Niobium Capacitor Size

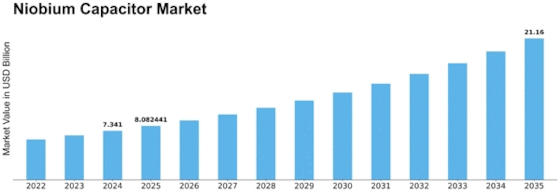

Niobium Capacitor Market Growth Projections and Opportunities

The Niobium Capacitor Market, a niche within the broader electronic components sector, is influenced by a myriad of market factors that shape its dynamics. One of the primary drivers is the increasing demand for miniaturized and high-performance electronic devices across various industries. As consumer electronics, automotive, and telecommunications sectors continue to evolve, there is a growing need for compact and efficient capacitors, wherein niobium capacitors find their niche. The ability of niobium capacitors to offer high capacitance in a small form factor positions them as a preferred choice for modern electronic applications.

Global economic conditions also play a crucial role in determining the trajectory of the niobium capacitor market. Economic growth and stability positively impact the overall consumer spending, which, in turn, drives the demand for electronic devices. In times of economic expansion, businesses and consumers are more likely to invest in new technologies and gadgets, boosting the market for niobium capacitors. Conversely, economic downturns can lead to a temporary slowdown in the market, as consumers become more cautious about discretionary spending.

Technological advancements and innovations are constant catalysts for change in the niobium capacitor market. As electronic devices become more sophisticated and energy-efficient, the demand for capacitors with enhanced performance characteristics rises. Manufacturers in the niobium capacitor market continuously invest in research and development to bring forth products that meet the evolving requirements of modern electronics. This technology-driven aspect ensures that the market remains dynamic, with a constant influx of new and improved niobium capacitors.

Moreover, regulatory factors also shape the landscape of the niobium capacitor market. Environmental regulations, safety standards, and compliance requirements imposed by governing bodies influence the manufacturing processes and materials used in electronic components, including niobium capacitors. Manufacturers must navigate and adapt to these regulations to ensure the sustainability and marketability of their products. Additionally, the push towards sustainable and eco-friendly electronic components has prompted innovations in materials and manufacturing processes within the niobium capacitor market.

Global supply chain dynamics and geopolitical factors contribute to the overall market conditions of niobium capacitors. The availability of raw materials, geopolitical tensions, and trade policies impact the production costs and supply chain efficiency for manufacturers. Fluctuations in these external factors can lead to challenges in procurement, production delays, and ultimately affect the pricing and availability of niobium capacitors in the market.

Market competition and the presence of alternative capacitor technologies also exert a significant influence on the niobium capacitor market. The availability of substitutes and the competitive landscape among manufacturers drive product development, pricing strategies, and market positioning. As new capacitor technologies emerge, manufacturers of niobium capacitors must differentiate their products to maintain a competitive edge in the market.

Leave a Comment