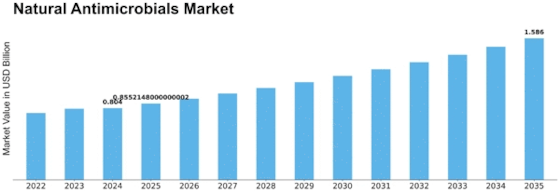

Natural Antimicrobials Size

Natural Antimicrobials Market Growth Projections and Opportunities

The natural antimicrobials market is influenced by various factors that collectively shape its dynamics. One of the primary determinants is the increasing consumer preference for natural and clean-label products. As awareness of health and wellness grows, consumers are seeking alternatives to synthetic antimicrobials, driving the demand for natural alternatives derived from sources like plants, herbs, and essential oils. This shift in consumer behavior is a significant driving force behind the growth of the natural antimicrobials market. Global concerns about food safety and the need for natural preservation methods contribute to the market dynamics. Natural antimicrobials, such as plant extracts and organic acids, are increasingly recognized for their ability to inhibit the growth of harmful microorganisms in food products without the use of synthetic chemicals. The market is influenced by regulations and standards promoting the use of natural antimicrobials as safe and effective solutions for food preservation. Technological advancements play a crucial role in the natural antimicrobials market. Innovations in extraction techniques, formulation processes, and delivery systems enhance the efficacy and stability of natural antimicrobial products. Research and development efforts focus on improving the shelf life and performance of these natural alternatives, providing manufacturers with reliable solutions for preserving the quality and safety of various products. The livestock and agriculture sectors significantly impact the natural antimicrobials market. With a growing emphasis on sustainable farming practices and animal welfare, there is an increasing demand for natural antimicrobials in livestock feed and crop protection. Farmers seek alternatives to traditional antimicrobial agents, leading to the adoption of natural solutions that promote animal health, reduce the need for antibiotics, and contribute to environmentally friendly farming practices. Government regulations and policies related to food safety and agricultural practices influence the natural antimicrobials market. Compliance with regulatory standards is critical for manufacturers to ensure the safety and efficacy of their products. Government initiatives promoting sustainable agriculture and reducing the use of synthetic chemicals in food production contribute to the market's growth as natural antimicrobials gain recognition as viable alternatives. Environmental sustainability is a key factor driving the natural antimicrobials market. Consumers and businesses are increasingly concerned about the environmental impact of synthetic chemicals. Natural antimicrobials align with sustainability goals, as they are often biodegradable and pose fewer environmental risks. Manufacturers adopting eco-friendly practices in sourcing, production, and packaging of natural antimicrobial products gain favor among environmentally conscious consumers. Market factors related to the pharmaceutical and healthcare industries also influence the natural antimicrobials market. The rising awareness of antibiotic resistance and the limitations of conventional antimicrobial drugs have led to a growing interest in natural alternatives. Researchers explore the antimicrobial properties of natural compounds for potential use in pharmaceuticals, contributing to the expansion of the market into the healthcare sector. Economic considerations, including the cost-effectiveness of natural antimicrobial solutions, impact market trends. The pricing and availability of natural antimicrobial products influence their adoption by food manufacturers, farmers, and other end-users. As economies strive for sustainable and cost-efficient solutions, the market dynamics are shaped by the balance between the effectiveness of natural antimicrobials and their economic feasibility.

Leave a Comment