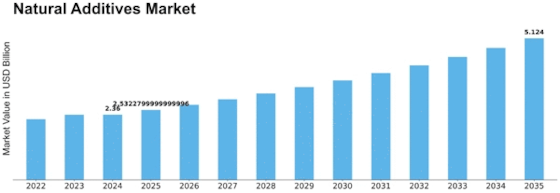

Natural Additives Size

Natural Additives Market Growth Projections and Opportunities

Different elements, including buyer inclinations, innovative turns of events, administrative orders, manageability, cutthroat strategies, and advancing industry rehearses, impact the natural additives market section. The interest for straightforward, better food choices is driving the advancement of regular added substances, as customers progressively normally like clean-name items that contain added substances got from normal sources. Because of this pattern toward more clear names, plant-based extricates, different rejuvenating balms, regular tones, and cell reinforcements have multiplied. The market is going through change because of innovative progressions and modernization. Ebb and flow research is centered around improving normal added substances as options in contrast to engineered ones in food plans. Modern methods for extraction, embodiment, and safeguarding ensure the added substances' security, viability, and tangible qualities, subsequently empowering their joining into an extensive variety of food things without compromising item quality. The market for natural additives is significantly impacted by administrative rules, which lay out wellbeing principles, grant satisfactory purposes, and direct naming guidelines. Makers should comply with these guidelines to ensure the wellbeing and straightforwardness of their items, which has suggestions for their detailing methodology and market accessibility. Consistence with these principles impacts the definition of items and showcasing strategies, ensuring benchmarks for quality and wellbeing. The rising accentuation on manageability inside the food business is affecting the market. As customers put more noteworthy significance on eco-accommodating items obtained morally, this gives organizations an upper hand. The regular added substances market is altogether affected by the cutthroat systems and market situating of industry members. Collusions and speculations act as impetuses for rivalry and apply an impact on the progression and accessibility of these items. The market is affected by advancing shopper ways of life and dietary inclinations. A rising number of buyers are deciding on clean-name items that contain regular added substances, as they seek after better dietary choices. This gives makers possibilities to improve and synchronize their items with the changing requests of buyers. Customer inclinations for straightforwardness, better other options, innovative headways, administrative contemplations, manageable cycles, serious methodologies, and way of life changes all add to the development of the market. As buyer interest for normal and cleaner food choices builds, the food business keeps on being impacted by natural additives.

Leave a Comment