Market Share

Natural Organic Cosmetics Market Share Analysis

Regulations governing the natural and organic cosmetics sector stand as formidable pillars shaping consumer confidence. By setting rigorous standards that limit the presence of harmful substances in products labeled as "natural" or "organic," these directives instill trust among consumers. Collaborative efforts between governments and industry associations further fortify this confidence through certification schemes, ensuring purchased products adhere to stringent quality and safety benchmarks. These regulatory measures not only benefit consumers but also provide producers with a structured framework, fostering accountability and compliance within their operations.

Critical government support extends beyond regulations, encompassing strategic investment in research and development for this burgeoning sector. This financial backing serves as a catalyst for innovation, driving advancements in ingredients, formulations, and manufacturing processes. These innovations, in turn, enable businesses to create compelling, high-quality products that align with evolving consumer preferences for natural and organic cosmetics.

Moreover, governments play a pivotal role in facilitating global trade by promoting the export and import of these eco-conscious cosmetics through trade agreements. This international perspective not only broadens market horizons but also encourages companies to expand their reach globally. As a result, the natural and organic cosmetics industry experiences an upsurge driven by consumer demand and augmented market accessibility, leading to a positive impact on the environment through sustainable practices.

The market landscape is witnessing a profound shift catalyzed by consumers' heightened consciousness about environmental concerns. The surge in the sub-zero waste trend epitomizes this transformation, with consumers demanding cosmetics that are not only free from chemicals but also packaged sustainably. Leading brands are strategically pivoting towards this paradigm shift, reimagining product packaging to achieve zero waste and environmental sustainability. The rise in consumer preference for reusable, recyclable, and minimal packaging signals a decisive move towards more sustainable practices in the industry.

This shift in consumer behavior is underpinned by a discerning approach towards personal care products, including a preference for natural and organic cosmetics. Consumers are increasingly attentive to the chemicals, potential side effects, and overall benefits associated with the products they use. Notable industry figures, such as Tata Harper, have played a role in this change by founding businesses rooted in their firsthand experiences of the adverse effects of synthetic chemicals. Consequently, natural ingredients are now perceived as safer for both the environment and human health, leading cosmetics manufacturing companies to pivot towards natural and organic ingredients in lieu of synthetic ones.

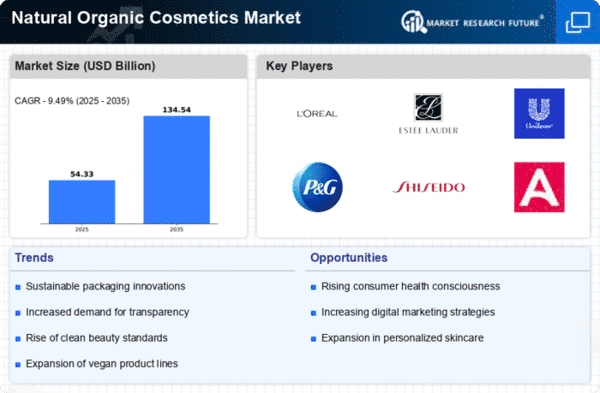

The convergence of these factors, among others, is expected to propel substantial growth in the global market for natural and organic cosmetics. Consumer-driven demand, regulatory support, industry innovation, and an evolving market landscape all contribute to an optimistic forecast for the industry's expansion. As consumers increasingly prioritize environmentally friendly and chemical-free products, the natural and organic cosmetics sector stands poised for remarkable growth in the foreseeable future.

Leave a Comment