Aircraft Maintenance Engineering Co., Ltd.) and FL Technics are gaining recognition for their specialized services, including interior modifications, avionics upgrades, and digital solutions for narrowbody aircraft. These emerging companies often bring agility and fresh perspectives to the Narrowbody Aircraft MRO market, contributing to advancements in maintenance efficiency and the integration of digital technologies.

Industry News: Recent industry news in the Narrowbody Aircraft MRO market underscores ongoing developments and trends shaping the industry. News often covers advancements in predictive maintenance using data analytics and machine learning, allowing MRO providers to enhance efficiency and reduce aircraft downtime. Innovations in avionics upgrades, interior refurbishments, and sustainable practices are common themes. Additionally, developments in the adoption of augmented reality (AR) and virtual reality (VR) technologies for maintenance training and troubleshooting are reshaping the landscape of narrowbody aircraft maintenance. Industry news reflects the dynamic nature of the Narrowbody Aircraft MRO market, with continuous efforts to enhance services, reduce costs, and embrace innovative solutions.

Current Company Investment Trends: Investment trends in the Narrowbody Aircraft MRO market highlight a commitment to technology-driven solutions, sustainability, and operational efficiency. Companies are allocating significant resources to R&D initiatives focused on predictive maintenance tools, digital twin technologies, and automation to optimize maintenance processes. Investments in sustainable practices, including the use of eco-friendly materials and energy-efficient operations, align with the aviation industry's broader environmental goals. Moreover, strategic acquisitions of technology startups, partnerships with avionics manufacturers, and collaborations with airlines contribute to a holistic approach, ensuring a continuous stream of cutting-edge solutions and maintaining a competitive stance in the market.

Overall Competitive Scenario: The overall competitive scenario in the Narrowbody Aircraft MRO market is characterized by a delicate balance between established industry leaders and emerging companies that bring innovation and alternative business models. Established MRO providers leverage their extensive experience, global networks, and comprehensive service offerings to set industry standards. Simultaneously, emerging companies inject new perspectives and technologies, contributing to advancements in predictive maintenance, digitalization, and sustainability initiatives. The industry's response to global challenges, such as the impact of the COVID-19 pandemic on air travel, underscores the adaptability and resilience of Narrowbody Aircraft MRO providers. As the aviation industry continues to evolve, with a focus on efficiency, cost-effectiveness, and sustainability, the Narrowbody Aircraft MRO market is poised for continued innovation. The emphasis on technological advancements, strategic collaborations, and meeting the evolving needs of narrowbody aircraft operators positions this market as a critical component of ensuring the reliability and longevity of these workhorse aircraft in the global aviation fleet.

Recent Developments:

Airbus has unveiled its intentions to broaden its Maintenance, Repair, and Overhaul (MRO) presence in North America by establishing a new facility in Mobile, Alabama. Positioned at the Mobile Aeroplex, this facility will deliver comprehensive maintenance services for Airbus A320 family aircraft. Anticipated to commence operations in 2025, the initial hangar will contribute to the expansion of Airbus's MRO capabilities in the region.Top of Form

Boeing is set to bolster its Maintenance, Repair, and Overhaul (MRO) footprint in North America through the establishment of a new facility in Everett, Washington. Situated at Paine Field, this facility will offer extensive maintenance services specifically tailored for Boeing 737 aircraft. With the first hangar slated for operational readiness in 2024, Boeing aims to enhance its MRO capabilities in the region.