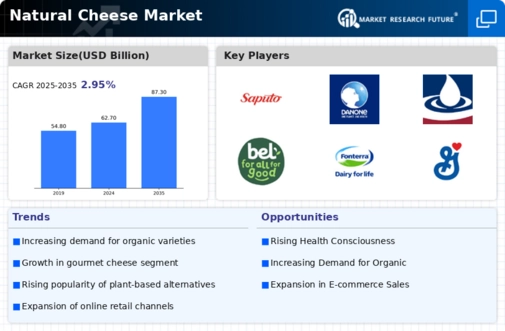

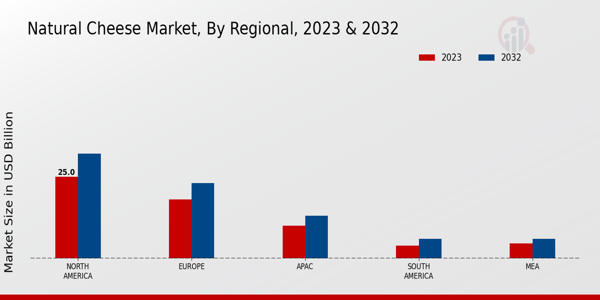

Market Growth Charts

Increased Global Trade

The Global Natural Cheese Market Industry is benefiting from increased global trade, which facilitates the distribution of natural cheese products across borders. As trade agreements and logistics improve, manufacturers can reach new markets, expanding their consumer base. This trend is particularly relevant as countries with strong cheese traditions, such as France and Italy, export their products worldwide, enhancing the global appreciation for natural cheese. The anticipated growth in market value to 87.3 USD Billion by 2035 suggests that international trade dynamics will continue to play a pivotal role in shaping the future of the natural cheese sector.

Rising Health Consciousness

The Global Natural Cheese Market Industry is experiencing a notable shift as consumers increasingly prioritize health and wellness. This trend is driven by a growing awareness of the nutritional benefits associated with natural cheese, such as its high protein content and essential vitamins. As individuals seek healthier dietary options, the demand for natural cheese, perceived as a wholesome alternative to processed varieties, is likely to rise. This shift is reflected in the market's projected value of 62.7 USD Billion in 2024, indicating a robust consumer preference for natural products that align with health-conscious lifestyles.

Diverse Culinary Applications

Natural cheese is gaining traction across various culinary applications, which is a significant driver for the Global Natural Cheese Market Industry. Chefs and home cooks alike are increasingly incorporating natural cheese into a wide range of dishes, from gourmet pizzas to artisanal sandwiches. This versatility not only enhances flavor profiles but also caters to diverse consumer palates. As the culinary landscape evolves, the demand for high-quality natural cheese is expected to grow, contributing to the market's expansion. The projected increase to 87.3 USD Billion by 2035 underscores the potential for natural cheese to become a staple ingredient in global cuisine.

Innovative Product Development

The Global Natural Cheese Market Industry is witnessing a surge in innovative product development, which plays a crucial role in attracting consumers. Manufacturers are increasingly focusing on creating unique flavors, textures, and formats to cater to evolving consumer preferences. For instance, the introduction of lactose-free and organic natural cheese options has broadened the market appeal, attracting lactose-intolerant individuals and health-conscious consumers. This innovation is likely to drive market growth, as evidenced by the anticipated CAGR of 3.05% from 2025 to 2035, indicating a sustained interest in diverse and high-quality natural cheese products.

Growing Demand for Plant-Based Alternatives

The rise of plant-based diets is influencing the Global Natural Cheese Market Industry, as consumers seek alternatives that align with their dietary choices. While natural cheese remains a staple, the demand for plant-based cheese products is growing, prompting traditional cheese producers to explore innovative formulations. This trend reflects a broader shift towards sustainability and ethical consumption, as consumers become more conscious of their food sources. The market's ability to adapt to these changing preferences may enhance its resilience and growth potential, particularly as the overall cheese market evolves to accommodate diverse dietary needs.