Natural Food Additives Size

Natural Food Additives Market Growth Projections and Opportunities

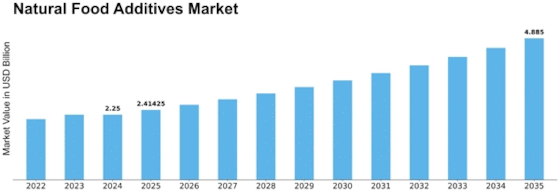

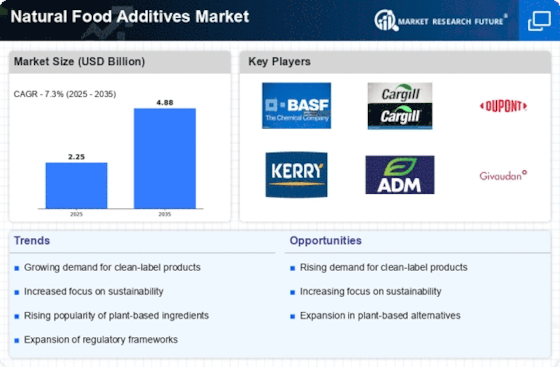

Natural food additives market is expected to expand at a CAGR of 7.30% over the forecast period, at such stellar growth rate, the market is likely to attain valuation of USD 3.95 billion by 2032. The market valued at USD 2.1 billion in 2022. The market dynamics for natural food additives are influenced by a wide range of factors, including consumer preferences, technology developments, legal constraints, sustainability initiatives, competitive tactics, and changing business procedures. One major component driving this industry is consumer preferences. Consumers are looking for natural food substitutes for artificial ingredients and clearer labeling as they place a greater focus on leading healthy lives. As people choose items they believe to be safer and more nutritious, there is a growing demand for natural food additives made from plant and animal sources, such as antioxidants, natural flavors, and plant extracts. Innovations and technological breakthroughs in the food sector are major drivers of the market for natural food additives. The goal of ongoing research and development projects is to find and improve natural additives that can operate as useful substitutes for synthetic ones in food items. Improved extraction processes, encapsulation technologies, and preservation strategies guarantee the stability, safety, and sensory qualities of natural additives, making it easier to include them into a variety of food recipes without sacrificing flavor or quality. The market for natural food additives is heavily influenced by regulations and recommendations. Strict guidelines are set by regulatory organizations for the security, appropriate application, and truthful labeling of natural food additives. It is imperative that manufacturers adhere to these standards in order to create and promote goods that use natural additives. This includes determining the best practices for product development, labeling, and market accessibility. Natural food additives' market dynamics are significantly shaped by sustainability initiatives. The growing preference of customers for eco-friendly products and ethical sourcing has made natural additives sourced from renewable resources more appealing. By using sustainable sourcing and production techniques for natural additives, manufacturers may gain a competitive advantage and satisfy customer desires for goods that are responsibly sourced and environmentally friendly. The market for natural food additives is greatly impacted by industry participants' competitive tactics and market positioning. Prominent businesses spend money on marketing, R&D, and development projects to highlight the advantages of natural additives. Competition in the business is fueled by alliances, strategic collaborations, and investments in creative solutions. These factors have an impact on the market's growth and accessibility for natural additives. Furthermore, alterations in dietary habits and shifting consumer preferences have a significant impact on the market dynamics for natural food additives. Demand for natural ingredients in clean-label products is rising as customers prioritize wellness and health more and more. Manufacturers have a chance to get creative with these additives and match their product offers to changing customer tastes.

Leave a Comment